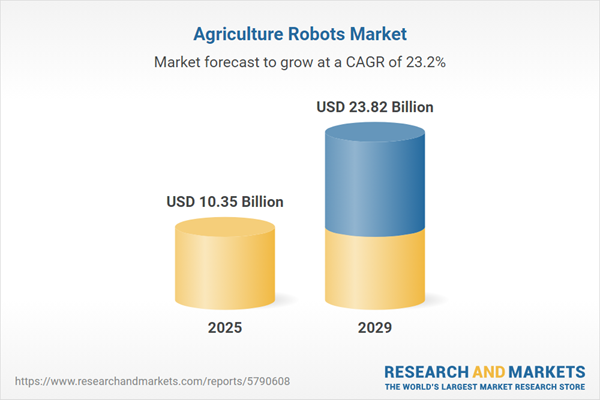

The agriculture robots market size is expected to see exponential growth in the next few years. It will grow to $23.82 billion in 2029 at a compound annual growth rate (CAGR) of 23.2%. The growth in the forecast period can be attributed to robotics-as-a-service (RaaS), sustainability mandates, global population growth, environmental monitoring, urban agriculture focus. Major trends in the forecast period include robotics in autonomous tractors, robots for weeding operations, modular and customizable robotics, robotic soil management, robotic harvesting solutions.

The upward trajectory of the agriculture robots market is significantly driven by the increasing adoption of automation technology. This technology streamlines processes with minimal human intervention, employing programmed commands and automatic feedback for precise execution. In agriculture, automation serves to enhance farm management technologies, optimizing day-to-day tasks and bolstering crop and livestock production. Its application in dairy farms focuses on enhancing profitability, animal welfare, lifestyle, and milk quality by leveraging robots for milking, cattle health monitoring, labor-intensive tasks like feeding, and more. Notably, Formstack, a US-based software company, reported in May 2023 that 76% of organizations implement automation for daily workflows, with 58% utilizing it for data and reporting automation for planning purposes, while 36% use it for regulatory compliance. This surge in automation adoption significantly fuels the growth of the agriculture robots market.

The burgeoning expenses associated with labor are poised to drive the expansion of the agriculture robots market. Labor costs encompass the total expenditures incurred by organizations in compensating their workforce. Agriculture robots offer a solution to mitigate these costs by automating repetitive tasks such as planting, weeding, and harvesting with heightened precision and efficiency, thereby reducing reliance on manual labor. Notably, according to the United States Department of Agriculture's August 2023 report, the average hourly wage for agricultural managers surged to $27.57 in 2022, marking a notable 7.9% increase from 2021. This substantial rise in labor costs significantly contributes to the escalating growth of the agriculture robots market.

Major companies in the agriculture robots market are concentrating on technological advancements such as Robots as a Service (RaaS) to boost operational efficiency, decrease processing times, and enhance accuracy in invoice and payment management. RaaS is a cloud-based service model that allows businesses to access robotic systems through a subscription, enabling them to leverage robotic automation without significant upfront costs. For example, in February 2022, Naïo Technologies, a France-based firm specializing in agricultural robotics, showcased its innovations at the World Ag Expo 2022. Their robot operates entirely on electric power, significantly reducing environmental impact by eliminating carbon emissions and the use of chemicals associated with conventional farming practices.

Prominent players within the agriculture robots sphere are spearheading innovative technological advancements, exemplified by Solix, an autonomous crop monitoring robot designed to deliver dependable services to customers. Launched by Solinftec, a Brazil-based ag-tech company in May 2022, Solix represents a cutting-edge solution that meticulously monitors crops plant-by-plant, striking a balance between efficiency and productivity. Its primary objective is to offer real-time insights into fields. Solix operates on solar power and incorporates lithium-ion batteries for energy storage. Equipped with onboard cameras, sensors, and AI technology, the robot diligently monitors plant health, detects insect damage, and identifies field alterations, underscoring a significant leap in precision agriculture.

In October 2023, Rockwell Automation, Inc., a US-based company focused on industrial automation and information technology, acquired Clear Path Robotics for an undisclosed amount. This acquisition is intended to enhance Rockwell Automation's technology portfolio, broaden its capabilities in industrial automation, and reinforce its market position. Clearpath Robotics, based in Canada, specializes in manufacturing a variety of autonomous mobile robots (AMRs).

Major companies operating in the agriculture robots market are Deere & Company, SZ DJI Technology Co Ltd., AGCO Corporation, DeLaval, Trimble Inc., BouMatic Robotics BV, Lely Industries NV, AgJunction Inc., AgEagle Aerial Systems Inc., Yanmar Co Ltd., Agribotix LLC, Harvest Automation Inc., Topcon Positioning Systems Inc., GEA Group AG, Ag Leader Technology, Deepfield Robotics, Autonomous Tractor Corporation, Clearpath Robotics Inc., Agrobot, Naïo Technologies, PrecisionHawk Inc., CNH Industrial NV, Harvest CROO Robotics LLC, Robotics Plus Limited, Ecorobotix SA, AutoCopter Corp., Autonomous Solutions Inc., Kubota Corporation, DroneDeploy Inc., FFRobotics Ltd., Fullwood Packo, Octinion BV, Dot Technology Corp., SwarmFarm Robotics, Fendt, Robotina, Soft Robotics Inc.

North America was the largest region in the agriculture robots market in 2024. Europe is expected to be the fastest-growing region in the global agriculture robots market during the forecast period. The regions covered in the agriculture robots market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the agriculture robots market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Agricultural robots are robotic systems designed to enhance various agricultural processes by automating labor-intensive or time-consuming tasks, ultimately making farming operations more efficient, quicker, and productive.

The primary types of agricultural robots include milking robots, unmanned aerial vehicles (UAVs) or drones, automated harvesting systems, and driverless tractors, among others. Milking robots automate the entire milking process by employing a combination of manual and mechanical systems to milk and manage cows. These robots offer a range of solutions, including hardware, software, and services, applied to the cultivation of fruits and vegetables, field crops, dairy and livestock, both in indoor and outdoor farming environments. They find application in harvest management, field farming, dairy and livestock management, soil and irrigation management, and various other agricultural tasks.

The agriculture robots market research report is one of a series of new reports that provides agriculture robots market statistics, including agriculture robots industry global market size, regional shares, competitors with agriculture robots market share, detailed agriculture robots market segments, market trends, and opportunities, and any further data you may need to thrive in the agriculture robots industry. This agriculture robots market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The agriculture robots market consists of revenues earned by entities by providing GPS agriculture, satellite imagery, farming software, online data and merging datasets services. The market value includes the value of related goods sold by the service provider or included within the service offering. The agriculture robots market also includes sales of fixed-wing drones, rotary blade drones, hybrid drones, SCARA (selective compliance assembly robot arm) robots, crop-harvesting robots, and weeding robots which are used in providing agriculture robots services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Agriculture Robots Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on agriculture robots market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for agriculture robots? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The agriculture robots market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Offering: Hardware; Software; Services2) by Type: Milking Robots; UAVs or Drones; Automated Harvesting Systems; Driverless Tractors; Other Types

3) by Farm Produce: Fruits and Vegetables; Field Crops; Dairy and Livestock; Other Farm Produces

4) by Farming Environment: Indoor; Outdoor

Subsegments:

1) by Hardware: Robotic Harvesters; Autonomous Tractors; Drones; Soil and Crop Monitoring Robots2) by Software: Robotic Control Software; Data Analytics and Management Software; Navigation and Mapping Software

3) by Services: Installation and Integration Services; Maintenance and Support Services; Training and Consulting Services

Key Companies Mentioned: Deere & Company; SZ DJI Technology Co Ltd.; AGCO Corporation; DeLaval; Trimble Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Agriculture Robots market report include:- Deere & Company

- SZ DJI Technology Co Ltd.

- AGCO Corporation

- DeLaval

- Trimble Inc.

- BouMatic Robotics BV

- Lely Industries NV

- AgJunction Inc.

- AgEagle Aerial Systems Inc.

- Yanmar Co Ltd.

- Agribotix LLC

- Harvest Automation Inc.

- Topcon Positioning Systems Inc.

- GEA Group AG

- Ag Leader Technology

- Deepfield Robotics

- Autonomous Tractor Corporation

- Clearpath Robotics Inc.

- Agrobot

- Naïo Technologies

- PrecisionHawk Inc.

- CNH Industrial NV

- Harvest CROO Robotics LLC

- Robotics Plus Limited

- Ecorobotix SA

- AutoCopter Corp.

- Autonomous Solutions Inc.

- Kubota Corporation

- DroneDeploy Inc.

- FFRobotics Ltd.

- Fullwood Packo

- Octinion BV

- Dot Technology Corp.

- SwarmFarm Robotics

- Fendt

- Robotina

- Soft Robotics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.35 Billion |

| Forecasted Market Value ( USD | $ 23.82 Billion |

| Compound Annual Growth Rate | 23.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 38 |