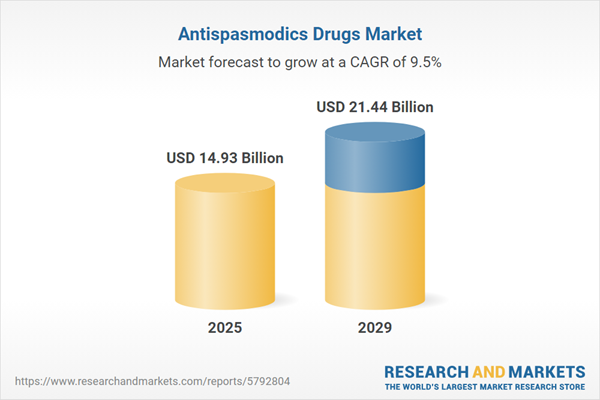

The antispasmodics drugs market size is expected to see strong growth in the next few years. It will grow to $21.44 billion in 2029 at a compound annual growth rate (CAGR) of 9.5%. The growth in the forecast period can be attributed to increasing healthcare expenditure, personalized medicine, global population growth, emerging markets, clinical trials and research. Major trends in the forecast period include expanding indications for antispasmodics, healthcare infrastructure development, advancements in drug development, increasing awareness and diagnosis, preference for non-invasive treatment options.

The forecast of 9.5% growth over the next five years reflects a modest reduction of 0.3% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. The imposition of tariffs may pose a significant challenge for gastroenterology clinics by increasing costs of dicyclomine and hyoscyamine imported from India and Israel, potentially reducing IBS treatment options and raising digestive disorder management expenditures. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The anticipated rise in the elderly population stands as a driving force behind the growth of the antispasmodic drug market. Individuals aged 65 and above, often grappling with various physical and psychological health challenges, find relief in antispasmodic drugs to manage symptoms linked to conditions causing muscle spasms or cramping. These drugs also prove beneficial for ailments such as irritable bowel syndrome (IBS), gastroesophageal reflux disease (GERD), interstitial cystitis, and uterine cramping. In October 2022, the World Health Organization (WHO) projected a substantial increase in the global population aged 60 and above, expected to reach 1.4 billion by 2030 and double to 2.1 billion by 2050. This demographic shift, including a significant rise in those aged 80 or older, estimated to reach 426 million by 2050, underscores the impetus driving the antispasmodic drug market linked to an expanding elderly populace.

The rising incidence of irritable bowel syndrome (IBS) is anticipated to drive the growth of the antispasmodics drugs market in the future. IBS is a prevalent digestive disorder characterized by a collection of symptoms affecting the large intestine (colon), causing discomfort and disrupting normal digestive function. Antispasmodic medications are utilized in the treatment of IBS to target and relieve muscle spasms and cramps in the gastrointestinal tract, providing relief from abdominal pain and discomfort for patients. For example, in June 2024, the Centers for Disease Control and Prevention (CDC), a US federal agency, reported that the estimated prevalence of inflammatory bowel disease (IBD) in the U.S. ranges from 2.4 to 3.1 million, with variations in impact among different demographics. Additionally, according to Oxford University Press, a UK publishing company, approximately 322,600 Canadians were estimated to be living with inflammatory bowel disease (IBD) in 2023. Therefore, the increasing prevalence of irritable bowel syndrome (IBS) is fueling the growth of the antispasmodics drugs market.

Innovative product developments emerge as a pivotal trend fueling the ascent of the antispasmodic drugs market. Key players in this domain prioritize pioneering solutions to fortify their market positions. For instance, in April 2022, Ardelyx Inc., a US-based biopharmaceutical company, unveiled IBSRELA, an NHE-3 inhibitor tailored for individuals grappling with irritable bowel syndrome with constipation (IBS-C). This product represents a breakthrough therapeutic option boasting a novel mode of action, yielding significant efficacy in addressing constipation and assorted abdominal symptoms prevalent in IBS-C patients, as substantiated by Phase 3 clinical studies. This innovative approach underscores the market's trend towards developing impactful solutions catering to specific conditions within the antispasmodic drugs segment.

Prominent entities within the antispasmodics drugs market are unveiling new products as part of their strategy to fortify their market presence. For example, in January 2023, Lupin Limited, an India-based pharmaceutical company, introduced Fesoterodine Fumarate, an FDA-approved generic antispasmodic drug. This medication is specifically designed to address certain bladder issues such as overactive bladder and neurogenic detrusor overactivity. Belonging to the antispasmodic drug class, Fesoterodine Fumarate functions by relaxing the muscles in the bladder. It is available in extended-release tablet form, representing a new addition to Lupin Limited's repertoire in addressing bladder-related ailments.

In October 2022, Silo Wellness Inc., a US-based company specializing in psychedelic therapy, concluded the acquisition of Dyscovry Science Ltd. for an undisclosed amount. This strategic acquisition enables Silo Wellness to consolidate its presence in the psychedelic business landscape. Dyscovry Science Ltd., a Canada-based biotechnology firm, specializes in biosynthetic production of psilocybin and its derivatives for treating irritable bowel syndrome. By incorporating Dyscovry Science Ltd., Silo Wellness aims to encompass both facets of the psychedelic industry, augmenting its capabilities in research and biosynthetic development for innovative treatment solutions.

Major companies operating in the antispasmodics drugs market include Daiichi Sankyo Company Limited, Fresenius Kabi AG, Hikma Pharmaceuticals plc, Johnson & Johnson Services Inc., Pfizer Inc., Shanghai Fosun Pharmaceutical Co. Ltd., Takeda Pharmaceutical Company Limited, Akorn Inc., Aurobindo Pharma Limited, Lannett Company Inc., Nexus Pharmaceuticals Inc., Actiza Pharmaceutical Private Limited, Blue Cross Laboratories Pvt. Ltd., Dr. Reddy's Laboratories Ltd., Lexicare Pharma Pvt. Ltd., Solitaire Pharmacia Private Limited, Strides Pharma Science Limited, Wellona Pharma Private Limited, SunGen Pharma LLC, GlaxoSmithKline plc, Novartis AG, Sanofi SA, AstraZeneca plc, Merck & Co. Inc., Bayer AG, Teva Pharmaceutical Industries Ltd., Endo Pharmaceuticals Inc., Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Ltd.

North America was the largest region in the antispasmodics drugs market in 2024. Asia-Pacific is expected to be the fastest-growing region in the antispasmodics drugs market report during the forecast period. The regions covered in the antispasmodics drugs market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the antispasmodics drugs market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The antispasmodics drugs market research report is one of a series of new reports that provides antispasmodics drugs market statistics, including antispasmodics drugs industry global market size, regional shares, competitors with antispasmodics drugs market share, detailed antispasmodics drugs market segments, market trends, and opportunities, and any further data you may need to thrive in the antispasmodics drugs industry. This antispasmodic drugs market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Antispasmodic drugs are medications designed to treat, prevent, or decrease the frequency of muscular spasms, especially those involving smooth muscle, such as those occurring in the walls of the gastrointestinal tract. These drugs function by slowing down the normal movements of the gut and inducing relaxation in the muscles of the stomach and intestines.

Key drugs in the category of antispasmodics include dicyclomine hydrochloride, loperamide hydrochloride, and others. Dicyclomine is an anticholinergic medication that reduces spasms in the gastrointestinal muscles by inhibiting the activity of a natural chemical in the body. Indications for the use of antispasmodic drugs include conditions such as irritable bowel syndrome, stomach cramps, and others. These medications can be administered through oral, parenteral, and other modes. Distribution channels for antispasmodic drugs include hospital pharmacies, online pharmacies, and retail pharmacies, with end-users ranging from hospitals and homecare settings to specialty clinics and others.

The antispasmodics drugs market consists of sales of natural alkaloids such as atropine, belladonna, hyoscyamine, scopolamine, and related drugs. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Antispasmodics Drugs Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on antispasmodics drugs market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for antispasmodics drugs? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The antispasmodics drugs market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug: Dicyclomine Hydrochloride; Loperamide Hydrochloride; Other Drugs2) By Indication: Irritable Bowel Syndrome; Stomach Cramps; Other Indications

3) By Route of Administration: Oral; Parenteral; Other Modes of Administrations

4) By Distribution Channel: Hospital Pharmacy; Online Pharmacy; Retail Pharmacy

5) By End-User: Hospitals; Homecare; Specialty Clinics; Other End-Users

Subsegments:

1) By Dicyclomine Hydrochloride: Oral Tablets; Injectable Formulations2) By Loperamide Hydrochloride: Oral Tablets; Liquid Formulations

3) By Other Drugs: Hyoscine Butylbromide (Scopolamine); Peppermint Oil; Atropine; Other Antispasmodics

Companies Mentioned: Daiichi Sankyo Company Limited; Fresenius Kabi AG; Hikma Pharmaceuticals plc; Johnson & Johnson Services Inc.; Pfizer Inc.; Shanghai Fosun Pharmaceutical Co. Ltd.; Takeda Pharmaceutical Company Limited; Akorn Inc.; Aurobindo Pharma Limited; Lannett Company Inc.; Nexus Pharmaceuticals Inc.; Actiza Pharmaceutical Private Limited; Blue Cross Laboratories Pvt. Ltd.; Dr. Reddy's Laboratories Ltd.; Lexicare Pharma Pvt. Ltd.; Solitaire Pharmacia Private Limited; Strides Pharma Science Limited; Wellona Pharma Private Limited; SunGen Pharma LLC; GlaxoSmithKline plc; Novartis AG; Sanofi SA; AstraZeneca plc; Merck & Co. Inc.; Bayer AG; Teva Pharmaceutical Industries Ltd.; Endo Pharmaceuticals Inc.; Sun Pharmaceutical Industries Ltd.; Cipla Ltd.; Lupin Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Antispasmodics Drugs market report include:- Daiichi Sankyo Company Limited

- Fresenius Kabi AG

- Hikma Pharmaceuticals plc

- Johnson & Johnson Services Inc.

- Pfizer Inc.

- Shanghai Fosun Pharmaceutical Co. Ltd.

- Takeda Pharmaceutical Company Limited

- Akorn Inc.

- Aurobindo Pharma Limited

- Lannett Company Inc.

- Nexus Pharmaceuticals Inc.

- Actiza Pharmaceutical Private Limited

- Blue Cross Laboratories Pvt. Ltd.

- Dr. Reddy's Laboratories Ltd.

- Lexicare Pharma Pvt. Ltd.

- Solitaire Pharmacia Private Limited

- Strides Pharma Science Limited

- Wellona Pharma Private Limited

- SunGen Pharma LLC

- GlaxoSmithKline plc

- Novartis AG

- Sanofi SA

- AstraZeneca plc

- Merck & Co. Inc.

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Endo Pharmaceuticals Inc.

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Lupin Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 14.93 Billion |

| Forecasted Market Value ( USD | $ 21.44 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |