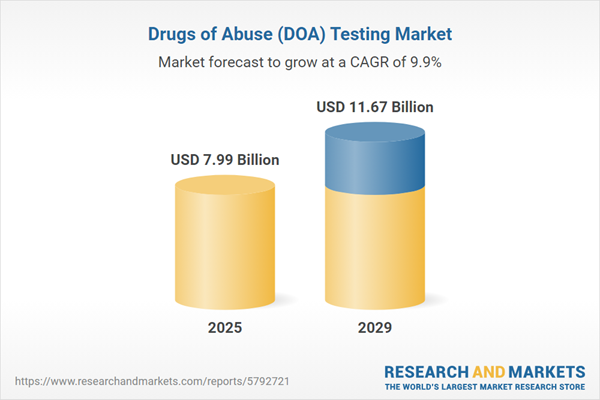

The drugs of abuse (DOA) testing market size is expected to see strong growth in the next few years. It will grow to $11.67 billion in 2029 at a compound annual growth rate (CAGR) of 9.9%. The growth in the forecast period can be attributed to expanding sports and athletics testing, increasing awareness and education, rise in drug-related crimes, corporate wellness programs, advancements in testing methods. Major trends in the forecast period include use of portable and handheld testing devices, implementation of laboratory information management systems (LIMS), emphasis on synthetic drug testing, increasing demand for cannabis testing, integration of artificial intelligence (AI) for result interpretation.

The rising demand for drug abuse treatment is expected to drive the growth of the drugs of abuse (DOA) testing market. Drug abuse, or substance abuse, involves using substances in quantities harmful to the individual or others. Drug testing helps identify these substances through an initial screening test followed by confirmatory testing to detect and validate the presence of specific compounds. As the demand for drug abuse treatment increases, the need for DOA testing also grows. For example, in December 2023, the Government of the United Kingdom (GOV.UK), a UK-based government platform, reported that between April 2022 and March 2023, 290,635 adults accessed drug and alcohol services, up slightly from 289,215 in the previous year. Treatment admissions also increased, with 137,749 individuals admitted compared to 130,490 and 133,704 in the two preceding years. Thus, the growing demand for drug abuse treatment is driving the expansion of the DOA testing market.

The growing demand for hospitals is anticipated to drive the expansion of the drugs of abuse (DOA) testing market. Hospitals, as comprehensive healthcare institutions, play a crucial role in delivering a broad spectrum of medical services, treatment, and care for individuals facing illness or injury. The integration of drugs of abuse (DOA) testing within hospitals facilitates early detection of substance abuse, enabling customized treatment plans, enhancing clinical decision-making, ensuring patient safety, and contributing to public health, workplace safety, and efficient healthcare resource utilization. As of August 2023, there are reported to be 1148 hospitals in the UK, emphasizing the significant role hospitals play in healthcare services. Hence, the increasing demand for hospitals is a key factor propelling the growth of the drugs of abuse (DOA) testing market.

Major players in the drugs of abuse (DOA) testing market are directing their efforts towards developing cutting-edge products, including software-as-a-service (SaaS) platforms, to reinforce their market presence. Software-as-a-Service (SaaS) represents a software distribution model where applications are hosted by a third-party provider and accessed by customers over the internet. A notable example is the introduction of the Addison drug discovery software by Merck KGaA, a US-based science and technology company, in December 2023. This software accelerates drug development and enhances the success rate of novel medications and therapies by integrating computer-aided drug design, machine learning, and generative AI. Addison provides recommendations on optimal methods for synthesizing medications, bridging the gap between virtual molecule design and practical manufacturability. By extracting hidden insights from extensive datasets, the platform increases the likelihood of patients benefiting from innovative treatments.

Key players in the drugs of abuse (DOA) testing market are actively introducing new products, including advanced drug testing, to stay ahead in the market competition. Drug testing involves analyzing biological specimens, such as urine, to identify specific drugs or their metabolites. In December 2022, Omega Laboratories Inc., a US-based company specializing in forensic toxicology and hair testing services, launched urine drugs of abuse testing services. These services are known for their ease of use, rapid effects, and affordability. The laboratory provides accredited urine drug testing services, ensuring high quality and precision in test results. Serving over 6,000 clients worldwide, the organization employs both screening and confirmatory testing in urine drug abuse testing services to ensure the accuracy and reliability of the results.

In June 2024, Premier Biotech Inc., a biotechnology company based in the United States, acquired Desert Tox LLC for an undisclosed sum. This acquisition aims to expand Premier Biotech’s portfolio of cost-effective drug misuse screening solutions, enhancing the accessibility and efficiency of its drug testing services. Desert Tox LLC, also based in the United States, specializes in toxicology and drug testing solutions, further strengthening Premier Biotech’s capabilities in this sector.

Major companies operating in the drugs of abuse (DOA) testing market include Siemens AG, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Abbott Laboratories, Danaher Corporation, Laboratory Corporation of America Holdings, Quest Diagnostics Inc., bioMérieux Inc., Dragerwerk AG & Co. KGaA, Aegis Sciences Corporation, NMS Labs, Clinical Reference Laboratory Inc., Cordant Health Solutions, Millennium Health, ACM Global Laboratories, Psychemedics Corporation, Alfa Scientific Designs Inc., Alere Toxicology Services, Omega Laboratories Inc., BioTek Laboratories, Premier Biotech Inc., Dominion Diagnostics LLC, Randox Toxicology Ltd., Cansford Laboratories Ltd., United States Drug Testing Laboratories Inc., American Bio Medica Corporation, Confirm BioSciences, Immunalysis Corporation, Medtox Diagnostics Inc., Forensic Fluids Laboratories.

North America was the largest region in the drugs of abuse (DOA) testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global drugs of abuse (DOA) testing market report during the forecast period. The regions covered in the drugs of abuse (doa) testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the drugs of abuse (doa) testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Drug of abuse (DOA) testing involves examining substances, such as drugs, chemicals, or plant products, typically used recreationally. This includes marijuana, cocaine, opioids, amphetamines, alcohol, and PCP, which are screened for on a drug panel. Clinical screening methods use the patient's urine, saliva, blood, hair, or sweat for this purpose.

Drug of Abuse (DOA) testing encompasses various products and services, including analyzers, rapid testing devices, consumables, and laboratory services. Analyzers, automatic devices measuring chemical concentrations, play a crucial role in this domain. The testing involves sample types such as urine, hair, oral fluid, and breath, with applications in pain management, criminal justice, and workplace screening. End-users of DOA testing include hospitals, diagnostic laboratories, forensic laboratories, and other relevant entities.

The drugs of abuse (DOA) testing market research report is one of a series of new reports from. The Business Research Company that provides drugs of abuse (DOA) testing market statistics, including drugs of abuse (DOA) testing industry global market size, regional shares, competitors with a drugs of abuse (DOA) testing market share, detailed drugs of abuse (DOA) testing market segments, market trends and opportunities, and any further data you may need to thrive in the drugs of abuse (DOA) testing industry. This drug of abuse (DOA) testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The drugs of abuse (DOA) testing market includes revenues earned by entities by providing services such as analyzers, rapid testing devices, consumables, and laboratory services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Drugs of Abuse (DOA) Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on drugs of abuse (doa) testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for drugs of abuse (doa) testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The drugs of abuse (doa) testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product and Service: Analyzers; Rapid Testing Devices; Consumables; Laboratory Services2) By Sample Type: Urine; Hair; Oral Fluid; Breath

3) By Application: Pain Management; Criminal Justice; Workplace Screening

4) By End User: Hospitals; Diagnostic Laboratories; Forensic Laboratories; Other End Users

Subsegments:

1) By Analyzers: Immunoassay Analyzers; Chromatography-Based Analyzers; Mass Spectrometry Systems2) By Rapid Testing Devices: Urine Test Kits; Saliva Test Kits; Hair Test Kits

3) By Consumables: Test Strips; Reagents; Sample Collection Devices

4) By Laboratory Services: Toxicology Testing; Confirmation Testing; Screening Services

Key Companies Mentioned: Siemens AG; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Abbott Laboratories; Danaher Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens AG

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Danaher Corporation

- Laboratory Corporation of America Holdings

- Quest Diagnostics Inc.

- bioMérieux Inc.

- Dragerwerk AG & Co. KGaA

- Aegis Sciences Corporation

- NMS Labs

- Clinical Reference Laboratory Inc.

- Cordant Health Solutions

- Millennium Health

- ACM Global Laboratories

- Psychemedics Corporation

- Alfa Scientific Designs Inc.

- Alere Toxicology Services

- Omega Laboratories Inc.

- BioTek Laboratories

- Premier Biotech Inc.

- Dominion Diagnostics LLC

- Randox Toxicology Ltd.

- Cansford Laboratories Ltd.

- United States Drug Testing Laboratories Inc.

- American Bio Medica Corporation

- Confirm BioSciences

- Immunalysis Corporation

- Medtox Diagnostics Inc.

- Forensic Fluids Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.99 Billion |

| Forecasted Market Value ( USD | $ 11.67 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |