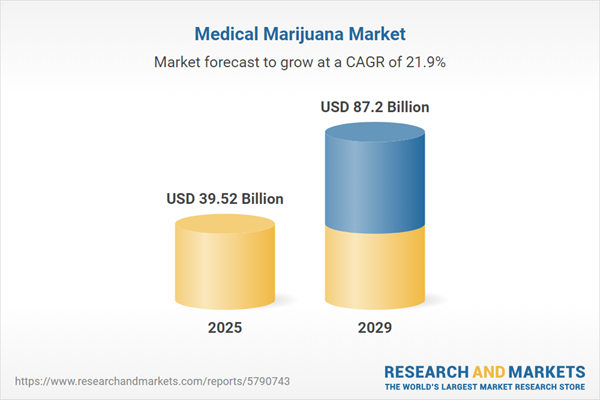

The medical marijuana market size is expected to see exponential growth in the next few years. It will grow to $87.2 billion in 2029 at a compound annual growth rate (CAGR) of 21.9%. The growth in the forecast period can be attributed to continued regulatory developments, scientific research and evidence, patient education and awareness, expansion of medical marijuana product offerings, integration into mainstream healthcare. Major trends in the forecast period include partnerships with traditional healthcare providers, focus on customized treatment plans, standardization of dosage and labeling, investment and M&A activity.

The forecast of 21.9% growth over the next five years reflects a modest reduction of 0.4% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions could hinder U.S. dispensaries by inflating prices of medical-grade cannabis extracts and cannabinoid testing kits imported from Canada and the Netherlands, resulting in reduced patient access and higher alternative treatment costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The rising prevalence of cancer is anticipated to boost the demand for the medical marijuana market in the coming years. Cancer is a condition characterized by the uncontrolled growth of certain cells in the body, which can spread to other areas. Medical marijuana is beneficial for treating cancer patients experiencing neuropathy, nausea, pain, vomiting, loss of appetite, and weight loss. For example, a report from the World Health Organization in February 2024, a Switzerland-based specialized agency focused on international public health, projects that by 2050, there will be over 35 million new cancer cases, representing a 77% increase from the estimated 20 million cases in 2022. Consequently, the increasing prevalence of cancer is expected to drive the growth of the medical marijuana market.

The shifting societal attitudes toward cannabis use are expected to drive the growth of the medical marijuana market in the future. Societal attitudes toward cannabis use encompass the prevailing perceptions, beliefs, and opinions within a community or society regarding the acceptance, legality, and social norms surrounding the consumption and use of cannabis. The cannabis plant and its components are used to alleviate symptoms and treat certain medical conditions under the supervision of a healthcare professional. For example, a survey conducted by the Pew Research Center in October 2022 found that a significant 88% of U.S. adults expressed support for the legalization of marijuana. Specifically, 59% of respondents supported its legalization for both medical and recreational purposes, while 30% supported its legalization solely for medical use. This shift in public opinion indicates a growing acceptance of cannabis use for medical purposes, which is expected to drive the growth of the medical marijuana market. Therefore, the evolving societal attitudes toward cannabis use, as evidenced by increasing support for legalization, are driving the expansion of the medical marijuana market.

Strategic partnerships are becoming a significant trend in the medical marijuana market. Major players in this sector are increasingly focusing on these alliances to broaden their market presence and utilize each other's resources effectively. For example, in October 2024, Trulieve Cannabis Corp., a US-based cannabis retailer, teamed up with Black Buddha Cannabis, a US company known for its wellness brands, to introduce Black Buddha's products in Trulieve dispensaries located in Arizona and Pennsylvania. This collaboration aims to enhance Trulieve's product offerings by incorporating Black Buddha's wellness-focused cannabis lines, specifically the BLYSS and DREAM collections, which highlight therapeutic benefits and carefully curated terpene profiles. Additionally, in January 2022, Trulieve Cannabis Corp. expanded its partnership with Connected Cannabis Co., a premier cannabis cultivator in the US. This expanded partnership is designed to maintain a portfolio of proprietary top-shelf strains.

Major companies in the medical marijuana market are focusing on significant investments in business expansion, particularly the establishment of medical marijuana dispensaries. These efforts aim to improve accessibility for patients and strengthen their presence in the evolving landscape of medical cannabis distribution. Medical marijuana dispensaries are authorized facilities or stores where individuals with valid medical marijuana prescriptions or cards can legally purchase medicinal cannabis products. For example, in July 2023, Botanical Sciences, a Georgia-based medical cannabis provider, opened a medical cannabis dispensary in Pooler, near Savannah, with plans for extensive expansion. The company intends to establish additional outlets in Columbus and Evans, and it aims to further expand its presence by opening dispensaries in Augusta, Chamblee, Marietta, and Stockbridge. In compliance with Georgia's regulations, MMJ operators have the opportunity to open up to six dispensaries each. This strategic focus on expanding dispensary networks reflects a broader trend in the medical marijuana market towards improving patient access and market reach.

In February 2024, Curaleaf International, a UK-based biotechnology research company, acquired Can4Med LLC for an undisclosed amount. This acquisition is intended to enhance Curaleaf's supply chain and improve access to high-quality medical cannabis products for patients in various regions. Can4Med LLC is a pharmaceutical manufacturing company based in Poland.

Major companies operating in the medical marijuana market include Pfizer Inc., Curaleaf Holdings Inc., Trulieve Cannabis Corp, Green Thumb Industries GTI Inc., Cresco Labs Inc., Tilray Inc, Aphria Inc., Canopy Growth Corporation, Jushi Holdings Inc., TerrAscend Corp, Aurora Cannabis Inc., HEXO Corp, MedMen Enterprises Inc., Organigram Holdings Inc., Charlotte's Web Holdings Inc., Vireo Health International Inc., Medical Marijuana Inc., Cara Therapeutics Inc., VIVO Cannabis Inc., Valens GroWorks Corp, Green Relief Inc., Harborside Inc., MediPharm Labs Inc., Tikun Olam Cannbit Ltd., Emerald Health Therapeutics Inc., MedReleaf Corporation, GB Sciences Inc., CanniMed Therapeutics Inc., The Cronos Group Inc., Planet 13 Holdings Inc.

North America was the largest region in the medical marijuana market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global medical marijuana market during forecast period. The regions covered in the medical marijuana market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical marijuana market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The medical marijuana market research report is one of a series of new reports that provides medical marijuana market statistics, including medical marijuana industry global market size, regional shares, competitors with a medical marijuana market share, detailed medical marijuana market segments, market trends and opportunities, and any further data you may need to thrive in the medical marijuana industry. This medical marijuana market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Medical marijuana refers to products derived from the cannabis plant, which are used for medicinal purposes. It is used to manage conditions such as pain, nausea, and addiction, and is sometimes used as an alternative to traditional medications.

In the medical marijuana industry, the main types of products are dried flower and extracts. Dried flower medical marijuana consists of the smokable, trichome-rich portion of the cannabis plant and is used to treat various mental and physical illnesses or alleviate their symptoms. Medical marijuana is available in various forms such as flower, concentrate, edibles, and others, and is used for pain management, Tourette syndrome, Alzheimer's disease, migraines, depression and anxiety, multiple sclerosis, cancer, and other applications. These products are distributed through retail pharmacies, e-commerce platforms, and other distribution channels.

The medical marijuana market consists of sales of cartridges, concentrates, flower and extracts. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Medical Marijuana Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical marijuana market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical marijuana? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The medical marijuana market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Dried Flower; Extract Form2) By Type: Flower; Concentrate; Edibles; Other Types

3) By Application: Pain Management; Tourette Syndrome; Alzheimer's disease; Migraines; Depression and Anxiety; Multiple Sclerosis; Cancer; Other Applications

4) By Distribution Channel: Retail Pharmacy; E-Commerce; Other Distribution Channels

Subsegments:

1) By Dried Flower: Indica Strains; Sativa Strains; Hybrid Strains2) By Extract Form: Oils; Tinctures; Concentrates; Edibles

Companies Mentioned: Pfizer Inc.; Curaleaf Holdings Inc.; Trulieve Cannabis Corp; Green Thumb Industries GTI Inc.; Cresco Labs Inc.; Tilray Inc; Aphria Inc.; Canopy Growth Corporation; Jushi Holdings Inc.; TerrAscend Corp; Aurora Cannabis Inc.; HEXO Corp; MedMen Enterprises Inc.; Organigram Holdings Inc.; Charlotte's Web Holdings Inc.; Vireo Health International Inc.; Medical Marijuana Inc.; Cara Therapeutics Inc.; VIVO Cannabis Inc.; Valens GroWorks Corp; Green Relief Inc.; Harborside Inc.; MediPharm Labs Inc.; Tikun Olam Cannbit Ltd.; Emerald Health Therapeutics Inc.; MedReleaf Corporation; GB Sciences Inc.; CanniMed Therapeutics Inc.; the Cronos Group Inc.; Planet 13 Holdings Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Medical Marijuana market report include:- Pfizer Inc.

- Curaleaf Holdings Inc.

- Trulieve Cannabis Corp

- Green Thumb Industries GTI Inc.

- Cresco Labs Inc.

- Tilray Inc

- Aphria Inc.

- Canopy Growth Corporation

- Jushi Holdings Inc.

- TerrAscend Corp

- Aurora Cannabis Inc.

- HEXO Corp

- MedMen Enterprises Inc.

- Organigram Holdings Inc.

- Charlotte's Web Holdings Inc.

- Vireo Health International Inc.

- Medical Marijuana Inc.

- Cara Therapeutics Inc.

- VIVO Cannabis Inc.

- Valens GroWorks Corp

- Green Relief Inc.

- Harborside Inc.

- MediPharm Labs Inc.

- Tikun Olam Cannbit Ltd.

- Emerald Health Therapeutics Inc.

- MedReleaf Corporation

- GB Sciences Inc.

- CanniMed Therapeutics Inc.

- The Cronos Group Inc.

- Planet 13 Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 39.52 Billion |

| Forecasted Market Value ( USD | $ 87.2 Billion |

| Compound Annual Growth Rate | 21.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |