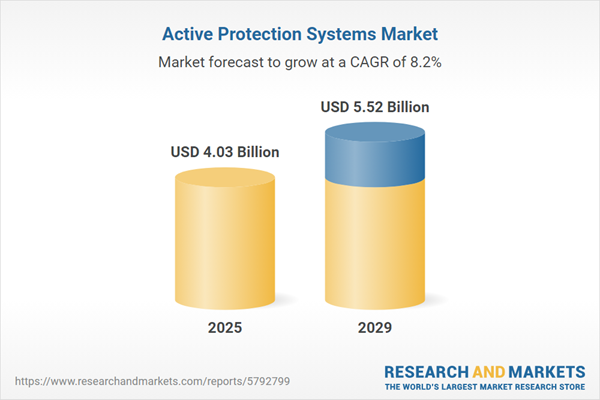

The active protection systems market size is expected to see strong growth in the next few years. It will grow to $5.52 billion in 2029 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to growing demand for lightweight and integrated apps, global security concerns, military modernization initiatives, increasing defense budgets, integration with future vehicle platforms. Major trends in the forecast period include advancements in interceptor technologies, growing adoption of soft-kill systems, development of next-generation hard-kill systems, integration of apps with other defensive systems, AI and machine learning integration.

The increase in terrorist attacks and threats is anticipated to drive the growth of the active protection systems market in the future. Terrorist attacks involve violent actions aimed at instilling fear or terror among individuals, targeting people or locations. Active protection systems safeguard against these threats by defending against short-range maneuverable projectiles, such as sea-skimming weapons and anti-tank-guided missiles. For instance, in February 2024, the Institute for Economics and Peace, an Australia-based non-profit think tank, reported that deaths from terrorism rose by 22%, totaling 8,352 fatalities in 2023. The most notable terrorist attack that year occurred on October 7, when Hamas-led militants launched an assault in Israel, resulting in 1,200 deaths. This attack was the largest since 9/11 and ranks among the deadliest in history. The repercussions of this incident have been extensive, with Israel's retaliatory military actions leading to an estimated 25,000 Palestinian deaths by February 2024. Consequently, the rise in terrorist attacks and threats is propelling the growth of the active protection systems market.

The upswing in defense expenditure is poised to drive the expansion of the active protection systems market. This expenditure encompasses the total financial allocation by governments towards military forces and activities, providing the necessary resources for the development, procurement, and maintenance of active protection systems for military purposes. Notably, as per the Ministry of Defense (MOD) departmental resources 2022, published by gov.UK in December 2022, the defense spending for 2021-2022 amounted to $76.25 billion (71.4 Euros), marking a substantial increase of $46.88 billion (43.9 euros) from the previous year. This surge in financial resources allocated to defense activities is a driving force behind the growth of the active protection systems market.

Major companies in the active protection systems sector are concentrating on technological advancements, such as hard-kill torpedo countermeasure systems, to enhance their surveillance capabilities. A hard-kill torpedo countermeasure system is a defensive mechanism designed to intercept and destroy incoming torpedoes before they can hit a naval vessel, utilizing various projectiles or explosive devices to neutralize the threat. For example, in May 2023, Rafael Advanced Defense Systems, an Israel-based defense company, introduced the multi-layered integrated torpedo defense system (TDS) for ships. This system includes soft-kill Scutter Mk 3 decoys, a new Torbuster hard-kill torpedo countermeasure system launched by surface platforms, and a new series of hull-mounted sonars. The surface-launched version of the Torbuster hard-kill countermeasure, which was originally intended for submarines, is designed to prevent re-attacks from torpedoes initially misled by expandable decoys deployed from ships. The Torbuster SP can operate effectively in both shallow and deep water environments, making it suitable for lightweight and heavyweight guided torpedoes that are active, passive, or wake-homing, according to the Israeli manufacturer. The system offers rapid response times and is particularly effective against short-range threats. The Israeli company has announced that the system is set for its first sea trials in the coming months, as reported by EDR On-Line.

Prominent entities within the active protection systems market are dedicated to product innovation, exemplified by the creation of Iron Fist, a hard-kill active protection system (APS) tailored to deliver steadfast solutions for customers. Iron Fist boasts a modular design, offering adaptability across a spectrum of platforms, ranging from light utility vehicles to heavily armored fighting vehicles. Elbit Systems Ltd., an Israel-based defense contractor, unveiled Iron Fist in August 2023, positioning it as a robust defense mechanism against anti-tank threats, significantly enhancing platform survivability. This system ensures 360-degree protection for armored platforms, featuring a fixed active electronically scanned array radar sensor designed to detect incoming threats. Available in two versions - IFLK (Iron Fist Light Kinetic) catering to tanks and heavy infantry fighting vehicles (IFVs), and IFLD (Iron Fist Light Decoupled) tailored for light to medium infantry fighting vehicles (IFVs) - Iron Fist stands as a versatile and adaptable defense solution.

In September 2024, BAE Systems, a UK-based defense, aerospace, and security company, acquired Kirintec for an undisclosed amount. This acquisition enhances BAE Systems' capabilities in Cyber Electromagnetic Activities (CEMA) and multi-domain integration, enabling the company to better meet the increasing demands of its customers. As part of BAE Systems’ Digital Intelligence division, Kirintec will contribute new products that expand the company's offerings in electronic warfare and force protection. Kirintec is a UK-based provider of active protection systems.

Major companies operating in the active protection systems market include Artis LLC, Aselsan A.S., JSC Konstruktorskoye Byuro Mashinostroyeniya, Krauss-Maffei Wegmann GmbH & Co. KG, Rafael Advanced Defense System Ltd., Raytheon Technologies Corporation, Rheinmetall AG, SAAB AB, Israel Military Industries Ltd., Airbus SE, Safran SA, IMI Systems Ltd., General Dynamics Corporation, Rostec State Corporation, BAE Systems plc, Leonardo S.p.A., Thales Group, KBM Group, Israel Aerospace Industries Ltd., Elbit Systems Ltd., Nexter Group SA, Denel Dynamics Ltd., ST Engineering Ltd., AVX Aircraft Company LLC, Textron Inc., Missile Systems, Battlefields and Air Defense, QinetiQ Group plc, L3Harris Technologies Inc., Kongsberg Defence & Aerospace AS, Hanwha Defense Systems Corporation.

North America was the largest region in the active protection systems market in 2024. Asia-Pacific is expected to be the fastest-growing region in the active protection systems market report during the forecast period. The regions covered in the active protection systems market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the active protection systems market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Active Protection Systems (APS) are designed to safeguard vehicles by thwarting anti-tank threats, ensuring the safety of both the crew and the vehicle. These systems incorporate a combination of countermeasures aimed at either concealing the vehicle from potential threats or disrupting the guidance of incoming dangers.

Active Protection Systems can be broadly categorized into hardware and software components. The hardware encompasses devices such as sensors and radars that constitute the protective system. Kill system variants, including the soft kill system, hard kill system, and reactive armor, play a crucial role in enhancing the overall defense capabilities. These protective measures are applicable across diverse platforms, namely land-based, airborne, and marine environments. The end users benefiting from these systems span across defense and homeland security sectors. The integration of APS in various scenarios contributes significantly to the survivability and resilience of both personnel and assets.

The active protection systems market research report is one of a series of new reports that provides active protection systems market statistics, including active protection systems industry global market size, regional shares, competitors with an active protection systems market share, detailed active protection systems market segments, market trends, and opportunities, and any further data you may need to thrive in the active protection systems industry. This active protection systems market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The active protection systems market consists of revenues earned by entities by providing active protection services using digital radio frequency memory and software services. The market value includes the value of related goods sold by the service provider or included within the service offering. The active protection systems market also includes sales of anti-aircraft, anti-ballistic missiles, close-in weapon systems, sensors and tracking radars, which are used in providing active protection services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Active Protection Systems Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on active protection systems market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for active protection systems ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The active protection systems market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Solution: Hardware; Software2) by Kill System Type: Soft Kill System; Hard Kill System; Reactive Armor

3) by Platform: Land-Based; Airborne; Marine

4) by End Users: Defense; Homeland Security

Subsegments:

1) by Hardware: Sensors; Surveillance Systems; Control Units; Actuators2) by Software: Threat Detection Software; Monitoring and Management Software; Analytics and Reporting Tools

Key Companies Mentioned: Artis LLC; Aselsan a.S.; JSC Konstruktorskoye Byuro Mashinostroyeniya; Krauss-Maffei Wegmann GmbH & Co. KG; Rafael Advanced Defense System Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Active Protection Systems market report include:- Artis LLC

- Aselsan A.S.

- JSC Konstruktorskoye Byuro Mashinostroyeniya

- Krauss-Maffei Wegmann GmbH & Co. KG

- Rafael Advanced Defense System Ltd.

- Raytheon Technologies Corporation

- Rheinmetall AG

- SAAB AB

- Israel Military Industries Ltd.

- Airbus SE

- Safran SA

- IMI Systems Ltd.

- General Dynamics Corporation

- Rostec State Corporation

- BAE Systems plc

- Leonardo S.p.A.

- Thales Group

- KBM Group

- Israel Aerospace Industries Ltd.

- Elbit Systems Ltd.

- Nexter Group SA

- Denel Dynamics Ltd.

- ST Engineering Ltd.

- AVX Aircraft Company LLC

- Textron Inc.

- Missile Systems, Battlefields and Air Defense

- QinetiQ Group plc

- L3Harris Technologies Inc.

- Kongsberg Defence & Aerospace AS

- Hanwha Defense Systems Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.03 Billion |

| Forecasted Market Value ( USD | $ 5.52 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |