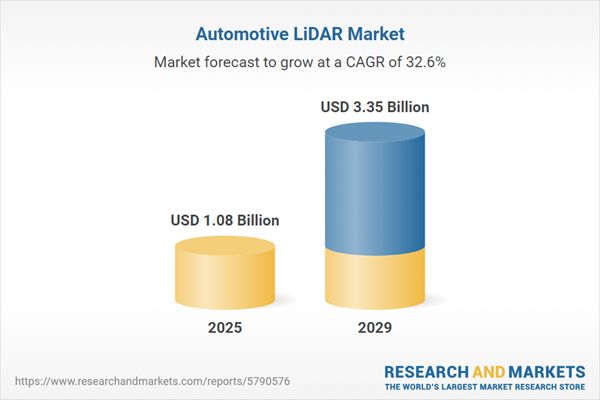

The automotive LiDAR market size is expected to see exponential growth in the next few years. It will grow to $3.35 billion in 2029 at a compound annual growth rate (CAGR) of 32.6%. The growth in the forecast period can be attributed to autonomous vehicle development, market competition and investments, increasing consumer awareness and demand, electric and connected vehicle growth, infrastructure development and smart cities. Major trends in the forecast period include advancements in solid-state lidar, integration in ADAS and autonomous vehicles, multi-sensor fusion, mass production and cost reduction, enhanced perception capabilities.

The robust demand for semi-autonomous and fully autonomous vehicles is playing a significant role in propelling the growth of the automotive LiDAR market. Autonomous vehicles, equipped with environmental sensing capabilities and the ability to operate without human intervention, rely on LiDAR sensors to create comprehensive 3D maps for 360-degree vision. These maps provide accurate data crucial for self-navigation and object detection, essential elements in the functioning of self-driving cars. As indicated by a report from Gerber Injury Law in June 2021, the self-driving vehicle industry is anticipated to witness an annual growth rate of 16%, projecting a trillion-dollar valuation by 2025. This increasing demand for autonomous driving technology is a key driver fueling the growth of the automotive LiDAR market.

The growing adoption of electric vehicles (EVs) is expected to contribute significantly to the expansion of the automotive LiDAR market. Electric vehicles, powered either partially or entirely by electricity, benefit from LiDAR technology in enhancing energy efficiency. LiDAR provides precise environmental data that aids in optimizing driving routes, managing energy consumption, and overall efficiency improvement. According to CleanTechnica in the first half of 2023, over 670,000 EVs were sold, with over 80% being fully-electric battery electric vehicles (BEVs). This increasing adoption of electric vehicles plays a pivotal role in driving the growth of the automotive LiDAR market.

Technological advancements emerge as a key trend in the automotive LiDAR market, with major companies focusing on integrating innovative technologies to enhance LiDAR system functionality, particularly in autonomous vehicles. In November 2022, RoboSense, a China-based intelligent LiDAR technology company, introduced the RS-LiDAR-E1, a flash solid-state LiDAR based on independently created chips and a new technological platform. This LiDAR system utilizes area array transceiver technology with application-specific designed chips, eliminating moving components. The RS-LiDAR-E1 is designed for factory installation and mass manufacturing, working to close the perception gap for smart driving and enhance the capability of automated and autonomous cars to perceive their surroundings in all scenarios.

Major players in the automotive LiDAR market are actively concentrating on innovative product solutions, particularly the development of 360º LiDAR technology, to offer reliable services to customers. Also known as full-surround LiDAR, this remote sensing technology utilizes lasers to measure distances and generate a 3D map of the surrounding environment. As an illustration of this trend, Innoviz Technologies, an Israel-based leader in LiDAR technology, introduced Innoviz360 in January 2022. Innoviz360 represents a new HD (high definition) LiDAR category, delivering 10 times the performance at a significantly lower cost compared to traditional 360º LiDARs. It supports multiple scanning software configurations with up to 1280 scanning lines, making it a cost-effective and durable solution. Innoviz360's features and capabilities cater to a diverse range of industries, including autonomous vehicles, trucks, shuttles, heavy machinery, smart cities, logistics, construction, and maritime applications.

In October 2022, Velodyne Lidar Inc., a US-based LiDAR technology company, acquired Bluecity Holdings Limited. Although the financial details remain undisclosed, this acquisition positions Velodyne Lidar Inc. to deliver industry-leading AI-powered autonomous vision solutions to its customers. Bluecity Holdings Limited, a US-based startup, specializes in AI LiDAR-based solutions software, addressing challenges in safety, transportation, and infrastructure.

Major companies operating in the automotive LiDAR market include Continental AG, Ibeo Automotive Systems GmbH, Innoviz Technologies Ltd., LeddarTech Inc., Luminar Technologies Inc., Ouster Inc., Robert Bosch GmbH, Velodyne Lidar Inc., Denso Corporation, Leica Geosystems AG, Mira Solutions Inc., Argo AI LLC, ZF Friedrichshafen AG, Quanergy Systems Inc., AEye Inc., Blackmore Sensors and Analytics Inc., Cepton Technologies Inc., Hesai Technology Co. Ltd., Suteng Innovation Technology Co. Ltd., Blickfeld GmbH, Innovusion Inc., Aeva Technologies Inc., Baraja Pty Ltd, XenomatiX NV, Benewake Co. Ltd., Phantom Intelligence Inc., HoloMatic Technologies Co. Ltd., LeiShen Intelligent Systems Co. Ltd.

Asia-Pacific was the largest region in the automotive LiDAR market share in 2024. The regions covered in the automotive lidar market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the automotive lidar market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Automotive LiDAR is a sensing technique utilized for object detection and distance measurement by emitting an optical pulse towards a target and analyzing the properties of the reflected signal. The width of the optical pulse can range from a few nanoseconds to several microseconds.

Primary types of automotive LiDAR products include aerial, mobile, terrestrial or static, and short-range systems. Aerial LiDAR involves an airborne mapping system utilizing laser returns from the Earth's surface, reflected by an overhead GPS-monitored aircraft equipped with onboard positioning and Inertial Measurement Unit (IMU) sensors. Its key components comprise lasers, GPS/GNSS receivers, cameras, inertial navigation systems, and Micro-Electro-Mechanical Systems (MEMS). Various technologies are employed, including solid-state LiDAR and mechanical or scanning LiDAR, tailored for different vehicle types such as internal combustion engine (IC) vehicles, hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs). These LiDAR systems find applications in Advanced Driver Assistance Systems (ADAS) and autonomous vehicles.

The automotive LiDAR market research report is one of a series of new reports that provides automotive LiDAR market statistics, including automotive LiDAR industry global market size, regional shares, competitors with an automotive LiDAR market share, detailed automotive LiDAR market segments, market trends and opportunities, and any further data you may need to thrive in the automotive LiDAR industry. This automotive LiDAR market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The automotive LiDAR market consists of revenues earned by entities by providing 2D automotive LiDAR and 3D automotive LiDAR and related annotation technological services. The market value includes the value of related goods sold by the service provider or included within the service offering. The automotive LiDAR market also includes sales of automotive components such as automotive gimbaling systems and strap-down systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Automotive LiDAR Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on automotive lidar market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for automotive lidar ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The automotive lidar market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Aerial; Mobile; Terrestrial or Static; Short-Range2) by Technology: Solid-State LiDAR; Mechanical or Scanning LiDAR

3) by Vehicle Type: IC Engine Vehicles; Hybrid Electric Vehicles (HEVS); Plug-in Hybrid Electric Vehicles (PHEVS); Battery Electric Vehicles (BEVS)

4) by Components: Laser; GPS or GNSS Receiver; Camera; Inertial Navigation System; Micro Electro Mechanical System

5) by Application: Semi-Autonomous; Autonomous

Subsegments:

1) by Aerial: Drone-Mounted LiDAR; Helicopter-Mounted LiDAR2) by Mobile: Vehicle-Mounted LiDAR Systems; Portable LiDAR Units For Mapping

3) by Terrestrial or Static: Ground-Based LiDAR Systems; Fixed Installation LiDAR Systems

4) by Short-Range: LiDAR For Obstacle Detection; LiDAR For Close-Range Mapping

Key Companies Mentioned: Continental AG; Ibeo Automotive Systems GmbH; Innoviz Technologies Ltd.; LeddarTech Inc.; Luminar Technologies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Automotive LiDAR market report include:- Continental AG

- Ibeo Automotive Systems GmbH

- Innoviz Technologies Ltd.

- LeddarTech Inc.

- Luminar Technologies Inc.

- Ouster Inc.

- Robert Bosch GmbH

- Velodyne Lidar Inc.

- Denso Corporation

- Leica Geosystems AG

- Mira Solutions Inc.

- Argo AI LLC

- ZF Friedrichshafen AG

- Quanergy Systems Inc.

- AEye Inc.

- Blackmore Sensors and Analytics Inc.

- Cepton Technologies Inc.

- Hesai Technology Co. Ltd.

- Suteng Innovation Technology Co. Ltd.

- Blickfeld GmbH

- Innovusion Inc.

- Aeva Technologies Inc.

- Baraja Pty Ltd

- XenomatiX NV

- Benewake Co. Ltd.

- Phantom Intelligence Inc.

- HoloMatic Technologies Co. Ltd.

- LeiShen Intelligent Systems Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.08 Billion |

| Forecasted Market Value ( USD | $ 3.35 Billion |

| Compound Annual Growth Rate | 32.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |