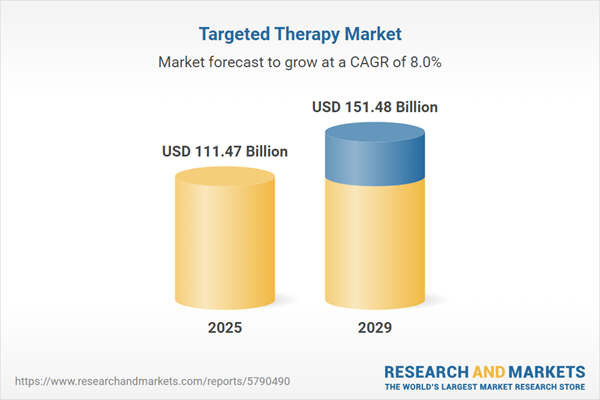

The targeted therapy market size is expected to see strong growth in the next few years. It will grow to $151.48 billion in 2029 at a compound annual growth rate (CAGR) of 8%. The growth in the forecast period can be attributed to expanding oncology research, rising demand for precision medicine, emergence of immunotherapies, growing investment in biopharmaceuticals, patient awareness and advocacy. Major trends in the forecast period include integration of artificial intelligence (AI) in drug discovery, patient advocacy and involvement in treatment decisions, expansion of companion diagnostics, regulatory support for expedited approvals, increasing investment in biotechnology and pharma.

The rising incidence of cancer is anticipated to drive the growth of the targeted therapy market in the coming years. Cancer refers to a group of conditions characterized by abnormal cells that can invade surrounding tissues and proliferate uncontrollably. Targeted therapy works by interrupting the signals that promote the growth of cancer cells or by prompting these cells to self-destruct. It utilizes medications designed to specifically target the genes and proteins that facilitate the growth and survival of cancer cells, thereby increasing its demand. For example, in January 2024, the American Cancer Society, a nonprofit organization based in the U.S., reported that the number of cancer cases rose to 2,001,140, up from 1,958,310 in 2023, marking a growth of 2.19%. Thus, the increasing prevalence of cancer is expected to stimulate the growth of the targeted therapy market.

The anticipated growth is expected to be bolstered by increasing government initiatives and funding. Government initiatives and funding encompass actions and financial support provided by government agencies across various sectors, including healthcare, science, technology, and education. Such support plays a crucial role in advancing targeted therapies, with a focus on research and development in precision medicine contributing to the commercial expansion of adapted therapies. In November 2023, the National Center for Science and Engineering Statistics, a US-based agency, reported a 5.2% increase in expenditures on research and experimental development, reaching $2.644 billion compared to the 2021 expenditures of $2.513 billion. This financial backing underscores the role of government support in driving the growth of the targeted therapy market.

Major companies in the targeted therapy market are actively engaged in developing innovative technological solutions to enhance their market position. For instance, in March 2022, Novartis AG, a Swiss multinational pharmaceutical corporation, introduced Pluvicto, the first FDA-approved targeted radioligand therapy (RLT) for eligible patients with metastatic castration-resistant prostate cancer (mCRPC). Pluvicto combines a therapeutic radioisotope with a targeted chemical, representing a significant advancement in targeted cancer therapy. By binding to specific cells, including prostate cancer cells expressing the transmembrane protein PSMA, Pluvicto's radioisotope induces energy emissions that damage target cells and adjacent ones, impeding replication and potentially leading to cell death.

Companies in the targeted therapy market are also prioritizing strategic partnerships to enhance service offerings. One such example is Shine Technologies, a US-based pharmaceutical company specializing in radioactive isotopes, which partnered with Curadh MTR Inc. in September 2023. Curadh MTR Inc. focuses on advancing molecularly targeted radiation therapies for solid tumors. This collaboration aims to leverage radioisotopes' potential to precisely target and eliminate cancer cells, providing new prospects for patients and reshaping the landscape of cancer treatment.

In August 2022, Bristol Myers Squibb, a US-based biopharmaceutical company, made a strategic move by acquiring Turning Point Therapeutics for an undisclosed amount. This acquisition positions Bristol Myers Squibb to address a critical medical need for patients with non-small cell lung cancer testing positive for ROS1. Additionally, it grants access to a pipeline of experimental drugs, including repotrectinib, targeting prevalent mutations associated with oncogenesis. Turning Point Therapeutics, Inc., the acquired company, operates in the targeted therapy sector as a clinical-stage precision oncology company.

Major companies operating in the targeted therapy market include Pfizer Inc., Johnson & Johnson, F. Hoffmann-La Roche Ltd, Merck & Co Inc., AbbVie Inc., Bayer AG, Novartis AG, Sanofi SA, Bristol Myers Squibb, AstraZeneca, GlaxoSmithKline plc, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Gilead Sciences Inc., Amgen Inc., Genmab A/S, Regeneron Pharmaceuticals Inc., Biogen Inc., Vertex Pharmaceuticals Incorporated, Agilent Technologies Inc., Illumina Inc., Incyte Corporation, Sysmex Corporation, Exact Sciences Corporation, Seagen Inc., Exelixis Inc., Seattle Genetics Inc., Genentech Inc., Daiichi Sankyo Company Limited.

North America was the largest region in the targeted therapy market in 2024. The regions covered in the targeted therapy market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the targeted therapy market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Targeted therapy is a type of cancer treatment that utilizes medications or chemicals to specifically attack molecules crucial for the survival and spread of cancer cells. This approach involves drugs targeting specific genes and proteins that support the survival and growth of cancer cells.

Targeted therapy involves small molecule medicines and monoclonal antibodies. Small-molecule medicines are synthetic chemicals inspired by or derived from natural products, distributed through channels such as hospital pharmacies, retail pharmacies, and online pharmacies. They are used for treating various cancers, including breast cancer, colorectal cancer, leukemia, lung cancer, lymphoma, and renal cancer.

The targeted therapy market research report is one of a series of new reports that provides targeted therapy market statistics, including targeted therapy industry global market size, regional shares, competitors with a targeted therapy market share, detailed targeted therapy market segments, market trends and opportunities, and any further data you may need to thrive in the targeted therapy industry. This targeted therapy market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The targeted therapy market includes revenues earned by entities by providing various kinds of cancer drugs, such as EGFR inhibitors, angiogenesis inhibitors, and apoptosis inducers. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Targeted Therapy Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on targeted therapy market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for targeted therapy? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The targeted therapy market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Small Molecule Medicines; Monoclonal Antibodies2) By Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Online Pharmacies

3) By Application: Breast Cancer; Colorectal Cancer; Leukemia; Lung Cancer; Lymphoma; Renal Cancer; Other Applications

Subsegments:

1) By Small Molecule Medicines: Tyrosine Kinase Inhibitors (TKIs); Proteasome Inhibitors; Phosphatidylinositol 3-Kinase (PI3K) Inhibitors; Other Small Molecule Therapies2) By Monoclonal Antibodies: Immune Checkpoint Inhibitors; Antibody-Drug Conjugates (ADCs); Cytokine Blockers; Other Monoclonal Antibodies

Key Companies Mentioned: Pfizer Inc.; Johnson & Johnson; F. Hoffmann-La Roche Ltd; Merck & Co Inc.; AbbVie Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc.

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd

- Merck & Co Inc.

- AbbVie Inc.

- Bayer AG

- Novartis AG

- Sanofi SA

- Bristol Myers Squibb

- AstraZeneca

- GlaxoSmithKline plc

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Gilead Sciences Inc.

- Amgen Inc.

- Genmab A/S

- Regeneron Pharmaceuticals Inc.

- Biogen Inc.

- Vertex Pharmaceuticals Incorporated

- Agilent Technologies Inc.

- Illumina Inc.

- Incyte Corporation

- Sysmex Corporation

- Exact Sciences Corporation

- Seagen Inc.

- Exelixis Inc.

- Seattle Genetics Inc.

- Genentech Inc.

- Daiichi Sankyo Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 111.47 Billion |

| Forecasted Market Value ( USD | $ 151.48 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |