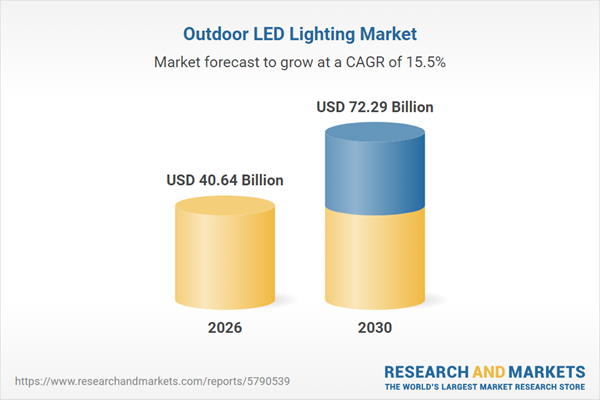

The outdoor led lighting market size is expected to see rapid growth in the next few years. It will grow to $72.29 billion in 2030 at a compound annual growth rate (CAGR) of 15.5%. The growth in the forecast period can be attributed to rising demand for smart city lighting systems, expansion of adaptive street and area lighting, increasing focus on energy savings and emissions reduction, growth in iot-enabled outdoor lighting networks, development of advanced lighting analytics and management platforms. Major trends in the forecast period include adoption of smart connected outdoor lighting systems, expansion of energy-efficient sustainable lighting solutions, advancement of intelligent lighting control platforms, development of automated outdoor illumination management, integration of sensor-based adaptive lighting technologies.

An increase in construction and infrastructure projects is anticipated to boost the outdoor LED lighting market. Infrastructure encompasses the systems and facilities that underpin a country’s economic development, including the construction of roads, railways, bridges, tunnels, water supply, sewage, electrical grids, and telecommunications. Construction sites are often among the most hazardous work environments, and LED lighting serves as a safety measure that can mitigate the risk of accidents and dangers in these areas. LED lighting enhances visibility, ensuring the safety of workers. For example, in September 2024, the United States Census Bureau, a US government agency, reported that construction spending in July 2024 was estimated at a seasonally adjusted annual rate of $2.16 trillion, which is 6.7 percent (±1.8 percent) higher than the July 2023 estimate of $2.02 trillion. During this period, total construction spending reached $1.23 trillion, representing an 8.8 percent (±1.2 percent) increase compared to $1.13 trillion in the same timeframe in 2023. Consequently, the rise in construction and infrastructure projects is driving the growth of the outdoor LED lighting market.

Major companies operating in the outdoor LED lighting market are emphasizing product innovations, such as cloud-based control platforms, to improve operational efficiency and enable advanced smart city services. Cloud-based control platforms centralize the oversight of entire lighting networks, supporting remote monitoring, data-driven automation, and integration with broader urban infrastructure. For example, in June 2025, Signify, a Netherlands-based lighting manufacturer, introduced its Interact Emergency Lighting system. This cloud-native platform allows for single-point wireless activation of emergency protocols across a facility, delivers real-time status updates to first responders, and integrates smoothly with other Interact IoT systems for unified facility management. This advancement significantly lowers operational costs and enhances emergency response coordination, although it requires substantial investment in network security and dependable connectivity.

In March 2023, Signify Holding, a Netherlands-based provider of lighting products, connected lighting systems, and data-driven services for both professional and consumer markets, acquired Intelligent Lighting Controls, Inc. (ILC) for an undisclosed amount. Through this acquisition, Signify aimed to broaden its connected portfolio by incorporating ILC’s leading wired control systems, thereby strengthening its range of energy-efficient LED lighting solutions for North American professional lighting applications. Intelligent Lighting Controls Inc. (ILC) is a US-based company specializing in energy-efficient lighting control solutions, including outdoor lighting components.

Major companies operating in the outdoor led lighting market are CREE Inc., Dialight PLC, General Electric Co. Ltd., Osram Licht AG, Signify N.V., Syska Led Lights Pvt. Ltd., Zumtobel Group AG, Acuity Brands Lighting Inc., Panasonic Corporation, Hubbell Inc., Eaton Corporation, Philips Lighting Holding B.V, Wipro Lighting Ltd., Opple Lighting Co. Ltd., Bajaj Electricals Limited, Cooper Lighting Solutions, Havells India Limited, LED Roadway Lighting Ltd., LG Innotek Co. Ltd., LIGMAN Lighting Co. Ltd., Lumileds Holding B.V., MLS Co. Ltd., Nichia Corporation, Samsung Electronics Co. Ltd., Schréder Group, Seoul Semiconductor Co. Ltd., Soraa, Amerlux, L.D. Kichler Co. Inc.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs have impacted the outdoor LED lighting market by raising the cost of imported LED chips, control modules, metal housings, and power supplies used in lighting hardware. Municipal, commercial, and architectural lighting installations in North America, Europe, and Asia-Pacific have faced procurement delays and increased project costs. However, tariffs have also supported the expansion of regional LED manufacturing, encouraged local sourcing of lighting components, and driven innovation in cost-efficient smart outdoor lighting technologies that strengthen long-term market competitiveness.

The outdoor LED lighting market research report is one of a series of new reports that provides outdoor LED lighting market statistics, including outdoor LED lighting industry global market size, regional shares, competitors with a outdoor LED lighting market share, detailed outdoor LED lighting market segments, market trends and opportunities, and any further data you may need to thrive in the outdoor LED lighting industry. This outdoor LED lighting market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Outdoor LED lighting serves as a versatile tool for illuminating outdoor spaces or reflective surfaces, offering both permanent fixtures and portable options. Its applications range from providing light to enhancing aesthetics or showcasing advertisements. This technology finds purpose in various settings such as city roads, peripheral areas, heritage sites, and urban landscapes.

The primary categories within outdoor LED lighting encompass hardware, software, and associated services. Hardware denotes tangible components or methods for delivering and executing software instructions. Communication aspects are divided into wired and wireless segments. These lighting solutions are deployable in new setups or as retrofits, accessible through retail, wholesale, direct sales, and e-commerce platforms. The utilization of outdoor LED lighting spans across diverse domains including street and road lighting, architectural enhancement in urban landscapes, illuminating sports arenas and expansive areas, tunnel lighting, and numerous other applications.Asia-Pacific was the largest region in the outdoor LED lighting market in 2025. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the outdoor led lighting market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the outdoor led lighting market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The outdoor led lighting market consists of revenues earned by pre-installation and post-installation services. The market value includes the value of related goods sold by the service provider or included within the service offering. The outdoor led lighting market also includes sales of lamps, luminaires and control systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Outdoor LED Lighting Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses outdoor led lighting market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for outdoor led lighting? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The outdoor led lighting market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By Offering: Hardware; Software; Services2) By Communication: Wired; Wireless

3) By Installation: New; Retrofit

4) By Sales Channel: Retail Or Wholesale; Direct Sales; E-Commerce

Subsegments:

1) By Hardware: LED Luminaires; Control Systems; Mounting And Housing Fixtures2) By Software: Lighting Control Software; Energy Management Software; Monitoring And Analytics Platforms

3) By Services: Installation Services; Maintenance And Support Services; Consulting Services For Lighting Design

5) By Application: Streets And Roads; Architecture And Urban Landscape; Sports And Large Area; Tunnels; Other Applications

Companies Mentioned: CREE Inc.; Dialight PLC; General Electric Co. Ltd.; Osram Licht AG; Signify N.V.; Syska Led Lights Pvt. Ltd.; Zumtobel Group AG; Acuity Brands Lighting Inc.; Panasonic Corporation; Hubbell Inc.; Eaton Corporation; Philips Lighting Holding B.V; Wipro Lighting Ltd.; Opple Lighting Co. Ltd.; Bajaj Electricals Limited; Cooper Lighting Solutions; Havells India Limited; LED Roadway Lighting Ltd.; LG Innotek Co. Ltd.; LIGMAN Lighting Co. Ltd.; Lumileds Holding B.V.; MLS Co. Ltd.; Nichia Corporation; Samsung Electronics Co. Ltd.; Schréder Group; Seoul Semiconductor Co. Ltd.; Soraa; Amerlux; L.D. Kichler Co. Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Outdoor LED Lighting market report include:- CREE Inc.

- Dialight PLC

- General Electric Co. Ltd.

- Osram Licht AG

- Signify N.V.

- Syska Led Lights Pvt. Ltd.

- Zumtobel Group AG

- Acuity Brands Lighting Inc.

- Panasonic Corporation

- Hubbell Inc.

- Eaton Corporation

- Philips Lighting Holding B.V

- Wipro Lighting Ltd.

- Opple Lighting Co. Ltd.

- Bajaj Electricals Limited

- Cooper Lighting Solutions

- Havells India Limited

- LED Roadway Lighting Ltd.

- LG Innotek Co. Ltd.

- LIGMAN Lighting Co. Ltd.

- Lumileds Holding B.V.

- MLS Co. Ltd.

- Nichia Corporation

- Samsung Electronics Co. Ltd.

- Schréder Group

- Seoul Semiconductor Co. Ltd.

- Soraa

- Amerlux

- L.D. Kichler Co. Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 40.64 Billion |

| Forecasted Market Value ( USD | $ 72.29 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |