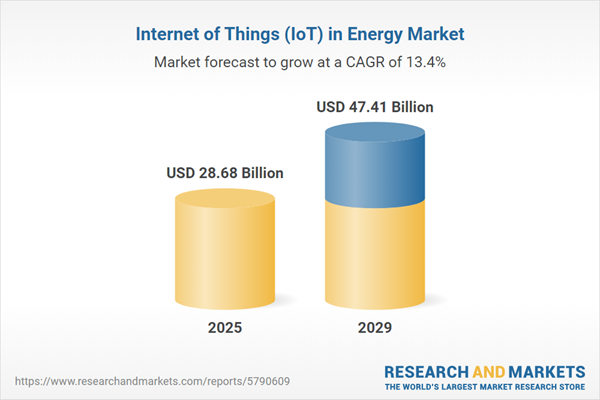

The internet of things (IoT) in energy market size is expected to see rapid growth in the next few years. It will grow to $47.41 billion in 2029 at a compound annual growth rate (CAGR) of 13.4%. The growth in the forecast period can be attributed to real-time asset monitoring, decentralized energy generation, IoT device proliferation, climate change mitigation, energy management systems. Major trends in the forecast period include adaptive energy management, energy consumption analytics, blockchain for energy transactions, renewable energy integration, IoT-enabled smart buildings.

The expanding adoption of energy management is poised to drive the advancement of the Internet of Things (IoT) within the energy market. Energy management involves a proactive, coordinated, and systematic approach to acquiring, transforming, distributing, and utilizing energy while considering environmental and economic objectives. IoT-based energy management systems in the energy industry leverage real-time power consumption data to optimize electricity usage. They dynamically transition to more cost- and resource-efficient models while crafting sustainable energy consumption strategies based on usage patterns. Notably, a report by the Federal Statistical Office of Germany highlighted that at the outset of 2022, 10% of German households embraced smart energy management systems like intelligent thermostats, electricity meters, and lighting, emphasizing their commitment to energy conservation. Consequently, the increasing adoption of energy management propels the demand for IoT solutions in the energy sector.

The surge in cyber threats is projected to stimulate the growth of IoT in the energy market. Cyber threats encompass various potential risks originating from malicious activities aimed at compromising data, targeting computer systems, networks, and digital information. IoT devices utilized within the energy sector handle sensitive data related to power consumption, grid operations, and user behavior. These devices are susceptible to cyberattacks leading to unauthorized access and privacy breaches. As per the Australian Cyber Security Centre's data in February 2023, cybercrime reports surged to 76,000 in 2022, marking a 13% increase from the previous year. This escalation in cyber threats serves as a driving force behind the growth of IoT in the energy market as organizations aim to reinforce cybersecurity measures and safeguard critical data infrastructure.

Innovating products stands as a crucial trend within the Internet of Things (IoT) in the energy market. Leading companies in this domain are dedicated to developing inventive solutions to maintain their market standing. For instance, in November 2022, ABB Ltd., a Switzerland-based technology company, introduced ABB Ability OPTIMAX, an innovative energy-management system. This system facilitates cost reduction in production by providing real-time insights into energy consumption across operational processes. ABB's OPTIMAX plays a pivotal role in supporting the complete lifecycle of a hydrogen plant, aiding in design simulation, engineering phases, real-time visualization, and operational monitoring. It actively detects carbon dioxide emissions and analyzes two-way power flows, empowering operators with contextual data to optimize energy consumption levels for efficient plant operations and waste reduction, especially in the production of green hydrogen through electrolysis.

Prominent companies engaged in the Internet of Things (IoT) within the energy market are concentrating on pioneering products infused with technological advancements to gain a competitive advantage. One such innovation is DATUM, a smart storage and diesel management tool adopted by major players. For instance, Repos Energy, an India-based energy distribution company, launched DATUM in June 2023. DATUM furnishes real-time insights into fuel availability, quality, quantity, and usage, empowering businesses to monitor diesel consumption and access comprehensive usage records on a daily, weekly, monthly, and yearly basis. Equipped with an anti-theft mechanism, DATUM aims to curb fuel theft, ensuring accessibility for consumers with a simple click on their phones, thereby optimizing operations and enhancing efficiency in fuel management.

In September 2024, Kaynes Technology, an India-based integrated electronics manufacturer specializing in end-to-end and IoT solutions, acquired Iskraemeco for $5.11 million. This acquisition aims to broaden Kaynes's energy management product portfolio and strengthen its competitive position in the fast-growing smart meter market. It represents a strategic effort to enhance Kaynes' presence in the energy sector, addressing the increasing demand for advanced energy management solutions across various industries. Iskraemeco is also an India-based provider of energy IoT solutions focused on smart transitions.

Major companies operating in the internet of things (IoT) in energy market are Cisco Systems Inc., International Business Machines Corporation, Intel Corporation, SAP SE, AGT International, Davra Networks, HCL Technologies Limited, Accenture PLC, Google LLC, Altair Engineering Inc., Siemens AG, Schneider Electric SE, Rockwell Automation Inc., Asea Brown Boveri Ltd., Aclara Technologies LLC, C3.ai Inc., Honeywell International Inc., Vodafone Group PLC, Duke Energy Corporation, Enel S.p.A., Électricité de France, Pacific Gas and Electric Company, National Grid PLC, Southern Company, Carriots SL, Flutura Business Solutions LLC, Maven Systems Private Limited, Wind River Systems Inc.

North America was the largest region in the k market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global internet of things (IoT) in energy market during the forecast period. The regions covered in the internet of things (iot) in energy market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the internet of things (iot) in energy market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

IoT, or the Internet of Things, encompasses a network of physical devices and objects linked wirelessly. Through communication and sensing technologies, IoT facilitates the collection and transmission of real-time data, enabling rapid computations and optimal decision-making within the energy industry. Leveraging IoT, the energy sector can transition from a centralized model to a distributed, intelligent, and integrated energy system.

Within the domain of energy, IoT components comprise solutions, platforms, and services. Solutions involve bundles of devices or technologies facilitating IoT applications for users. Various technologies such as cellular networks, satellite networks, radio networks, and others play pivotal roles in applications related to energy generation, consumption, network security, email security, database management, cloud security, and other relevant applications.

The internet of things (IoT) in energy market research report is one of a series of new reports that provides internet of things (IoT) in energy market statistics, including internet of things (IoT) in energy industry global market size, regional shares, competitors with the internet of things (IoT) in energy market share, detailed internet of things (IoT) in energy market segments, market trends, and opportunities, and any further data you may need to thrive in the internet of things (IoT) in energy industry. This internet of things (IoT) in energy market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The internet of things (IoT) in energy market consists of revenues earned by entities by providing connected logistics, risk management, data management and analytics, supervisory control and data acquisition, mobile workforce management and energy management services in the energy industry. The market value includes the value of related goods sold by the service provider or included within the service offering. The internet of things (IoT) in energy market also includes sales of IoT sensors, computer chips, actuators, cables, and smart devices used in providing IoT services in the energy industry. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Internet of Things (IoT) in Energy Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on internet of things (iot) in energy market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for internet of things (iot) in energy? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The internet of things (iot) in energy market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Solution; Platforms; Services2) by Technology: Cellular Network; Satellite Network; Radio Network; Other Technologies

3) by Application: Energy Generation; Energy Consumption; Network Security; Email Security; Database and Cloud Security; Other Applications

Subsegments:

1) by Solution: Smart Metering Solutions; Energy Management Solutions; Predictive Maintenance Solutions; Demand Response Solutions2) by Platforms: IoT Platforms For Energy Management; Data Analytics Platforms; Cloud-Based Platforms; Connectivity Platforms

3) by Services: Consulting Services; Implementation Services; Maintenance and Support Services; Training and Education Services

Key Companies Mentioned: Cisco Systems Inc.; International Business Machines Corporation; Intel Corporation; SAP SE; AGT International

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Internet of Things (IoT) in Energy market report include:- Cisco Systems Inc.

- International Business Machines Corporation

- Intel Corporation

- SAP SE

- AGT International

- Davra Networks

- HCL Technologies Limited

- Accenture PLC

- Google LLC

- Altair Engineering Inc.

- Siemens AG

- Schneider Electric SE

- Rockwell Automation Inc.

- Asea Brown Boveri Ltd.

- Aclara Technologies LLC

- C3.ai Inc.

- Honeywell International Inc.

- Vodafone Group PLC

- Duke Energy Corporation

- Enel S.p.A.

- Électricité de France

- Pacific Gas and Electric Company

- National Grid PLC

- Southern Company

- Carriots SL

- Flutura Business Solutions LLC

- Maven Systems Private Limited

- Wind River Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 28.68 Billion |

| Forecasted Market Value ( USD | $ 47.41 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |