Speak directly to the analyst to clarify any post sales queries you may have.

Positioning Software as the Root of On-Board Intelligence as Mobility Transitions into a Digitally Connected Era

As vehicles evolve from purely mechanical systems into sophisticated software-driven platforms, operating systems have become the foundational layer enabling next-generation mobility. This transformation is underpinned by consumer demand for seamless connectivity, ever-smarter driver assistance, and personalized in-vehicle experiences. The automotive operating system sits at the confluence of hardware abstraction, middleware services, and application ecosystems, ensuring robust performance, safety compliance, and over-the-air update capabilities.

The significance of operating systems has never been greater, as automakers and suppliers race to differentiate through user interfaces, cybersecurity measures, and integration of advanced driver assistance systems. Furthermore, regulatory mandates around functional safety and data privacy are elevating the technical and compliance bar for core software. Consequently, the competitive landscape is shifting toward open-source ecosystems, tier-one collaborations, and platform partnerships that promise accelerated innovation while managing costs.

This introduction lays the groundwork for a deep exploration of how transformative shifts, tariff impacts, segmentation dynamics, regional variations, and key players collectively shape the strategic decisions of executives. By understanding these critical dimensions, stakeholders can position themselves for sustained growth and resilience in an industry defined by rapid technological progress and evolving consumer expectations.

Navigating the Shift from Monolithic Architectures to Adaptive, Service-Oriented Platforms Fueled by Connectivity and AI

The past decade has witnessed seismic shifts in automotive software architecture as cloud connectivity, artificial intelligence, and data analytics converge to redefine vehicle capabilities. Conventional monolithic systems are giving way to service-oriented architectures that enable modular updates, reduce integration complexity, and foster third-party application ecosystems. As a result, the role of middleware has escalated beyond abstraction layers to become a critical facilitator for seamless communication among sensors, control units, and user interfaces.

Amid these shifts, developers are gravitating toward open-source platforms that accelerate time to market and encourage community-driven innovation. Parallel to this trend, proprietary solutions continue to guarantee stringent security protocols and vendor-backed support, driving a dual-track approach in software selection. Additionally, the emergence of over-the-air update infrastructures has redefined lifecycle management, enabling continuous feature rollout, security patching, and personalized service provisioning post-purchase.

Looking ahead, the interplay between human-machine interface enhancements, real-time data processing at the edge, and high-performance computing units will catalyze the next wave of transformation. As vehicles become mobile data centers, executives must anticipate evolving technical requirements, strategic alliances, and regulatory frameworks that will shape how operating systems deliver intelligent, adaptive experiences.

Managing Input Cost Volatility and Supply Chain Resilience in Response to United States Tariff Escalations on Automotive Electronics

In anticipation of 2025, escalating tariffs imposed by the United States on imported semiconductor components and electronic subsystems are set to influence platform deployment costs and supplier relationships. Although certain core processors for automotive operating systems have domestic manufacturing footprints, many specialized chips and security modules originate from regions subject to tariff levies. As a result, automakers and tier-one suppliers are reassessing sourcing strategies to mitigate input cost inflation.

These tariff pressures are prompting industry players to strengthen regional supply chains, expand localization of software development, and invest in in-house module fabrication where feasible. Concurrently, procurement teams are renegotiating long-term contracts to absorb or counterbalance duties through volume discounts and strategic partnerships. The ripple effects extend to pricing strategies for software licensing, with OEMs exploring usage-based models and subscription services to preserve margins and maintain end-customer value propositions.

Despite these headwinds, the industry is seizing tariff-driven challenges as an impetus for greater vertical integration and supply chain resilience. By proactively addressing input cost volatility, stakeholders can safeguard development roadmaps, ensure uninterrupted over-the-air update capabilities, and uphold the rigorous cybersecurity standards vital to operating system integrity.

Unraveling the Intricate Fabric of Type, Offering, Technology, Vehicle Type, and Application-Based Adoption Patterns for Strategic Planning

Analyzing the market through multiple lenses reveals nuanced adoption patterns and innovation hotspots. When studied by type, open-source Linux distributions coexist alongside proprietary QNX and Windows variants and Android-based infotainment platforms, each catering to distinct integration and customization needs. Platforms built around middleware and core operating system kernels deliver the performance backbone, while human-machine interface tools and security solutions overlay critical user engagement and risk mitigation capabilities.

From an offering perspective, the ecosystem spans software development kits that accelerate code reuse, over-the-air platforms that enable continuous delivery, and simulation tools that validate performance across virtual environments. These solutions collectively underpin the delivery lifecycle from initial development through field updates. Technologically, the tension between open-source ecosystems and proprietary stacks shapes partner ecosystems and intellectual property strategies as companies balance speed of innovation with control over security and compliance.

Vehicle type segmentation underscores divergent requirements between commercial vehicles-spanning heavy-duty trucks to light vans-and passenger cars focused on infotainment, telematics, and comfort features. Application-level distinctions further delineate use cases, from advanced driver assistance systems ensuring safety to telematics and connected services redefining mobility paradigms. This rich tapestry of segmentation insights enables decision-makers to pinpoint high-value domains and tailor platform roadmaps accordingly.

Comparing Infrastructure, Regulatory, and Consumer Dynamics Across the Americas, EMEA, and Asia-Pacific to Guide Regional Strategies

Regional analysis uncovers distinct adoption trajectories shaped by regulatory landscapes, infrastructure maturity, and consumer expectations. In the Americas, rapid uptake of connected services and telematics is driven by strong aftermarket ecosystems and early adoption of over-the-air update frameworks. Meanwhile, European, Middle Eastern, and African markets prioritize functional safety compliance and cybersecurity certifications, with open-source alliances gaining traction amidst stringent data privacy mandates.

In Asia-Pacific, the confluence of expansive automotive manufacturing hubs, cost-competitive semiconductor production, and government incentives for digital mobility is fostering robust investment in operating system platforms. OEMs and suppliers in the region are accelerating localization efforts and forging joint ventures to integrate middleware solutions and security overlays into domestically produced vehicles. Transitional market segments in emerging economies are also leapfrogging traditional telematics models in favor of cloud-native architectures.

Collectively, these regional dynamics inform risk assessments, partnership strategies, and go-to-market priorities. By understanding how infrastructure investment, regulatory frameworks, and consumer proclivities vary across the Americas, EMEA, and Asia-Pacific, executives can align resource allocation, product roadmaps, and deployment strategies to maximize return on innovation.

Evaluating Strategic Alliances, M&A Activity, and Technology Roadmaps to Identify the Most Compatible Operating System Partners

The competitive arena of automotive operating systems is characterized by alliances between semiconductor vendors, software specialists, and OEMs. Leading players differentiate through robust middleware integrations, end-to-end security certifications, and scalable over-the-air update infrastructures. Partnerships with cloud service providers and AI development platforms are also reshaping the value chain, enabling deeper data analytics and predictive maintenance capabilities.

Strategic mergers and acquisitions continue to consolidate expertise in safety-critical operating systems and real-time computing frameworks. Emerging entrants are staking claims in niche domains such as cybersecurity solutions tailored for vehicle networks and virtualized cockpit platforms that support multiple operating environments. As the ecosystem broadens, alliances between chip manufacturers and operating system licensors are instrumental in optimizing hardware-software co-design and reducing integration lead times.

Executives must scrutinize each player’s technology roadmap, partnership network, and service delivery model to gauge compatibility with organizational objectives. By evaluating criteria such as update latency, security certification level, and development ecosystem maturity, stakeholders can select partners who deliver both immediate value and long-term innovation momentum.

Embracing Modular Architectures and Hybrid Licensing While Building Robust Over-the-Air Update and Security Competencies

To thrive amid intensifying competition and rapid technological change, executives should embrace a modular architecture strategy that decouples core operating system kernels from application layers. This approach accelerates development cycles and simplifies integration of third-party modules for human-machine interfaces and connectivity services. Moreover, adopting a hybrid licensing model that blends open-source cores with proprietary security overlays can balance cost efficiencies with compliance requirements.

Investing in a robust over-the-air update infrastructure is also imperative; it enables continuous feature enhancements and security patching while fostering customer loyalty through ongoing service delivery. Organizations should prioritize partnerships that deliver high bandwidth, low-latency data pipelines and end-to-end encryption. Concurrently, building in-house expertise in functional safety standards and cybersecurity certifications will fortify operating system credentials and support faster regulatory approvals.

Finally, leaders must cultivate cross-functional teams that integrate software development, cybersecurity, hardware engineering, and customer experience specialists. This holistic organizational model ensures that platform roadmaps align with market trends, regulatory shifts, and user expectations, ultimately driving sustainable differentiation.

Employing a Mixed-Methods Framework of Executive Interviews, Secondary Research, and Quantitative Patent and Adoption Data Analysis

This research employs a rigorous mixed-methods approach combining primary interviews with senior executives across OEMs, tier-one suppliers, and software vendors with extensive secondary data analysis from industry white papers, regulatory filings, and technical standards bodies. Primary engagements provided qualitative insights into strategic priorities, technological challenges, and partnership preferences, while secondary sources validated market dynamics and technological trajectories.

Quantitative analysis drew upon historical adoption rates, patent filings, and open-source community contributions to map innovation hotspots and project development pipelines. Supply chain assessments incorporated tariff schedules, regional manufacturing capabilities, and logistics constraints to evaluate cost and risk exposures. Regulatory frameworks around functional safety and data privacy were systematically reviewed to inform compliance considerations and security solution efficacy.

This methodology ensures a balanced and transparent view of the automotive operating system landscape, delivering both actionable intelligence and foundational context for strategic decision-making. By triangulating multiple data inputs and engaging directly with industry participants, the research uncovers nuanced trends and prepares stakeholders for future evolution.

Consolidating Insights on Platform Adaptability, Supply Chain Resilience, and Strategic Partnerships to Drive Next-Generation Mobility Excellence

In an era where software defines the differential advantage in mobility experiences, the strategic selection of operating system platforms is paramount. Organizations that embrace adaptable architectures, foster open innovation, and commit to rigorous security and safety certifications will lead the next wave of digital transformation in transportation.

Tariff-driven supply chain realignments underscore the importance of regional resilience and procurement agility, while segmentation and regional insights enable precise targeting of high-value applications and markets. By partnering with technology leaders who demonstrate robust middleware integration, over-the-air update capabilities, and a commitment to compliance, stakeholders can accelerate time to market and drive continuous customer engagement.

Ultimately, the convergence of AI, connectivity, and functional safety will redefine the boundaries of in-vehicle software. Executives who act decisively on the research findings can shape platform roadmaps, secure competitive advantages, and realize the promise of next-generation mobility solutions.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Automotive Operating System Market

Companies Mentioned

The key companies profiled in this Automotive Operating System market report include:- ANAND Group

- Apple Inc.

- Automotive Grade Linux

- Bayerische Motoren Werke AG

- BlackBerry Limited

- BMW AG

- Continental AG

- Ford Motor Company

- General Motors

- Google LLC

- Green Hills Software

- Guangxi Yuchai Machinery Co., Ltd.

- HARMAN International

- Hirata Corporation

- Honda Motor Co., Ltd.

- HYUNDAI INFRACORE Co., Ltd.

- Hyundai Motor Group TECH

- Kawasaki Heavy Industries, Ltd.

- Kirloskar Oil Engines Ltd.

- KUKA AG

- LiuGong Machinery Corporation

- Luxoft Holding, Inc.

- Mahindra Construction Equipment

- Marelli Holdings Co., Ltd.

- Maruti Suzuki India Limited

- Mercedes-Benz Group AG

- Microsoft Corporation

- Montavista Software LLC

- Neusoft Corporation

- NVIDIA Corporation

- Obayashi Corporation

- Ouster, Inc.

- Qualcomm Technologies, Inc.

- Red Hat, Inc.

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Sandvik AB

- SANY Group Co., Ltd.

- Scania CV AB

- Shantui Construction Machinery co.,Ltd

- Siemens AG

- Tesla Inc.

- The Connected Vehicle Systems Alliance (COVESA)

- Thunder Software Technology Co., Ltd

- Toyota Motor Corporation

- Ubuntu by Canonical Ltd.

- Valeo SA

- Volkswagen AG

- Volvo Car Corporation

- Wind River Systems, Inc.

- XCMG Group

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

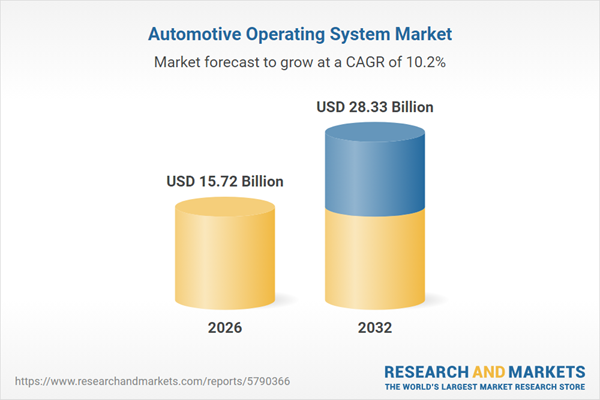

| Estimated Market Value ( USD | $ 15.72 Billion |

| Forecasted Market Value ( USD | $ 28.33 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 53 |