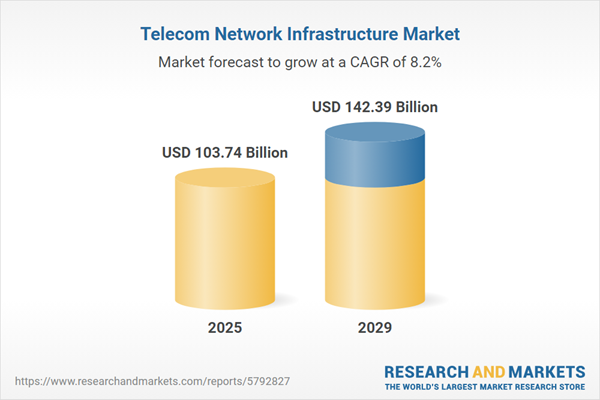

The telecom network infrastructure market size is expected to see strong growth in the next few years. It will grow to $142.39 billion in 2029 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to 5g deployment and expansion, edge computing growth, iot and connected devices, network security concerns, cloud and data center expansion, ai and network optimization. Major trends in the forecast period include virtualization and software-defined networking (sdn), edge computing adoption, rise of iot connectivity, security and privacy emphasis, cloud service expansion.

The growing penetration of smartphones is anticipated to drive the expansion of the telecom network infrastructure market in the future. The smartphone penetration rate is a metric that estimates mobile phone usage within a country, specifically measuring the ratio of SIM cards to the population. Telecom network infrastructure facilitates wireless communication through portable devices such as smartphones, tablets, or mobile phones. For example, in August 2024, Priori Data, a Berlin-based company specializing in data and intelligence for mobile applications, reported that the number of smartphone users currently stands at 4.88 billion and is projected to reach 7.12 billion by the end of 2024. Thus, the increase in smartphone penetration is propelling the growth of the telecom network infrastructure market.

The rollout and expansion of 5G networks emerge as another catalyst propelling the growth of the telecom network infrastructure market. The deployment of 5G networks involves implementing the latest generation of mobile telecommunications, offering faster speeds, lower latency, and increased capacity compared to its predecessor, 4G/LTE. The rollout and expansion of 5G networks trigger a domino effect throughout the telecom ecosystem, leading to substantial investments in infrastructure, fostering technological advancements, and creating new growth opportunities in the telecom network infrastructure sector. According to 5G Americas in April 2023, 5G wireless connections experienced a 76% increase, reaching 1.05 billion from 2021 to 2022. Projections suggest it will further increase to 1.9 billion by the end of 2023 and reach 5.9 billion by 2027, with North America expected to have 215 million 5G connections by the close of 2023. The expansion of 5G networks stands out as a significant driver for the growth of the telecom network infrastructure market.

Leading companies in the telecom network infrastructure market are prioritizing technological advancements, including the expansion of 5G networks and the integration of edge computing, to improve connectivity, minimize latency, and accommodate the rising demand for data-intensive applications across various sectors. A Managed Fibre Network (MFN) is a service where a provider assumes complete responsibility for the design, installation, and ongoing management of a fibre optic network, enabling businesses to enjoy high-speed connectivity without dealing with the technical or operational aspects themselves. For example, in October 2024, EXA Infrastructure, a UK-based digital infrastructure provider, launched its Managed Fibre Network (MFN) service to meet the growing demand for enhanced connectivity and quicker service delivery times. The MFN offers the advantages of dark fibre and equipment ownership, delivering the highest levels of scalability at the lowest unit costs, without the associated administrative, technical, and operational resource expenses of in-house management. EXA Infrastructure’s MFN solution allows companies to bridge network gaps, connect data centres and cable landing stations, and swiftly expand into new markets with ease.

Innovative solutions, such as 5G virtualized Radio Access Network (vRAN), are a focal point for major companies in the telecom network infrastructure market. 5G vRAN is a network architecture utilizing virtualization technologies to separate and centralize the processing functions of the Radio Access Network (RAN), providing flexibility and scalability in deploying 5G networks. Fujitsu Limited, a Japan-based information and communications technology company, exemplifies this trend by launching a novel 5G vRAN solution in February 2023. This solution integrates virtualized central units (CUs) and distributed units (DUs) with NVIDIA's GPU technology under the '5G Open RAN Ecosystem' (OREC) initiative. Leveraging NVIDIA's GPU processing engine, specifically the 'NVIDIA A100X,' for physical layer processing at the base station, the solution enables parallel processing of virtualized base stations and edge applications on GPU hardware, creating an integrated configuration on the same server. This design enhances radio unit (RU) capacity and processing power, ensuring a high-quality communication environment and accommodating various functions in a flexible open network. Fujitsu envisions this solution contributing significantly to the global expansion of open 5G networks.

In November 2022, NOVA Infrastructure, a US-based infrastructure investment company, successfully acquired Xchange Telecom for an undisclosed sum. This strategic acquisition aligns with NOVA's investment focus on the communications sector, bolstering and enriching its portfolio. Xchange Telecom, based in the United States, operates as a comprehensive telecommunications and data service provider catering to residential and commercial clientele in the New York region.

Major companies operating in the telecom network infrastructure market include Nokia Corporation Inc., Fujitsu Limited, Cisco Systems Inc., Ciena Corporation, CommScope Holding Company Inc., Huawei Technologies Co. Ltd., NEC Corporation, Samsung Electronics Co. Ltd., Qualcomm Incorporated, Altiostar Networks Inc., Juniper Networks Inc., Telefonaktiebolaget LM Ericsson, Altran Technologies SA, Capgemini SE, Broadcom Inc., Intel Corp., ZTE Corporation, Affirmed Networks, Ascendis Communications, Cambium Networks.

Asia-Pacific was the largest region in the telecom network infrastructure market in 2024. The regions covered in the telecom network infrastructure market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the telecom network infrastructure market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Telecom network infrastructure comprises a network of interconnected nodes and cables, encompassing towers and equipment utilized for transmitting audio, video, and data messages between originating and destination nodes.

The primary components of telecom network infrastructure include products and services. Products refer to both durable and nondurable commodities sold to meet customer needs. These products consist of various elements such as telecom towers, active and passive network equipment, and data centers, essential for ensuring optimal coverage and connectivity. Major connectivity technologies employed include 2G, 3G, 4G or LTE, and 5G. Telecom network infrastructure serves major end-user groups, including telecom operators and enterprises.

The telecom network infrastructure market research report is one of a series of new reports that provides telecom network infrastructure market statistics, including telecom network infrastructure industry global market size, regional shares, competitors with a telecom network infrastructure market share, detailed telecom network infrastructure market segments, market trends and opportunities, and any further data you may need to thrive in the telecom network infrastructure industry. This telecom network infrastructure market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The telecom network infrastructure market consists of revenues earned by entities by providing infrastructure services for the telephone landline network, the mobile network, cable TV networks, or the internet. The market value includes the value of related goods sold by the service provider or included within the service offering. The telecom network infrastructure market also includes sales of telephone wires, cables (including submarine cables), satellites, and microwaves. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Telecom Network Infrastructure Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on telecom network infrastructure market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for telecom network infrastructure ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The telecom network infrastructure market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Product; Service2) by Connectivity Technology: 2G; 3G; 4G or LTE; 5G

3) by End Users: Telecom Operators; Enterprises

Subsegments:

1) by Product: Routers; Switches; Base Stations; Antennas; Network Cables; Fiber Optic Components2) by Service: Network Design and Consulting; Installation and Integration Services; Maintenance and Support Services; Managed Services; Network Optimization Services

Key Companies Mentioned: Nokia Corporation Inc.; Fujitsu Limited; Cisco Systems Inc.; Ciena Corporation; CommScope Holding Company Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Telecom Network Infrastructure market report include:- Nokia Corporation Inc.

- Fujitsu Limited

- Cisco Systems Inc.

- Ciena Corporation

- CommScope Holding Company Inc.

- Huawei Technologies Co. Ltd.

- NEC Corporation

- Samsung Electronics Co. Ltd.

- Qualcomm Incorporated

- Altiostar Networks Inc.

- Juniper Networks Inc.

- Telefonaktiebolaget LM Ericsson

- Altran Technologies SA

- Capgemini SE

- Broadcom Inc.

- Intel Corp.

- ZTE Corporation

- Affirmed Networks

- Ascendis Communications

- Cambium Networks

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 103.74 Billion |

| Forecasted Market Value ( USD | $ 142.39 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |