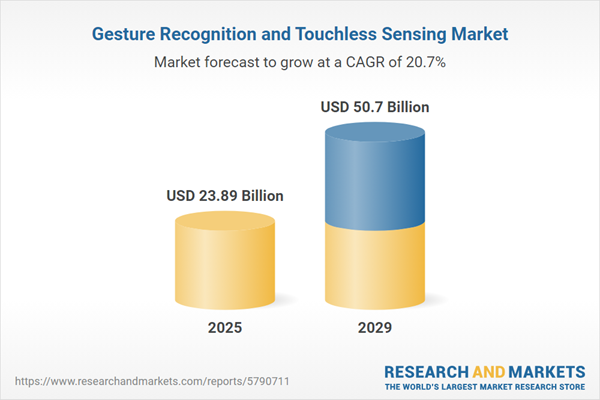

The gesture recognition and touchless sensing market size is expected to see exponential growth in the next few years. It will grow to $50.7 billion in 2029 at a compound annual growth rate (CAGR) of 20.7%. The growth in the forecast period can be attributed to application in entertainment and gaming, focus on hygiene and sanitary solutions, integration with internet of things (IoT) devices, rise in contactless payment and retail applications, expansion in automotive adoption. Major trends in the forecast period include application in healthcare and medical settings, innovation in sensing technologies, rise of augmented reality (AR) and virtual reality (VR), expansion in consumer electronics.

The expanding usage within the automotive sector is anticipated to drive the growth of the gesture recognition and touchless sensing market. These technologies offer solutions to reduce distractions for drivers, streamlining controls and reducing the need for physical interaction with screens. For instance, based on data from the Board of Governors of the Federal Reserve System in August 2023, the total vehicle production in the United States rose to 11.77 million units in July, up from 10.91 million units in June, indicating the driving force of automotive industry growth on gesture recognition and touchless sensing technologies.

The increasing adoption of contactless transactions in point-of-sale (POS) applications is poised to fuel the growth of gesture recognition and touchless sensing markets. Contactless transactions in POS applications involve payment methods where customers complete transactions without physically touching the terminal. This trend, driven by hygiene and convenience concerns, extends to various applications, including gesture recognition and touchless sensing technologies. For example, the Consumer Financial Protection Bureau reported in September 2023 that tap-to-pay usage at POS in the U.S. is on the rise due to widespread adoption of NFC technology in mobile devices and terminals, with projections of a significant 150% growth in digital wallet tap-to-pay transactions by 2028. Hence, the increased adoption of contactless transactions is expected to propel the gesture recognition and touchless sensing market.

Major companies in the gesture recognition and touchless sensing market are concentrating on the introduction of smartphone image sensors featuring TheiaCel technology, which enables more precise gesture recognition and touchless interactions across various applications, including mobile devices, smart home technology, and augmented reality. TheiaCel technology is a specialized image sensor technology that enhances the performance of camera sensors, particularly in low-light environments. It employs advanced pixel design and fabrication techniques to achieve higher sensitivity and improved image quality. For example, in March 2024, OmniVision Technologies Inc., a US-based company, launched the OV50K40, an innovative smartphone image sensor. The OV50K40 offers a resolution of 50 megapixels (MP) with a pixel size of 1.2 microns (µm), packaged in a 1/1.3-inch optical format. This configuration provides high gain and optimal performance in a variety of lighting conditions. Additionally, this cutting-edge technology uses lateral overflow integration capacitors (LOFIC) to enhance high dynamic range (HDR) capabilities, enabling superior single-exposure HDR and effectively tackling challenges related to bright backgrounds and low-light situations.

Key companies in the gesture recognition and touchless sensing market are focused on developing advanced products like gesture recognition digital displays. These displays utilize sensors and software to interpret and respond to human gestures, enabling users to interact with digital content via hand or body movements without physically touching the display surface. For instance, in November 2022, Hyundai Mobis Company, a South Korean automotive component manufacturer, introduced Quick Menu Selection, an onboard digital display technology featuring gesture recognition. This technology allows users to effortlessly open frequently used menus through hand gestures and taps, enhancing driving safety by minimizing distractions and ensuring a more convenient use of in-vehicle infotainment (IVI) systems.

In March 2022, SALTO Systems, S.L., a Spain-based company, acquired Cognitec Systems GmbH for an undisclosed amount. This acquisition is intended to enhance SALTO's portfolio by integrating Cognitec Systems' expertise in gesture recognition and touchless sensing technologies. Cognitec Systems GmbH is known for its capabilities in gesture recognition.

Major companies operating in the gesture recognition and touchless sensing market are Microsoft Corporation, Microchip Technology Inc., Apple Inc., Google LLC, Sony Depthsensing Solutions SA, Infineon Technologies AG, Cognitec Systems GmbH, GestureTek Systems Inc., OmniVision Technologies Inc., Intel Corporation, Qualcomm Inc., Eyesight Technologies Ltd., Omron Corporation, SoftKinetic International SA, Texas Instruments Inc., XYZ Interactive Technologies Inc., Elliptic Laboratories ASA, PMD Technologies AG, Oblong Industries Inc., Ultraleap Limited, PointGrab Ltd., Leap Motion Inc., Xilinx Inc., MicroVision Inc., Melexis NV, Vayyar Imaging Ltd., Cognitivesignals, Cognivue Corporation,

North America was the largest region in the gesture recognition and touchless sensing market share in 2024. The regions covered in the gesture recognition and touchless sensing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the gesture recognition and touchless sensing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Gesture recognition involves utilizing sensors to interpret hand movements, whereas touchless sensing represents a branch of gesture control focused on enabling human-computer interaction without the need for physical contact or input.

The primary offerings within gesture recognition and touchless sensing encompass biometric and sanitary equipment. Biometric equipment denotes devices that authenticate individuals based on distinct facial features, signatures, fingerprints, or iris patterns, serving various functions like logging health data and verifying user identities. These technologies, including touch-based and touchless solutions, find applications across automotive, consumer electronics, healthcare, advertising, defense, finance, government, and other sectors.

The gesture recognition and touchless sensing market research report is one of a series of new reports that provides gesture recognition and touchless sensing market statistics, including gesture recognition and touchless sensing industry global market size, regional shares, competitors with gesture recognition and touchless sensing market share, detailed gesture recognition and touchless sensing market segments, market trends and opportunities, and any further data you may need to thrive in the gesture recognition and touchless sensing industry. This gesture recognition and touchless sensing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The gesture recognition and touchless sensing market consists of revenues earned by entities by providing motion control services, perceptual computing user interface services, gesture control services. The market value includes the value of related goods sold by the service provider or included within the service offering. The gesture recognition and touchless sensing market also include sales of sensing equipment such as optical sensors, physiological identifiers, and ultrasonic sensors. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Gesture Recognition and Touchless Sensing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on gesture recognition and touchless sensing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for gesture recognition and touchless sensing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The gesture recognition and touchless sensing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Biometric equipment; Sanitary Equipment2) by Technology: Touch-based; Touchless

3) by Industry: Automotive; Consumer Electronics; Healthcare; Advertisement and Communication; Defense; Finance and Banking; Government; Other Industries

Subsegments:

1) by Biometric Equipment: Fingerprint Scanners; Facial Recognition Systems; Iris Scanners; Voice Recognition Systems2) by Sanitary Equipment: Touchless Faucets; Automatic Soap Dispensers; Touchless Hand Dryers; Sanitary Control Systems

Key Companies Mentioned: Microsoft Corporation; Microchip Technology Inc.; Apple Inc.; Google LLC; Sony Depthsensing Solutions SA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Gesture Recognition and Touchless Sensing market report include:- Microsoft Corporation

- Microchip Technology Inc.

- Apple Inc.

- Google LLC

- Sony Depthsensing Solutions SA

- Infineon Technologies AG

- Cognitec Systems GmbH

- GestureTek Systems Inc.

- OmniVision Technologies Inc.

- Intel Corporation

- Qualcomm Inc.

- Eyesight Technologies Ltd.

- Omron Corporation

- SoftKinetic International SA

- Texas Instruments Inc.

- XYZ Interactive Technologies Inc.

- Elliptic Laboratories ASA

- PMD Technologies AG

- Oblong Industries Inc.

- Ultraleap Limited

- PointGrab Ltd.

- Leap Motion Inc.

- Xilinx Inc.

- MicroVision Inc.

- Melexis NV

- Vayyar Imaging Ltd.

- Cognitivesignals

- Cognivue Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 23.89 Billion |

| Forecasted Market Value ( USD | $ 50.7 Billion |

| Compound Annual Growth Rate | 20.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |