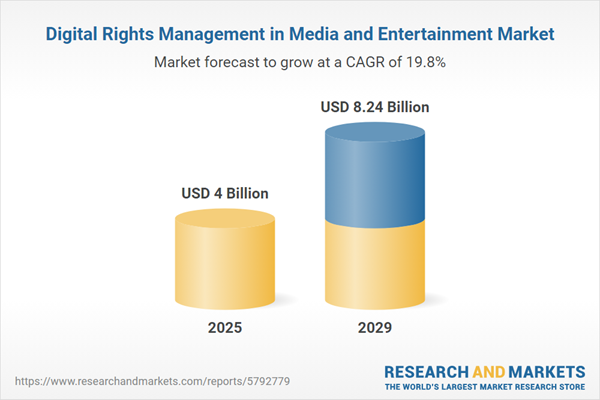

The digital rights management in media and entertainment market size is expected to see rapid growth in the next few years. It will grow to $8.24 billion in 2029 at a compound annual growth rate (CAGR) of 19.8%. The growth in the forecast period can be attributed to emergence of new content platforms, rise of user-generated content, cross-platform content consumption, increased content investment, focus on data privacy, dynamic content delivery models. Major trends in the forecast period include cloud-based DRM solutions, blockchain for enhanced security, cross-platform compatibility, ai and machine learning for content monitoring, standardized DRM solutions, multi-channel distribution strategies.

The growing demand for over-the-top (OTT) content is anticipated to drive the growth of digital rights management in the media and entertainment market in the future. Over-the-top (OTT) refers to the delivery of digital entertainment content, such as movies, via the internet, catering to the specific needs and preferences of individual consumers. Digital rights management in the media and entertainment sector for OTT helps content owners enforce access regulations by preventing users from duplicating and converting content to other media formats. The content owner establishes these access policies, which dictate how the content can be accessed and utilized. For instance, in November 2023, Ormax Media, an India-based company specializing in audio equipment and solutions, reported that the total audience for OTT platforms grew to over 481 million in 2023, marking a 13.5% increase from an estimated 424 million in 2022. Therefore, the rising demand for OTT content is propelling the growth of digital rights management in the media and entertainment market.

The increasing penetration of the internet is expected to boost the growth of digital rights management in the media and entertainment market going forward. Internet penetration refers to the proportion of the population or households in a particular geographic area that has access to and utilizes the internet. As internet penetration rises, there is a growing demand for robust digital rights management (DRM) solutions in the media and entertainment industry to protect intellectual property and regulate access to digital content. For example, in July 2023, the House of Commons Library, a UK government administration, reported that as of January 2023, 72% of premises in the UK had access to gigabit-capable broadband, up from 64% in January 2022 and a significant increase from 36% in January 2021. Therefore, the rising internet penetration is driving the growth of digital rights management in the media and entertainment market.

Technological advancements emerge as a pivotal trend shaping DRM in the media and entertainment industry. Key players in the market are actively developing sophisticated technologies and software to solidify their market positions. For instance, in April 2023, Amazon Web Services (AWS) introduced a free AWS Learning Plan and Digital Badge tailored for Media and Entertainment (M&E) focused on Direct-to-Consumer (D2C) and Broadcast Foundations. This educational plan, designed by AWS for M&E solution experts, aims to educate executives, industry professionals, and technologists on AWS services and best practices applicable to Broadcast and D2C workflows in the cloud. This technological innovation underscores the commitment of major companies to evolve their offerings and expertise in the realm of DRM for media and entertainment.

Major companies in the digital rights management market within the media and entertainment sector are increasingly focusing on partnerships and collaborations to enhance their product offerings and expand their geographical reach. Strategic partnerships and collaborations involve companies leveraging each other's strengths and resources to achieve mutual benefits and success. For instance, in June 2023, CDNetworks, a Singapore-based company specializing in delivering edge services, teamed up with Irdeto, a Netherlands-based IT services and consulting firm, to integrate CDNetworks' media delivery platform with built-in digital rights management (DRM) capabilities. This integrated solution offers content creators and distributors a comprehensive approach to digital content protection for their video streaming operations.

In March 2022, Bynder, a US-based digital asset management firm, made an undisclosed acquisition of GatherContent, a UK-based content operations platform operating in the domain of digital rights management in media and entertainment. This strategic acquisition expands the capabilities of both companies' centralized platforms, augmenting collaborative workflows and editorial processes for content creation. The integration empowers teams across diverse industries to efficiently manage the entire content creation lifecycle - from visual production to text creation - ensuring structured content approval, ready for distribution across multiple channels in an omnichannel strategy. By pooling their expertise, Bynder and GatherContent aim to streamline content creation processes and bolster the delivery of structured, high-quality content across various channels.S217.

Major companies operating in the digital rights management in media and entertainment market include Google LLC, Microsoft Corporation, Irdeto BV, Apple Inc., Vitrium Systems Inc., Bitmovin Inc., Kudelski Group, Intertrust Technologies Corporation, BuyDRM Inc., EditionGuard LLC, EZDRM Inc., Verimatrix Inc., Oracle Corporation, Fasoo Inc., International Business Machines Corporation, NextLabs Inc., Sony Corporation, Adobe Systems Incorporated, Conax AS, Locklizard Limited, OpenText Corp, Seclore Technology, Vera Security Inc., Amazon Web Services Inc., Akamai Technologies Inc., Brightcove Inc., Cisco Systems Inc.

North America was the largest region in the digital rights management in media and entertainment market in 2024. The regions covered in the digital rights management in media and entertainment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the digital rights management in media and entertainment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Digital Rights Management (DRM) in media and entertainment serves as a protective service for real-time streaming and digital media by employing copyrights and license keys. This service ensures the secure delivery of media content while upholding the rights and privacy of content owners. It restricts access to authorized users, preventing unauthorized duplication and distribution of media.

DRM is utilized by businesses of varying sizes, including small and medium enterprises (SMEs) and large enterprises. SMEs, characterized as independent businesses with fewer than 250 employees, deploy DRM to safeguard their digital assets and enhance organizational privacy. DRM finds applications in diverse sectors such as mobile content, video on demand (VOD), mobile gaming and apps, and ebooks. Industries such as banking, financial services, insurance (BFSI), healthcare, printing and publication, education, and television and film leverage DRM to protect their digital content.

The digital rights management in media and entertainment market research report is one of a series of new reports that provides digital rights management in media and entertainment market statistics, including digital rights management in the media and entertainment industry global market size, regional shares, competitors with a digital rights management in media and entertainment market share, detailed digital rights management in media and entertainment market segments, market trends, and opportunities, and any further data you may need to thrive in the digital rights management in media and entertainment industry. This digital rights management in media and entertainment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Digital rights management in the media and entertainment market includes revenues earned by entities by providing services such as software licenses and keys, proxy servers, user authentication, and IP authentication protocols, virtual private networks, regional restriction. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital Rights Management in Media and Entertainment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital rights management in media and entertainment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital rights management in media and entertainment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital rights management in media and entertainment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Enterprise Size: Small and Medium Enterprises; Large Enterprises2) by Application: Mobile Content; Video on Demand (VoD); Mobile Gaming and Apps; eBook

3) by Industry Vertical: Banking, Financial Services, and Insurance (BFSI); Healthcare; Printing and Publication Educational; Television and Film

Subsegments:

1) by Small and Medium Enterprises (SMEs): Small Enterprises; Medium Enterprises2) by Large Enterprises: Global Corporations; Regional Corporations

Key Companies Mentioned: Google LLC; Microsoft Corporation; Irdeto BV; Apple Inc.; Vitrium Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Digital Rights Management in Media and Entertainment market report include:- Google LLC

- Microsoft Corporation

- Irdeto BV

- Apple Inc.

- Vitrium Systems Inc.

- Bitmovin Inc.

- Kudelski Group

- Intertrust Technologies Corporation

- BuyDRM Inc.

- EditionGuard LLC

- EZDRM Inc.

- Verimatrix Inc.

- Oracle Corporation

- Fasoo Inc.

- International Business Machines Corporation

- NextLabs Inc.

- Sony Corporation

- Adobe Systems Incorporated

- Conax AS

- Locklizard Limited

- OpenText Corp

- Seclore Technology

- Vera Security Inc.

- Amazon Web Services Inc.

- Akamai Technologies Inc.

- Brightcove Inc.

- Cisco Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 8.24 Billion |

| Compound Annual Growth Rate | 19.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |