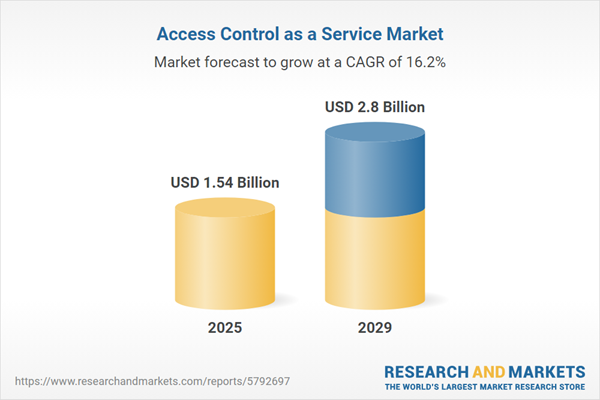

The access control as a service market size is expected to see rapid growth in the next few years. It will grow to $2.8 billion in 2029 at a compound annual growth rate (CAGR) of 16.2%. The growth in the forecast period can be attributed to interoperability and standardization, enhanced mobile access solutions, shift towards subscription-based models, rise in cybersecurity concerns, increased demand for remote access solutions. Major trends in the forecast period include cloud-based solutions, integration with IoT and AI, mobile-based access, demand for remote management, shift to subscription models.

Increasing concerns surrounding security are anticipated to drive the growth of the access control as a service market. These security concerns encompass a range of activities in computer or network systems that pose potential risks to the integrity or confidentiality of electronic systems, networks, and associated data. Access control forms a vital part of data security, regulating access to corporate resources and information through authentication and permissions. In January 2023, data from Checkpoint indicated a 38% rise in global cyberattacks in 2022 compared to 2021. Additionally, the ESET Threat Report T2 2021 identified a 7.3% surge in email-based attacks from May to August 2021, primarily attributed to phishing campaigns orchestrated by cybercriminals. Thus, mounting security apprehensions are fueling the demand for access control as a service.

The transition towards remote work is projected to be a significant driver for the access control as a service market. Remote work signifies employees performing their job responsibilities from a location outside the traditional office setting, often relying on digital tools for connectivity. Access Control as a Service (ACaaS) ensures secure and centralized management of user access to digital resources, thereby fortifying cybersecurity in remote work setups. A 2022 survey by FlexJobs' Career Pulse, encompassing responses from 4,000 participants, indicated that 65% of respondents strongly favored full-time remote work, while 32% preferred a hybrid work arrangement. This overwhelming 97% revealed a widespread preference for remote work options. Hence, the shift towards remote work is a significant driver for the access control as a service market.

Technological advancements are a prominent trend gaining traction within the access control as a service market. Major companies in this sector are dedicated to developing innovative technologies, aiming to solidify their market positions. In December 2022, PlainID, a US-based provider of authorization and policy-based access control, launched its PlainID Technology Network. This collaborative network, developed in conjunction with PlainID partners, aims to globally deploy their cutting-edge technology to assist organizations in securely transforming authorization and access control. The network focuses on seamless integration with essential adjacent technologies, enabling identity-aware security across various segments within an organization's technology stack.

Major players in the access control as a service market are prioritizing the provision of advanced access and authentication services, including cutting-edge solutions such as Zero-Trust Multi-Factor Adaptive Authentication, as a defense mechanism against credential theft. Zero-trust multi-factor Adaptive Authentication stands as an advanced security paradigm that ensures user identity verification through multiple factors and dynamically adapts to continuously assess and grant access. For instance, in January 2022, Telefónica Tech, a Spain-based provider of data analytics, cloud services, and cyber security management, partnered with VU, a UK-based cybersecurity company, to introduce the global Access and Authentication Service. This service focuses on safeguarding organizations against credential theft by employing Zero-Trust Multi-Factor Adaptive Authentication and incorporating biometric facial and voice recognition technologies. Built on VU technology, this service significantly enhances authentication security, offers Single Sign-on capabilities, and seamlessly integrates with Active Directory. Operating in a scalable Software-as-a-Service (SaaS) model, it facilitates easy deployment and monitoring through Telefónica Tech's global network of Security Operations Centers (SOCs).

In April 2022, Johnson Controls, an Ireland-based company specializing in sustainable building technology and software, made an undisclosed acquisition of Security Enhancement Systems (SES). This strategic acquisition aims to integrate SES's cutting-edge security and access control technology into Johnson Controls' portfolio. By incorporating SES's expertise, Johnson Controls is positioned to emerge as a singular, trusted provider of comprehensive security solutions tailored for corporate and various other locations. Security Enhancement Systems, headquartered in the US, specializes in keyless access control solutions, offering services such as keyless entry, real-time access control management, data security, integrated site access alarm management, and site access audit trail services.

Major companies operating in the access control as a service market include Digital Hands, Microsoft Corporation, Brivo Inc., Centrify Corporation, Oracle Corporation, Spica International d.o.o., Vanderbilt Industries GmbH, dormakaba Holding AG, Feenics Inc., Fleming Companies Inc., Honeywell International Inc., IBM Corporation, Johnson Controls International Plc., Kastle Systems, Kisi Inc., M3T Corporation, Honeywell Security Group, Allegion Plc., NEC Corporation, Identiv Inc., Bosch Security Systems Inc., Amazon Web Services, Cisco Systems Inc., Stanley Access Technologies, Ping Identity Corporation, Thales Group, Assa Abloy AB, AMAG Technology Inc., Cloudastructure Inc., Protection1 Security Solutions LLC.

North America was the largest region in the access control as a service market in 2024. The regions covered in the access control as a service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the access control as a service market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Access Control as a Service (ACaaS) integrates the benefits of subscription-based Software as a Service (SaaS) with on-site access control devices. In this model, the access control hardware remains in place, while the software and servers are relocated to secure data centers. This setup allows users to manage access remotely, conduct secure data backup, and store information in a centralized manner. The primary goal of ACaaS is to enable the provision of appropriate access to individuals at the right times.

The key services offered by Access Control as a Service include Managed Services, Hosted Services, Hybrid Services, and others. Managed services involve outsourcing day-to-day management duties, providing a tactical approach to improving operations and reducing costs. These services can be deployed on public cloud, private cloud, and hybrid cloud platforms, catering to various industries such as pharmaceuticals, government, education, healthcare, retail, transportation, and other end-users.

The access control as a service market research report is one of a series of new reports that provides access control as a service market statistics, including access control as a service industry global market size, regional shares, competitors with access control as a service market share, detailed access control as a service market segments, market trends, and opportunities, and any further data you may need to thrive in the access control as a service industry. This access control as a service market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The access control as a service market includes revenues earned by providing discretionary access control (DAC), role-based access control (RBAC), and mandatory access control (MAC) as a service. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Access Control As a Service Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on access control as a service market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for access control as a service ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The access control as a service market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Services: Managed Services; Hosted Service; Hybrid Service; Other Services2) by Deployment: Public Cloud; Private Cloud; Hybrid Cloud

3) by End-Users: Pharmaceuticals and Healthcare; Government; Education; Health Care; Retail; Transportation; Other End-Users

Subsegments:

1) by Managed Services: User Management; Policy Management; Compliance Management2) by Hosted Service: Cloud-Based Solutions; on-Premises Solutions

3) by Hybrid Service: Combination of Cloud and on-Premises; Flexible Deployment Options

4) by Other Services: Integration Services; Consulting Services; Support and Maintenance Services

Key Companies Mentioned: Digital Hands; Microsoft Corporation; Brivo Inc.; Centrify Corporation; Oracle Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Access Control as a Service market report include:- Digital Hands

- Microsoft Corporation

- Brivo Inc.

- Centrify Corporation

- Oracle Corporation

- Spica International d.o.o.

- Vanderbilt Industries GmbH

- dormakaba Holding AG

- Feenics Inc.

- Fleming Companies Inc.

- Honeywell International Inc.

- IBM Corporation

- Johnson Controls International Plc.

- Kastle Systems

- Kisi Inc.

- M3T Corporation

- Honeywell Security Group

- Allegion Plc.

- NEC Corporation

- Identiv Inc.

- Bosch Security Systems Inc.

- Amazon Web Services

- Cisco Systems Inc.

- Stanley Access Technologies

- Ping Identity Corporation

- Thales Group

- Assa Abloy AB

- AMAG Technology Inc.

- Cloudastructure Inc.

- Protection1 Security Solutions LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.54 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 16.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |