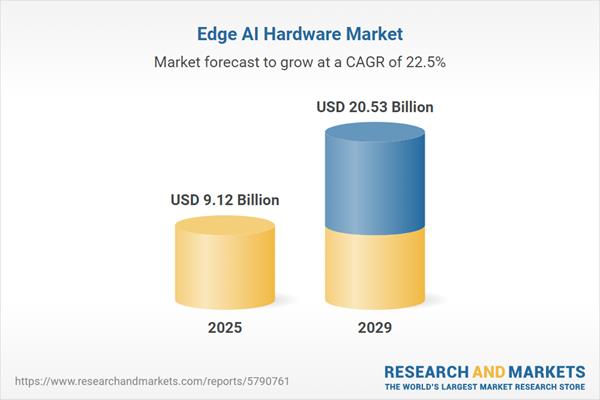

The edge AI hardware market size is expected to see exponential growth in the next few years. It will grow to $20.53 billion in 2029 at a compound annual growth rate (CAGR) of 22.5%. The growth in the forecast period can be attributed to advancements in hardware architecture, energy-efficient edge devices, edge-to-cloud balance, privacy and data security requirements, industry-specific solutions. Major trends in the forecast period include ai model optimization for edge, hardware acceleration solutions, edge-to-cloud synergy, decentralized ai applications, federated learning adoption.

The increasing number of IoT applications is expected to drive growth in the edge AI hardware market in the future. An IoT application consists of a suite of services and programs that aggregate data from multiple IoT devices. These applications can collect data from across the factory floor and consolidate it at the network's edge, leading to a rise in demand for edge AI hardware. For example, in November 2022, a report from Ericsson, a Sweden-based telecommunications company, revealed that broadband IoT (4G/5G), which connects most cellular IoT devices, reached 1.3 billion connections in 2022. It is projected that nearly 60% of cellular IoT connections will be broadband IoT connections by the end of 2028, with 4G handling the majority. Currently, North East Asia leads in cellular IoT connections, and it is expected to surpass 2 billion connections in 2023. Thus, the rise in IoT applications is fueling the growth of the edge AI hardware market.

The widespread adoption of 5G connectivity is poised to drive the advancement of the edge AI hardware market in the coming years. 5G connectivity denotes the fifth generation of mobile networks, offering swifter data speeds, reduced latency, and heightened capacity for wireless communication. Edge AI hardware augments 5G connectivity by facilitating real-time processing at the network edge, thereby curtailing latency and optimizing data traffic for more efficient and responsive applications. For instance, as of April 2023, data sourced from 5G Americas, a US-based industry trade organization, indicates a 76% upsurge in global 5G wireless connections from the end of 2021 to the end of 2022, reaching a total of 1.05 billion connections. Projections foresee this number reaching 5.9 billion by the end of 2027. Consequently, the uptake of 5G connectivity is steering the growth of the edge AI hardware market.

Technological advancements stand out as the pivotal trend garnering attention within the edge AI hardware market. Major companies operating in this sphere are vigorously developing sophisticated technologies to fortify their market positioning. For instance, in May 2022, Habana Labs, an Israel-based entity under Intel, introduced second-generation AI processors tailored for both training and inferencing tasks. The hallmark of these processors is their capacity to bridge market gaps by furnishing customers with high-performance and high-efficiency deep learning compute solutions, suitable for both training workloads and inference deployments in data centers. This innovation not only lowers the barriers to AI adoption for businesses of varying sizes but also distinguishes itself amidst competitive technological offerings.

Major players within the edge AI hardware market are actively engaged in the development of advanced platforms that amalgamate both hardware and software capabilities, exemplified by NVIDIA IGX Orin, which aims to establish novel functional safety benchmarks for AI and computing systems. NVIDIA IGX Orin represents a cutting-edge, high-precision edge AI computing platform that integrates sophisticated security and safety attributes. For instance, in September 2022, NVIDIA, a prominent US-based software company, unveiled its IGX Edge AI Computing Platform, specifically designed to meet the demands of high-precision edge AI across sectors such as manufacturing, logistics, and healthcare. This platform fosters improved collaboration between humans and machines while ensuring an additional layer of safety within real-world environments. It incorporates the potent NVIDIA IGX Orin tailored for autonomous industrial machinery and medical apparatus. Offering flexibility and adaptability, the platform can be easily programmed and configured to suit diverse requirements, ensuring adherence to edge AI protocols. In the healthcare sector, the IGX platform supports NVIDIA Clara Holoscan for real-time AI computation in medical equipment.

In June 2022, Qualcomm, a distinguished US-based semiconductor company, acquired Cellwize for an undisclosed sum. This acquisition merges Cellwize's cutting-edge cloud-native, multi-vendor RAN (Radio Access Network) automation and management platform with Qualcomm Technologies' top-tier 5G RAN offerings. This integration is poised to deliver leading-edge RAN automation and management software solutions, further expediting the evolution of the connected intelligent edge through the deployment of both private and public 5G networks. This strategic collaboration aims to minimize network deployment timelines and streamline network administration. Cellwize, a US-based telecommunications service provider, specializes in enabling future-oriented networks.

Major companies operating in the edge AI hardware market include Apple Inc., MediaTek Inc., Qualcomm Technologies Inc., Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., Intel Corporation, NVIDIA Corporation, International Business Machines Corporation, Google LLC, Microsoft Corporation, Advanced Micro Devices Inc., Imagination Technologies Limited, Adapteva Inc., Arm Limited, ADLINK Technology Inc., Alphabet Inc., Amazon.com Inc., Baidu Inc., Continental AG, Denso Corporation, Renesas Electronics Corporation, Infineon Technologies AG, KALRAY Corporation, Robert Bosch GmbH, Rockchip Electronics Co. Ltd., NXP Semiconductors N.V., ON Semiconductor Corporation, Oracle Corporation, STMicroelectronics N.V.

North America was the largest region in the edge AI hardware market in 2024. Asia-Pacific is expected to be the fastest-growing region in the edge AI hardware market during the forecast period. The regions covered in the edge ai hardware market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the edge ai hardware market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Edge AI hardware, often known as AI accelerators, plays a crucial role in accelerating deep learning inference on edge devices, offering an efficient solution for computation-intensive applications. The edge AI platform is versatile, capable of running on various hardware platforms, ranging from standard microcontroller units (MCUs) to advanced neural processors.

The primary devices utilizing edge AI hardware include smartphones, cameras, robots, wearables, smart speakers, and others. Smartphones are handheld electronic devices connected to cellular networks, equipped with components such as processors, memory, sensors, and more. These devices find applications across a wide range of industries and end-users, including consumer electronics, smart home systems, automotive, government, aerospace and defense, healthcare, industrial sectors, construction, and various other domains.

The edge AI hardware market research report is one of a series of new reports that provides edge AI hardware market statistics, including edge AI hardware industry global market size, regional shares, competitors with an edge AI hardware market share, detailed edge AI hardware market segments, market trends, and opportunities, and any further data you may need to thrive in the edge AI hardware industry. This edge AI hardware market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The edge AI hardware market consists of sales of IoT devices, and laptops used in the edge AI platform. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Edge AI Hardware Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on edge ai hardware market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for edge ai hardware ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The edge ai hardware market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Processor; Memory; Sensor; Other Components2) by Device Type: Smartphones; Cameras; Robots; Wearables; Smart Speaker; Other Device Types

3) by End User: Consumer Electronics; Smart Home; Automotive; Government; Aerospace and Defense; Healthcare; Industrial; Construction; Other End Users

Subsegments:

1) by Processor: CPU (Central Processing Unit); GPU (Graphics Processing Unit); FPGA (Field-Programmable Gate Array); ASIC (Application-Specific Integrated Circuit); DSP (Digital Signal Processor)2) by Memory: RAM (Random Access Memory); Flash Memory; SSD (Solid State Drive); EEPROM (Electrically Erasable Programmable Read-Only Memory)

3) by Sensor: Camera; LiDAR (Light Detection and Ranging); Microphones; Temperature Sensors; Pressure Sensors; Proximity Sensors

4) by Other Components: Power Management ICs; Connectivity Modules; Circuit Boards; Cooling Systems

Key Companies Mentioned: Apple Inc.; MediaTek Inc.; Qualcomm Technologies Inc.; Huawei Technologies Co. Ltd.; Samsung Electronics Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Edge AI Hardware market report include:- Apple Inc.

- MediaTek Inc.

- Qualcomm Technologies Inc.

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Intel Corporation

- NVIDIA Corporation

- International Business Machines Corporation

- Google LLC

- Microsoft Corporation

- Advanced Micro Devices Inc.

- Imagination Technologies Limited

- Adapteva Inc.

- Arm Limited

- ADLINK Technology Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Baidu Inc.

- Continental AG

- Denso Corporation

- Renesas Electronics Corporation

- Infineon Technologies AG

- KALRAY Corporation

- Robert Bosch GmbH

- Rockchip Electronics Co. Ltd.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Oracle Corporation

- STMicroelectronics N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.12 Billion |

| Forecasted Market Value ( USD | $ 20.53 Billion |

| Compound Annual Growth Rate | 22.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |