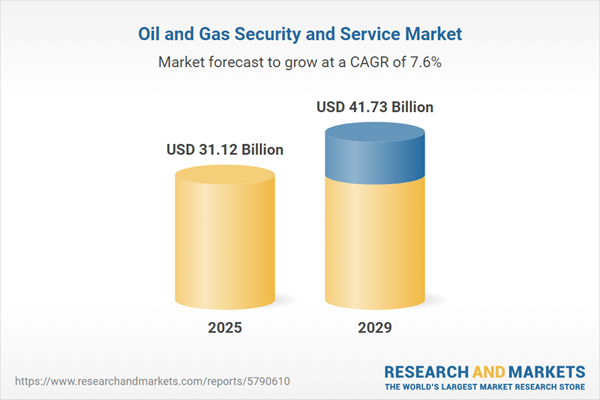

The oil and gas security and service market size is expected to see strong growth in the next few years. It will grow to $41.73 billion in 2029 at a compound annual growth rate (CAGR) of 7.6%. The growth in the forecast period can be attributed to supply chain resilience, focus on incident response, integration of biometric solutions, regulatory changes impacting security, remote asset management. Major trends in the forecast period include incident simulation and drills, cloud security solutions, security automation, zero trust security model, rapid incident response.

The oil and gas security and service market are poised for growth due to the increasing prevalence of cyber-attacks. These attacks, malicious attempts to breach information systems, have surged within the sector, prompting a robust adoption of security services. The primary focus lies in effectively managing and mitigating cyber threats, ensuring system availability, and preserving integrity. Notably, in February 2023, the Australian Cyber Security Centre reported a significant increase in cybercrime reports, reaching 76,000 in 2022, marking a 13% surge from the preceding year. Consequently, the escalating incidence of cyber-attacks propels the oil and gas security and service market.

Anticipated growth in the oil and gas security and service market stems from the expanding adoption of cloud computing. This technology offers computing services via the internet and has become a cornerstone for managing physical infrastructure and software. Within the oil and gas sector, cloud computing facilitates scalable, flexible, and advanced data management, analytics, collaboration, and automated threat response. For instance, statistics from Google LLC in January 2023 revealed a remarkable rise in public cloud usage, with a 76% adoption rate in 2022, a substantial 56% increase from the previous year. Consequently, the increasing embrace of cloud computing is driving growth in the oil and gas security and service market.

Innovative technological solutions stand out as a significant trend reshaping the oil and gas security and service market. Key industry players are focusing on developing cutting-edge solutions to fortify their market positions. For instance, Mine Safety Appliances introduced the HazardWatch FX-12 fire and gas system in August 2022, integrating advanced gas and flame field devices with dependable programmable logic controller technology. This scalable system caters to varied applications, from small-scale setups to extensive plant-wide implementations, certified for NFPA 72 compliance by Factory Mutual. Such systems offer intelligence, flexibility, and reliability, driving technological advancements in the industry.

Leading companies in the oil and gas security and service market are concentrating on the development of high-performance computing platforms, including exploration and production (E&P) storage solutions, to secure a competitive advantage. In the oil and gas sector, E&P storage solutions are crucial for maintaining safety and security, necessitating robust measures to prevent leaks and unauthorized access while adhering to environmental regulations and standards. For example, in September 2023, Huawei Technologies Co., Ltd., a technology and telecommunications firm based in China, introduced its Intelligent Architecture and Intelligent E&P Solution tailored for the oil and gas industry. These innovations aim to enhance efficiency and safety by integrating advanced technologies such as AI, cloud computing, and IoT to optimize exploration, production, and operational processes. The goal of these solutions is to establish intelligent, automated systems that enhance data management, monitoring, and decision-making in oil and gas operations, thereby ensuring more secure and efficient resource management.

In July 2023, ExxonMobil, a prominent US-based natural gas company, completed the acquisition of Denbury Inc. for $4.9 billion. This strategic move by ExxonMobil is geared toward broadening its scope in low-carbon initiatives, meeting the decarbonization demands of industrial clients, and mitigating emissions within its operational framework. Denbury Inc., a US-based firm, specializes in providing oil and gas security and services.

Major companies operating in the oil and gas security and service market are Cisco Systems Inc., Honeywell International Incorporated, Siemens AG, Microsoft Corporation, Lockheed Martin Corporation, Intel Corporation, Broadcom Inc., Parsons Corporation, Asea Brown Boveri Ltd., NortonLifeLock Inc., United Technologies Corporation, Thales Group, Johnson Controls International PLC, Fortinet Inc., Waterfall Security Solutions Ltd., Trend Micro Inc., Symantec Corporation, General Electric Company, Raytheon Company, BAE Systems PLC, FLIR Systems Inc., Motorola Solutions Inc., Booz Allen Hamilton Inc., Northrop Grumman Corporation, Safran S.A., Leidos Holdings Inc., L3Harris Technologies Inc., Accenture PLC, Conseillers en Gestion et Informatique Inc., Cognizant Technology Solutions Corporation, DXC Technology Company, Infosys Limited, Larsen & Toubro Infotech Limited, Schneider Electric, SAP SE.

North America was the largest region in the oil and gas security and service market share in 2024. The regions covered in the oil and gas security and service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the oil and gas security and service market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Oil and gas security and services encompass safeguarding and monitoring the operations of oil and gas segments - upstream, midstream, and downstream - employing robust physical and network security protocols. These measures aim to bolster operational efficiency while mitigating losses attributed to potential security breaches within the industry.

The primary categories of oil and gas security and services consist of physical security, network security, risk management services, system design, integration and consulting, and managed services. Physical security is integral to safeguarding critical oil and gas infrastructure and assets, holding substantial importance for both a nation's economic stability and environmental preservation. The solutions and services provided cater to various operations across the upstream, midstream, and downstream sectors, spanning activities like exploration, drilling, refining, storage, pipeline management, transportation, and distribution.

The oil and gas security and services market research report is one of a series of new reports that provides oil and gas security and services market statistics, including oil and gas security and services industry global market size, regional shares, competitors with oil and gas security and services market share, detailed oil and gas security and services market segments, market trends, and opportunities, and any further data you may need to thrive in the oil and gas security and services industry. This oil and gas security and services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The oil and gas security and service market consist of revenues earned by entities by providing oil and gas security and services through supervisory control and data acquisition (SCADA), and operational technology (OT). The market value includes the value of related goods sold by the service provider or included within the service offering. The oil and gas security and service market also includes sales of physical security systems such as distributed control system (DCS), and industrial control systems (ICS) that are used in providing oil and gas security and services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Oil and Gas Security and Service Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on oil and gas security and service market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for oil and gas security and service ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The oil and gas security and service market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Components: Solutions; Services2) by Type: Physical Security; Network Security; Risk Management Service; System Design, Integration and Consulting; Managed Service

3) by Operations: Upstream; Midstream; Downstream

4) by Application: Exploration and Drilling; Refining and Storage Area; Pipeline, Transportation and Distribution

Subsegments:

1) by Solutions: Physical Security Solutions; Cybersecurity Solutions; Risk Management Solutions; Incident Management Solutions; Compliance and Regulatory Solutions2) by Services: Security Consulting Services; Security Training and Awareness Programs; Managed Security Services; Incident Response Services; Risk Assessment Services

Key Companies Mentioned: Cisco Systems Inc.; Honeywell International Incorporated; Siemens AG; Microsoft Corporation; Lockheed Martin Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Oil and Gas Security and Service market report include:- Cisco Systems Inc.

- Honeywell International Incorporated

- Siemens AG

- Microsoft Corporation

- Lockheed Martin Corporation

- Intel Corporation

- Broadcom Inc.

- Parsons Corporation

- Asea Brown Boveri Ltd.

- NortonLifeLock Inc.

- United Technologies Corporation

- Thales Group

- Johnson Controls International PLC

- Fortinet Inc.

- Waterfall Security Solutions Ltd.

- Trend Micro Inc.

- Symantec Corporation

- General Electric Company

- Raytheon Company

- BAE Systems PLC

- FLIR Systems Inc.

- Motorola Solutions Inc.

- Booz Allen Hamilton Inc.

- Northrop Grumman Corporation

- Safran S.A.

- Leidos Holdings Inc.

- L3Harris Technologies Inc.

- Accenture PLC

- Conseillers en Gestion et Informatique Inc.

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- Infosys Limited

- Larsen & Toubro Infotech Limited

- Schneider Electric

- SAP SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 31.12 Billion |

| Forecasted Market Value ( USD | $ 41.73 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |