Speak directly to the analyst to clarify any post sales queries you may have.

The not from concentrate juices market is navigating pivotal changes as health priorities shift and supply chains adapt to evolving consumer expectations. Senior leaders require actionable market intelligence to anticipate competitive risks and inform growth-oriented strategies.

Market Snapshot: Not From Concentrate Juices Market

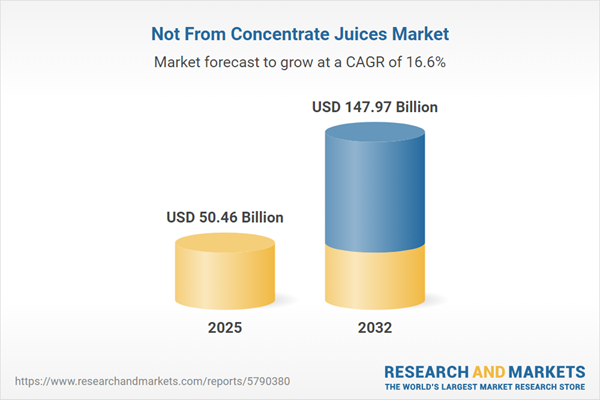

The not from concentrate juices market continues to demonstrate robust expansion, reaching a value of USD 43.25 billion in 2024 and projected to grow to USD 50.46 billion by 2025. This growth trajectory is shaped by a compound annual rate of 16.61%, highlighting substantial long-term opportunities. Industry forecasts point to a sector potential of USD 147.97 billion by 2032, underscoring the strong momentum. Market advancement is linked to increasing demand for transparent and health-focused beverages, with consumers seeking natural alternatives and clean-label assurances. Industry leaders are refining supply chains, prioritizing premium procurement standards, and intensifying research and development to answer calls for sustainable sourcing and product integrity.

Scope & Segmentation: Strategic Insights for Senior Leadership

This report provides in-depth analysis structured around the key segmentation and operational influences critical for executives overseeing the not from concentrate juices market. Segmentation granularity clarifies procurement priorities and guides commercial and investment decisions.

- End User Segments: Commercial channels including restaurants, hotels, quick service restaurants, and cafeterias, as well as evolving household consumption patterns, shape distribution, menu offerings, and marketing approaches.

- Distribution Channels: Established retail models such as supermarkets and convenience stores sit alongside fast-growing e-commerce presence, allowing organizations to optimize fulfillment and expand market access.

- Formulation Types: Both conventional and organic juice formulations cater to businesses seeking clean-label products and meet increasing demands for health and transparency.

- Packaging Types: A diverse range—spanning bottles, cans, cartons, pouches, and flexible packaging—supports operational workflows, maximizes convenience, and enables sustainability initiatives.

- Product Types: Pulpy and pulp-free variants allow brands to tailor offerings based on regional and customer-specific preferences, aligning with portfolio diversification strategies.

- Flavor Profiles: Popular options like apple, orange, and mixed fruit exist alongside differentiated local flavors, illustrating both traditional appeal and ongoing innovation.

- Geographic Coverage: Detailed assessment of trends and compliance requirements spans North America, Latin America, Europe, Middle East & Africa, and Asia-Pacific, providing country-level intelligence for supply chain optimization and quicker market adaptation.

- Key Companies: Market analysis covers leading producers such as PepsiCo, Keurig Dr Pepper, The Coca-Cola Company, Ocean Spray, Florida’s Natural Growers, The J. M. Smucker Company, The Campbell Soup Company, Conagra Brands, Langer Juice, and Suja Juice, evaluating their digital strategies, R&D initiatives, and operational flexibility.

Key Takeaways: Actionable Intelligence for Executive Decision-Makers

- Transparent ingredient sourcing and clean-label focus are central to building sustained trust with consumers and regulatory bodies, giving organizations a foundation for differentiated product positioning.

- Emerging processing advancements, such as cold pressing and high-pressure treatments, enable brands to deliver high-quality juice products while limiting dependence on additives.

- Deployment of technologies including blockchain and smart labeling solutions enhances supply chain transparency, making procurement processes more collaborative and traceable.

- Premiumization is fueled by the creation of distinct flavor profiles, ethical supply considerations, and brand storytelling, allowing for deeper engagement with new client segments and furthering customer loyalty.

- Expansion in digital commerce and omnichannel purchasing models is changing B2B buying dynamics and unlocking alternative growth pathways for established producers and new entrants alike.

Tariff Impact on Supply Chains & Pricing

Recent tariffs on citrus concentrate imports have elevated operational costs across the not from concentrate juices market. In response, businesses are redefining supplier relationships, focusing on domestic partners, and renegotiating contracts to achieve price stability and supply chain reliability. This approach also enhances resilience through increased reliance on localized sourcing and stronger compliance, mitigating the risks associated with trade disruptions.

Methodology & Data Sources

This report synthesizes authoritative government statistics, proprietary industry data, and rigorously reviewed white papers. Insights are validated through expert interviews and a structured multi-stage review process, ensuring relevance and reliability for executive decision-making.

Why This Report Matters

- Equips senior decision-makers with the clarity to identify actionable growth opportunities and refine business strategies in a shifting competitive landscape.

- Presents targeted frameworks for procurement and supply chain operations that adapt to evolving regulatory and market demands, facilitating agility and reduced risk.

- Delivers strategic intelligence on consumer trends, innovation paths, and emerging business models to build organizational resilience and drive sustainable growth.

Conclusion

This analysis empowers executives to address market transitions, manage emerging risks, and pursue sustainable innovation efforts within not from concentrate juice operations. The insights provided support long-term resilience and competitive advantage.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Not From Concentrate Juices market report include:- PepsiCo, Inc.

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Ocean Spray Cranberries, Inc.

- Florida's Natural Growers

- The J. M. Smucker Company

- The Campbell Soup Company

- Conagra Brands, Inc.

- Langer Juice Company, Inc.

- Suja Juice, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 50.46 Billion |

| Forecasted Market Value ( USD | $ 147.97 Billion |

| Compound Annual Growth Rate | 16.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |