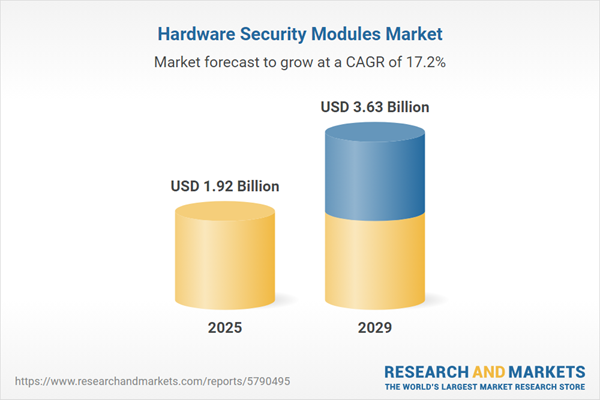

The hardware security modules market size is expected to see rapid growth in the next few years. It will grow to $3.63 billion in 2029 at a compound annual growth rate (CAGR) of 17.2%. The growth in the forecast period can be attributed to stricter data privacy regulations, increased use of biometric data, surge in remote work practices, demand from emerging markets, shift towards as-a-service models. Major trends in the forecast period include digital identity protection, expansion of 5g networks, integration with blockchain technology, emphasis on user-friendly interfaces, partnerships and collaborations, hybrid and multi-cloud environments.

The rising incidence of data breaches and cyberattacks is anticipated to drive the growth of the hardware security module (HSM) market in the future. A cyber attack refers to an attempt to unlawfully access a computer system or network with the intent to cause harm, while a data breach occurs when data is stolen or extracted from a system without the owner's consent or awareness. A hardware security module is a physical device designed to safeguard data against both logical and inherent security threats. It aims to ensure the security of data and information by offering built-in protection against vulnerabilities. Additionally, the increasing adoption of digital payments has led to a rise in cyberattacks and data breaches, consequently boosting the demand for hardware security modules. For example, in November 2023, the Department of Defence Australia reported that the Australian Cyber Security Centre received over 94,000 cybercrime reports in the 2022-2023 financial year, representing a 23% increase compared to the previous year. Thus, the rise in data breaches and cyberattacks is fueling the growth of the hardware security module market.

The growing adoption of cloud-based services is projected to enhance the growth of the hardware security module market in the coming years. Cloud-based services refer to the delivery of computing services via the Internet, which includes servers, storage, databases, networking, software, analytics, and intelligence. Hardware security modules are commonly employed alongside cloud-based services to provide an additional layer of security for sensitive information. For instance, in April 2024, Eurostat reported that in 2023, 77.6% of large enterprises indicated they were utilizing cloud computing services, reflecting a 6-percentage point increase since 2021. The adoption rate of cloud services among medium-sized enterprises rose to 59% in 2023, up from 53% in 2021. Small businesses also experienced growth, with the percentage of those using cloud services increasing by 3.8 percentage points to reach 41.7% during the same period. Therefore, the rising adoption of cloud-based services is driving the growth of the hardware security module market.

Product innovation is a significant trend gaining traction in the hardware security module market. Key players in the hardware security module sector are concentrating on creating innovative products to enhance their market position. For example, in February 2022, Thales Group, a France-based technology firm that designs and produces electrical systems and aerospace devices, introduced a new IoT connection solution called ELS62. This solution offers improved reliability and security for smart devices, facilitating the digital transition for enterprises. It integrates moderate technology to simplify design, streamline development, and decrease the time-to-market for IoT products. The product provides various connectivity options and robust cybersecurity for IoT devices, incorporating security measures that protect both the device and data by ensuring resilience against cyber threats, strong device authentication, and data encryption.

Leading companies in the hardware security module market are dedicated to developing innovative products, such as liquid security modules, to improve data protection, simplify cryptographic processes, and address the increasing demand for secure cloud computing solutions. The liquid security module is an advanced hardware security module (HSM) designed for secure key management and cryptographic operations. For instance, in September 2022, Marvell Technology, Inc., a US-based technology firm, launched the LiquidSecurity 2 (LS2) hardware security module (HSM) aimed at enhancing encryption, key management, and authentication services in multi-cloud environments. Built on the cloud-optimized OCTEON data processing unit (DPU), the LS2 offers remarkable performance, capable of processing up to 100,000 ECC operations per second and managing 1 million keys across 45 partitions. It features the lowest total cost of ownership (TCO) per key stored and complies with stringent standards like FIPS 140-31.

In December 2023, Thales Group, a France-based IT company, acquired Imperva, Inc. for an undisclosed sum. This acquisition is intended to bolster Thales's cybersecurity capabilities and expand its data and application security offerings, with expectations of generating an additional $500 million in revenue while positioning the company among the top global leaders in the cybersecurity market. Imperva, Inc., a US-based IT security firm, provides hardware security modules that safeguard sensitive information.

Major companies operating in the hardware security modules market include Thales e-Security Inc., Utimaco GmbH, International Business Machines Corporation, FutureX LP, Yubico Inc., SWIFT SCRL., ATOS SE, Ultra Electronics Holdings plc, Entrust Corporation, Hewlett-Packard Enterprise Development LP, Securosys SA, Infineon Technologies AG, Ledger & Spyrus Inc., Exceet Secure Solutions GmbH, JISA Softech Pvt Ltd, Google LLC, Microchip Technology Inc., Amazon Web Services Inc., WIBU-SYSTEMS AG, Trustwave Holdings.

Europe was the largest region in the hardware security module market in 2024. The regions covered in the hardware security modules market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hardware security modules market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A hardware security module (HSM) is a specialized cryptographic processor designed to manage and safeguard digital keys. Its primary function is to secure the cryptographic key lifecycle by executing encryption and decryption tasks for robust authentication, digital signatures, and other cryptographic operations.

The main types of hardware security modules include LAN-based or network-attached modules, PCI-based or embedded plugins, USB-based or portable modules, and smart cards. LAN-based modules operate within a local area network (LAN), connecting devices in a single physical location, such as a building or business. These modules can be deployed on-premises or in the cloud, serving various applications such as SSL (Secure Sockets Layer), TLS (Transport Layer Security), authentication, payment processing, code and document signing, application-level encryption, database encryption, public key infrastructure (PKI), and credential management. HSMs find applications across diverse industries, including banking and financial services, energy and utilities, retail and consumer products, government technology and communication, industrial and manufacturing, healthcare, and life sciences.

The hardware security modules market research report is one of a series of new reports that provides hardware security modules optical components market statistics, including hardware security modules optical components industry global market size, regional shares, competitors with a hardware security modules optical components market share, detailed hardware security modules optical components market segments, market trends and opportunities, and any further data you may need to thrive in the hardware security modules optical components industry. This hardware security modules optical components market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The hardware security module market consists of revenues earned by entities by providing encryption and decryption services such as cryptographic key generation, authentication process, data integrity, transaction processing, and RSA operations. The market value includes the value of related goods sold by the service provider or included within the service offering. The hardware security module market also includes sales of general-purpose hardware security module, card payment system HSMs, payment and transaction HSMs that are used for providing hardware security module services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Hardware Security Modules Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hardware security modules market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hardware security modules ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hardware security modules market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: LAN Based or Network Attached; PCI-Based or Embedded Plugins; USB Based or Portable; Smart Cards2) by Deployment Type: on-Premise; Cloud

3) by Application: SSL (Secure Sockets Layer); TSL (Transport Layer Security); Authentication; Payment Processing; Code and Document Signing; Application-Level Encryption; Database Encryption; Public Key Infrastructure (PKI); Credential Management

4) by End-User: Banking and Financial Services; Energy and Utility; Retail and Consumer Products; Government Technology and Communication; Industrial and Manufacturing; Healthcare; Life Sciences

Subsegments:

1) by LAN Based or Network Attached: Standalone HSMs; Clustered HSMs2) by PCI-Based or Embedded Plugins: Server-Side HSMs; PCI Express HSMs

3) by USB Based or Portable: USB HSMs; Hardware Tokens

4) by Smart Cards: Contact Smart Cards; Contactless Smart Cards

Key Companies Mentioned: Thales e-Security Inc.; Utimaco GmbH; International Business Machines Corporation; FutureX LP; Yubico Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Hardware Security Modules market report include:- Thales e-Security Inc.

- Utimaco GmbH

- International Business Machines Corporation

- FutureX LP

- Yubico Inc.

- SWIFT SCRL.

- ATOS SE

- Ultra Electronics Holdings plc

- Entrust Corporation

- Hewlett-Packard Enterprise Development LP

- Securosys SA

- Infineon Technologies AG

- Ledger & Spyrus Inc.

- Exceet Secure Solutions GmbH

- JISA Softech Pvt Ltd

- Google LLC

- Microchip Technology Inc.

- Amazon Web Services Inc.

- WIBU-SYSTEMS AG

- Trustwave Holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.92 Billion |

| Forecasted Market Value ( USD | $ 3.63 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |