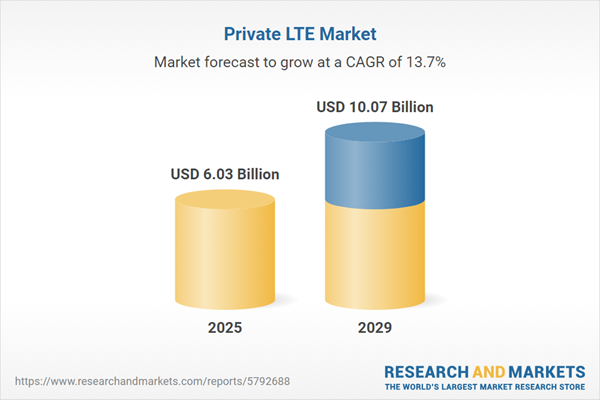

The private LTE market size is expected to see rapid growth in the next few years. It will grow to $10.07 billion in 2029 at a compound annual growth rate (CAGR) of 13.7%. The growth in the forecast period can be attributed to 5G integration, industry vertical demand, edge computing integration, cybersecurity enhancement, cloud-based deployments. Major trends in the forecast period include network slicing, smart infrastructure, private network as a service (NaaS), mission-critical communication, increasing interoperability.

The growing adoption of smartphones is anticipated to drive the expansion of the private LTE market in the future. A smartphone is defined as a mobile device that connects to the internet and operates software similar to that of a laptop. As smartphone usage rises, so does the demand for private LTE, as it provides a secure, individualized, and high-performance mobile network solution. For example, in November 2022, Ericsson, a Sweden-based networking and telecommunications firm, projected that smartphone subscriptions would increase from 6.57 billion to 8.1 billion, representing a compound annual growth rate (CAGR) of 3%. Thus, the rising adoption of smartphones is fueling the growth of the private LTE market.

The escalating rates of internet penetration are expected to fuel the expansion of the private LTE market. Internet penetration rate denotes the percentage of a given population using the internet. Private LTE plays a crucial role in enhancing internet penetration by extending coverage to areas where traditional wired or public cellular networks may not reach. It also allows precise control over network resources, enabling organizations to prioritize specific traffic types based on requirements. According to a report by the International Telecommunication Union (ITU), around 67% of the world's population, or approximately 5.4 billion people, were estimated to be using the internet in 2021. This represents a 1.88% increase from 2022, with 0.1 billion new users coming online during that period. Thus, the growing rates of internet penetration emerge as a significant factor driving the growth of the private LTE market.

Major companies in the private LTE market are embracing a strategic partnership approach to improve technology integration and broaden their market reach. A strategic partnership usually involves a collaborative relationship among two or more organizations, combining their resources, expertise, and efforts to achieve shared goals or objectives. For example, in June 2023, Nokia Corporation, a telecommunications and consumer electronics company based in Finland, teamed up with DXC Technology, a US-based IT services provider, to launch DXC Signal Private LTE and 5G. This managed, secure private wireless network solution is designed to assist industrial enterprises in enhancing automation, flexibility, and data processing. The partnership integrates Nokia Digital Automation Cloud and Nokia MX Industrial Edge with DXC Platform X, providing advanced monitoring, analytics, and security. The targeted sectors for this initiative include manufacturing, energy, healthcare, logistics, transportation, and education.

Major companies operating in the private LTE market are directing their efforts towards developing innovative network solutions, such as the network core, to gain a competitive edge. The network core, also referred to as the backbone network, is the central component of a telecommunications network responsible for routing and switching traffic between different segments. RAKwireless, a China-based provider of advanced IoT technology and services, exemplifies this trend. In February 2023, RAKwireless launched an All-in-one 5G solution designed to provide businesses and organizations with a comprehensive and easily deployable 5G network. This solution combines edge computing, an LTE/5G core network, and a 5G & LTE radio into a compact unit, facilitating fast and effective deployment of new IoT technologies on private networks.

In May 2023, Vocus Group Limited, an international telecommunications company based in Australia, successfully acquired Challenge Networks Pty Ltd. for an undisclosed amount. This acquisition is aimed at enhancing Vocus's capabilities in delivering private LTE and 5G networks, allowing the company to provide comprehensive, fully managed solutions tailored to meet the increasing demands of various industries, especially in remote and expansive areas such as mines. By integrating Challenge Networks' extensive mobile spectrum assets, Vocus can enable quicker deployment of reliable network solutions, thereby improving connectivity and operational efficiency for its customers. Challenge Networks Pty Ltd. is an Australia-based provider of private mobile and network services.

Major companies operating in the private LTE market include Nokia Corporation, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd., ZTE Corporation, Cisco Corporation, Verizon Communications Inc., Qualcomm Technologies Inc., Ruckus Networks Inc., Future Technologies Pvt. Ltd., Comba Telecom Systems Holdings Ltd., CommScope Inc., Samsung Group, Sierra Wireless Inc., Quortus Limited, Star Solutions Inc., Tecore Networks, Telrad Networks, Wireless Excellence, NEC Corporation, Aviat Networks Inc., Affirmed Networks Inc., Athonet SpA, Airspan Networks Inc., ASOCS Inc., Boingo Wireless Inc., Druid Software Limited, ExteNet Systems Inc., Fujitsu Limited, Lemko Corporation.

North America was the largest region in the private LTE market in 2024. The regions covered in the private lte market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the private lte market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Private LTE is a privately owned cellular network comprising various components, including radio equipment (both indoor and outdoor), mobile core software, SIM cards, and network orchestration software, tailored to meet the specific needs of an organization.

The main components of private LTE are infrastructure and services. Infrastructure refers to the fundamental physical facilities of a company, area, or country and often involves the creation of public goods or manufacturing processes. The technologies involved are frequency-division duplexing and time division duplexing, deployed in centralized and distributed models for applications such as public safety, logistics and supply chain, and asset management. End users of private LTE networks include sectors such as utilities, mining, oil and gas, manufacturing, transportation and logistics, government and public safety, healthcare, and others.

The private LTE market research report is one of a series of new reports that provides private LTE market statistics, including private LTE industry global market size, regional shares, competitors with private LTE market share, detailed private LTE market segments, market trends, and opportunities, and any further data you may need to thrive in the private LTE industry. This private LTE market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The private LTE market consists of revenues earned by entities by providing private and customized 4G internet services. The market value includes the value of related goods sold by the service provider or included within the service offering. The private LTE market also includes sales of remote radio head (RRH) devices, eNodeB and EPC (evolved packet core) which are used in providing private LTE services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Private LTE Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on private lte market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for private lte ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The private lte market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Infrastructure; Services2) by Technology: Frequency-Division Duplexing; Time Division Duplexing

3) by Deployment Model: Centralized; Distributed

4) by Applications: Public Safety; logistics and Supply Chain; Asset Management

5) by End User: Utilities; Mining; Oil and Gas; Manufacturing; Transportation and Logistics; Government and Public Safety; Healthcare; Other End Users

Subsegments:

1) by Infrastructure: Base Stations; Core Network Equipment; Backhaul Solutions; User Equipment (UE)2) by Services: Network Planning and Design; Installation and Deployment; Maintenance and Support; Consulting Services; Managed Services

Key Companies Mentioned: Nokia Corporation; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co. Ltd.; ZTE Corporation; Cisco Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Private LTE market report include:- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- ZTE Corporation

- Cisco Corporation

- Verizon Communications Inc.

- Qualcomm Technologies Inc.

- Ruckus Networks Inc.

- Future Technologies Pvt. Ltd.

- Comba Telecom Systems Holdings Ltd.

- CommScope Inc.

- Samsung Group

- Sierra Wireless Inc.

- Quortus Limited

- Star Solutions Inc.

- Tecore Networks

- Telrad Networks

- Wireless Excellence

- NEC Corporation

- Aviat Networks Inc.

- Affirmed Networks Inc.

- Athonet SpA

- Airspan Networks Inc.

- ASOCS Inc.

- Boingo Wireless Inc.

- Druid Software Limited

- ExteNet Systems Inc.

- Fujitsu Limited

- Lemko Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.03 Billion |

| Forecasted Market Value ( USD | $ 10.07 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |