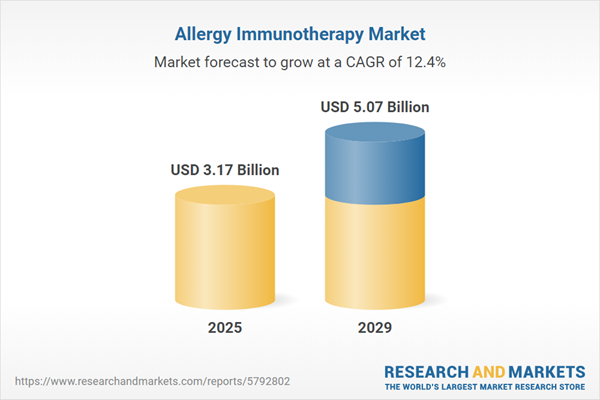

The allergy immunotherapy market size is expected to see rapid growth in the next few years. It will grow to $5.07 billion in 2029 at a compound annual growth rate (CAGR) of 12.4%. The growth in the forecast period can be attributed to rising global allergy burden, healthcare policy support, increasing acceptance of immunotherapy, emerging markets and untapped regions, increasing healthcare expenditure. Major trends in the forecast period include advancements in treatment technology, increasing allergy prevalence, rise in patient awareness and education, telemedicine and remote monitoring, customized treatment plans.

The increasing prevalence of allergic disorders is anticipated to drive the growth of the allergy immunotherapy market in the future. Allergic disorders are characterized by excessive immune responses to specific antigens. When immune responses are misdirected against the body's own components (self), they lead to autoimmune diseases. Allergy immunotherapy is available for individuals with atopic conditions, such as IgE-mediated allergic rhinitis and allergic asthma triggered by inhaled allergens like pollen and house dust mites (HDMs). For example, in August 2023, the Medicines and Healthcare Products Regulatory Agency (MHRA), a UK-based executive agency, reported that English hospitals recorded over 25,000 admissions for allergies and anaphylaxis in 2022-23, more than double the number seen in the past twenty years. Furthermore, in May 2024, the Food Standards Agency, a UK government department, released the Patterns and Prevalence of Adult Food Allergy (PAFA) report, indicating that approximately 6% of adults in the UK - around 2.4 million individuals - are affected by food allergies. The most common triggers for allergic reactions include peanuts and tree nuts, such as hazelnuts, walnuts, and almonds. Thus, the rising prevalence of allergic disorders is fueling the growth of the allergy immunotherapy market.

The rising consumption of alcohol is expected to contribute to the growth of the allergy immunotherapy market in the future. Alcohol refers specifically to ethyl alcohol or ethanol, a psychoactive substance, and the consumption of alcoholic beverages can have intoxicating effects that pose health risks. Alcoholic drinks, such as red wine, contain histamine, which can lead to allergic-like symptoms that may be treated with allergy immunotherapy. For instance, in 2024, a report from First Citizens Bank, a US financial institution, indicated a 1.2% increase in direct-to-consumer (DTC) wine case sales in 2023 compared to 2022. Additionally, a December 2023 report from Kirin Holdings Company Limited, a Japanese beverage company, noted that around 192.1 million kiloliters of beer were consumed in 2022, reflecting a 2.9% increase from the previous year. Consequently, the rise in alcohol consumption is driving the growth of the allergy immunotherapy market.

The growth of healthcare expenditure is expected to propel the allergy immunotherapy market in the coming years. Increased healthcare spending often results in a greater emphasis on innovative and effective treatment options, especially for widespread conditions like allergies. Allergy immunotherapy, which aims to address the underlying causes of allergic diseases and provide long-term relief, is well-positioned to benefit from this heightened financial investment in healthcare. The availability of more financial resources is likely to improve access to immunotherapy treatments, thereby increasing adoption rates and contributing to overall market growth. For example, a report from the Office for National Statistics, a UK government department, revealed that healthcare spending in the UK rose by 5.6% between 2022 and 2023, compared to a growth rate of 0.9% in 2022. The total UK healthcare expenditure was approximately $317.63 billion (£292 billion) in 2023. Therefore, the increase in healthcare expenditures is expected to drive the growth of the allergy immunotherapy market.

Prominent entities within the allergy immunotherapy market are at the forefront of technological innovation, introducing cutting-edge products such as artificial intelligence (AI)-powered allergy component testing to fortify their market standing. This groundbreaking testing platform, rooted in Component Resolved Diagnostics (CRD), represents a novel approach to diagnosing diverse allergy forms. For example, in May 2023, Metropolis Healthcare Limited, an Indian-based medical laboratory company, unveiled the AI-powered allergy component testing. This fourth-generation allergy testing technology utilizes Artificial Intelligence (AI) to aid clinicians in making informed clinical decisions. It offers comprehensive insights, aiding in the selection and optimization of treatment paths for allergic conditions. Moreover, its predictive capabilities extend to determining the efficacy of allergy vaccinations, delineating their effectiveness, and guiding the course of immunotherapy treatments.

Key players in the allergy immunotherapy arena are embracing strategic partnerships as a means to broaden their capabilities and reach new heights. These alliances entail leveraging each other's strengths and resources to mutually benefit and achieve success. An illustration of this strategy unfolded in November 2022, as Vimian Group AB, a Sweden-based veterinary company, forged a partnership with Angany Inc., a Canada-based pharmaceutical company specializing in allergy immunotherapy. This collaborative endeavor aims to pioneer novel vaccines catering to allergy and atopic dermatitis in companion animals. Leveraging proprietary eBioparticle-Potentiated Immunotherapy technology, this partnership is focused on advancing the development of innovative vaccines tailored to address specific allergy-related concerns in companion animals.

Major companies operating in the allergy immunotherapy market include LETI Pharma, Stallergenes Greer International AG, Allergy Therapeutics plc, ALK-Abelló A/S, HAL Allergy B.V., DBV Technologies, Circassia Pharmaceuticals Inc., Jubilant HollisterStier LLC, Allergopharma GmbH & Co. KG, Biomay AG, Anergis SA, HollisterStier Allergy, Mylan N.V., Adamis Pharmaceuticals Corporation, Desentum Oy, WOLW Pharma Limited, AllerGenics Inc., Greer Laboratories Inc., Aimmune Therapeutics Inc., Reliant Laboratories Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Danaher Corporation, QIAGEN NV, Merck & Co. Inc., Pfizer Inc., Novartis AG, GlaxoSmithKline plc, AstraZeneca plc, Sanofi SA, Teva Pharmaceutical Industries Ltd., Endo Pharmaceuticals Inc., Sun Pharmaceutical Industries Ltd., Cipla Ltd.

Europe was the largest region in the allergy immunotherapy market in 2024. Asia-Pacific is expected to be the fastest-growing region in the allergy immunotherapy market report during the forecast period. The regions covered in the allergy immunotherapy market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the allergy immunotherapy market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Allergy immunotherapy is a therapeutic approach designed to mitigate allergic reactions to substances such as house dust mites, grass pollen, and bee venom. This treatment involves gradually administering increasing doses of the specific chemical or allergen to which the patient is allergic.

The primary allergy types addressed through allergy immunotherapy include allergic rhinitis, asthma, food allergies, venom allergies, and others. Allergic rhinitis pertains to a diagnosis encompassing a set of symptoms that impact the nose. Various treatment modalities include subcutaneous immunotherapy (SCIT), sublingual immunotherapy, and specific immunotherapy (SIT). These treatments can be accessed through different channels, including hospital pharmacies, retail pharmacies, and online pharmacies.

The allergy immunotherapy market research report is one of a series of new reports that provides allergy immunotherapy market statistics, including the allergy immunotherapy industry global market size, regional shares, competitors with allergy immunotherapy market share, detailed allergy immunotherapy market segments, market trends, and opportunities, and any further data you may need to thrive in the allergy immunotherapy industry. This allergy immunotherapy market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The allergy immunotherapy market includes revenues earned by entities by providing monoclonal antibodies and immune checkpoint inhibitors therapy. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Allergy Immunotherapy Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on allergy immunotherapy market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for allergy immunotherapy ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The allergy immunotherapy market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Allergy Type: Allergic Rhinitis; Asthma; Food Allergy; Venom Allergy; Other Allergy Types2) by Treatment: Subcutaneous Immunotherapy (SCIT); Sublingual Immunotherapy; Specific Immunotherapy (SIT)

3) by Channel: Hospital Pharmacy; Retail Pharmacy; Online Pharmacy

Subsegments:

1) by Allergic Rhinitis: Seasonal Allergic Rhinitis; Perennial Allergic Rhinitis2) by Asthma: Allergic Asthma; Non-Allergic Asthma

3) by Food Allergy: Peanut Allergy; Tree Nut Allergy; Milk Allergy; Egg Allergy; Other Food Allergies

4) by Venom Allergy: Insect Sting Allergy; Other Venom Allergies

5) by Other Allergy Types: Allergic Conjunctivitis; Eczema; Drug Allergies; Other Environmental Allergies

Key Companies Mentioned: LETI Pharma; Stallergenes Greer International AG; Allergy Therapeutics plc; ALK-Abelló a/S; HAL Allergy B.V.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Allergy Immunotherapy market report include:- LETI Pharma

- Stallergenes Greer International AG

- Allergy Therapeutics plc

- ALK-Abelló A/S

- HAL Allergy B.V.

- DBV Technologies

- Circassia Pharmaceuticals Inc.

- Jubilant HollisterStier LLC

- Allergopharma GmbH & Co. KG

- Biomay AG

- Anergis SA

- HollisterStier Allergy

- Mylan N.V.

- Adamis Pharmaceuticals Corporation

- Desentum Oy

- WOLW Pharma Limited

- AllerGenics Inc.

- Greer Laboratories Inc.

- Aimmune Therapeutics Inc.

- Reliant Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- QIAGEN NV

- Merck & Co. Inc.

- Pfizer Inc.

- Novartis AG

- GlaxoSmithKline plc

- AstraZeneca plc

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- Endo Pharmaceuticals Inc.

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.17 Billion |

| Forecasted Market Value ( USD | $ 5.07 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |