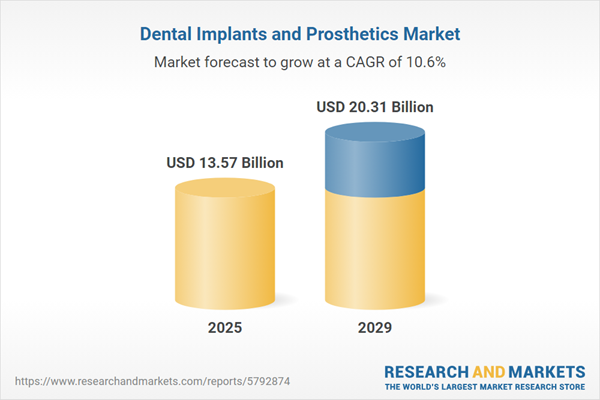

The dental implants and prosthetics market size is expected to see rapid growth in the next few years. It will grow to $20.31 billion in 2029 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to population demographics, rising oral health awareness, regulatory developments, market expansion strategies, customization and personalization. Major trends in the forecast period include digital dentistry integration, cost efficiency and accessibility, advancements in materials, rising dental awareness, regulatory changes.

The increasing prevalence of dental diseases is projected to drive the growth of the dental implants and prosthetics market in the coming years. Dental diseases encompass a variety of conditions that impact the mouth, particularly the teeth and gums. Dental implants and prosthetics provide solutions for individuals suffering from these diseases by restoring intraoral defects, such as missing teeth, parts of teeth, or soft and hard structures of the jaw and palate. For example, in May 2024, a report from the National Health Service (NHS), a UK-based publicly funded healthcare system, revealed that the number of adults treated by NHS dentists in England rose to 18,111,609 in 2023, up from 16,409,636 in 2022. The number of children treated also increased to 6,372,892, compared to 5,589,201 in the previous year. As a result, the growing incidence of dental diseases is fueling the expansion of the dental implants and prosthetics market.

The burgeoning geriatric population worldwide is poised to drive the expansion of the dental implants and prosthetics market. This demographic, typically aged 65 years or older, faces challenges related to tooth loss, where dental implants offer a durable and aesthetically pleasing solution, significantly improving oral function and overall quality of life. According to the World Health Organization in October 2022, the global population aged 60 and above is projected to rise to 1.4 billion by 2022, a notable increase from 1 billion in 2020. Projections suggest that by 2030, 1 out of 6 individuals globally will be aged 60 years or older. Consequently, the increasing geriatric populace will significantly contribute to the growth of the dental implants and prosthetics market.

Technological advancements represent a key trend driving innovation within the dental implants and prosthetics market. Leading companies in this sector are prioritizing the development of groundbreaking solutions to bolster their market presence. SprintRay Inc., a US-based 3D printer manufacturer specializing in user-friendly and advanced dental solutions, unveiled the OnX Tough, a new generation of hybrid ceramic resin in October 2022, designed for 3D printing dental prostheses. This innovative resin, employing SprintRay's NanoFusion technology, delivers exceptional durability and natural translucency, enabling the creation of high-quality, same-day smiles. The NanoFusion technology features a novel dental chemistry approach, producing prostheses with best-in-class fracture toughness, five times greater than first-generation technology. This unique composition generates dense polymer chains, striking the right balance between opacity and translucency to replicate real dentition effectively.

Prominent companies within the dental implants and prosthetics market are dedicatedly pursuing innovative product development, exemplified by the introduction of a cutting-edge conical hex-designed dental implant system. This novel dental implant technology, characterized by its conical hex shape, stands out for delivering optimal primary stability and aesthetics during various dental surgical procedures. For instance, in March 2023, Implant Direct LLC, a renowned US-based provider of dental treatment products and services, unveiled its latest advancement, the Simply Iconic implant system. This system integrates a conical hex design, emphasizing superior primary stability and aesthetics. The innovation simplifies treatment procedures, significantly impacting the dental field and catering to implantologists, periodontists, oral and maxillofacial surgeons, and proficient general dentists. The Simply Iconic implant system equips practitioners with a proven implant body, conical hex, and SimplePlatform, ensuring an optimal blend of primary stability and aesthetics. This introduction enhances the value of dental professionals' implant surgical workflows, instilling confidence in their ability to deliver effective patient treatments. The system's versatility accommodates diverse procedures, including full arch, all-on-X, single-tooth placement, and implant-supported crowns and bridges.

In May 2024, Osstem Implant, a dental implant company headquartered in South Korea, acquired Implacil De Bortoli for an undisclosed amount. This acquisition enhanced Osstem Implant's competitive edge, opened up access to new customer markets, and leveraged the rising demand for dental services. The move aligns with Osstem's strategic goal of becoming a global leader in dental implant technologies by growing its market share and expanding its product portfolio. Implacil De Bortoli is a dental implant manufacturer based in Brazil.

Major companies operating in the dental implants and prosthetics market include Institut Straumann AG, DENTSPLY Sirona Inc., Zimmer Biomet Holdings Inc., Henry Schein Inc., Mitsui Chemicals Inc., Ivoclar Vivadent AG, OSSTEM Implant Co. Ltd., Bicon LLC, Southern Implants Ltd., Thommen Medical AG, Ultradent Products Inc., Shofu Inc., Avinent Implant System, TBR Implants Group, BioHorizons Inc., Envista, HIOSSEN, Neoss Limited, Keystone Dental Inc., DIO Implant, Aseptico Inc.

North America was the largest region in the dental implants and prosthetics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the dental implants and prosthetics market report during the forecast period. The regions covered in the dental implants and prosthetics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dental implants and prosthetics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Dental implants and prosthetics are synthetic structures placed within the oral tissues, beneath the mucosa, periosteum, and within or through the bone, serving as a foundation for supporting and retaining fixed or removable dental prostheses. These specialized structures are designed to replace missing teeth.

The primary product categories within dental implants and prosthetics include dental bridges, dental implants, dental crowns, abutments, dentures, inlays, onlays, and others. Dental bridges are medical devices secured in place by abutment teeth on either side of a gap, connecting an artificial tooth securely to adjacent teeth or dental implants. These products come in various designs such as tapered dental implants and parallel-walled dental implants, crafted from materials such as titanium, zirconium, metal, ceramic, and others. Dental implants and prosthetics are utilized in dental hospitals and clinics, dental laboratories, and other relevant settings.

The dental implants and prosthetics market research report is one of a series of new reports that provides dental implants and prosthetics market statistics, including dental implants and prosthetics industry global market size, regional shares, competitors with an dental implants and prosthetics market share, detailed dental implants and prosthetics market segments, market trends and opportunities, and any further data you may need to thrive in the dental implants and prosthetics industry. This dental implants and prosthetics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The dental implants and prosthetics market consists of sales of endosteal implants, subperiosteal implants, implant overdentures. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Dental Implants and Prosthetics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental implants and prosthetics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental implants and prosthetics ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental implants and prosthetics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product Type: Dental Bridges; Dental Implants; Dental Crown; Abutment; Dentures; Inlays and Onlays; Other Products2) by Design: Tapered Dental Implants; Parallel-Walled Dental Implants

3) by Material: Titanium; Zirconium; Metal; Ceramic; Other Materials

4) by Price: Premium Implants; Value Implants; Discounted Implants

5) by End-User: Dental Hospital and Clinics; Dental Laboratories; Other End-Users

Subsegments:

1) by Dental Bridges: Traditional Bridges; Cantilever Bridges; Maryland Bridges; Implant-Supported Bridges2) by Dental Implants: Endosteal Implants; Subperiosteal Implants; Zygomatic Implants

3) by Dental Crown: Ceramic Crowns; Porcelain-Fused-to-Metal Crowns; Metal Crowns; Resin Crowns

4) by Abutment: Standard Abutments; Customized Abutments

5) by Dentures: Complete Dentures; Partial Dentures; Implant-Supported Dentures

6) by Inlays and Onlays: Ceramic Inlays or Onlays; Composite Inlays or Onlays; Gold Inlays or Onlays

7) by Other Products: Bone Grafts; Surgical Guides; Dental Adhesives

Key Companies Mentioned: Institut Straumann AG; DENTSPLY Sirona Inc.; Zimmer Biomet Holdings Inc.; Henry Schein Inc.; Mitsui Chemicals Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Dental Implants and Prosthetics market report include:- Institut Straumann AG

- DENTSPLY Sirona Inc.

- Zimmer Biomet Holdings Inc.

- Henry Schein Inc.

- Mitsui Chemicals Inc.

- Ivoclar Vivadent AG

- OSSTEM Implant Co. Ltd.

- Bicon LLC

- Southern Implants Ltd.

- Thommen Medical AG

- Ultradent Products Inc.

- Shofu Inc.

- Avinent Implant System

- TBR Implants Group

- BioHorizons Inc.

- Envista

- HIOSSEN

- Neoss Limited

- Keystone Dental Inc.

- DIO Implant

- Aseptico Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 13.57 Billion |

| Forecasted Market Value ( USD | $ 20.31 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |