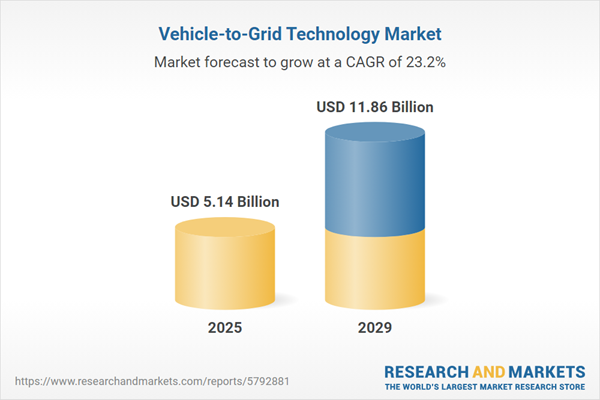

The vehicle-to-grid technology market size is expected to see exponential growth in the next few years. It will grow to $11.86 billion in 2029 at a compound annual growth rate (CAGR) of 23.2%. The growth in the forecast period can be attributed to expansion of electric vehicle fleets, grid decentralization and distributed energy resources, integration with smart grids, demand response programs, environmental sustainability goals. Major trends in the forecast period include collaborations between automakers and utilities, introduction of V2G-capable charging stations, expansion of V2G pilot programs and demonstrations, integration with renewable energy sources, regulatory support and standardization initiatives.

The rising adoption of electric vehicles is expected to drive the growth of the vehicle-to-grid technology market in the future. An electric vehicle is powered by an electric motor that draws energy from a battery and can be charged from an external source. Vehicle-to-grid technology enables electric vehicles to utilize smart charging, allowing their batteries to supply electricity back to the grid. This technology employs information technology to manage energy use while vehicles are on the road. For instance, in February 2024, the Department of Infrastructure, Transport, Regional Development, Communications, and the Arts, an Australia-based government department, reported that as of January 31, 2022, there were 20.7 million registered motor vehicles, marking a 2% increase from January 2021. Battery electric vehicles (BEVs) numbered around 40,000, reflecting a 100% increase from 2021, with 34,200 of these being passenger cars in 2022, up by 118% from the previous year. Hybrid-electric vehicles (HEVs) reached approximately 277,000 in 2022, showing a 35% increase from 2021. Therefore, the increasing adoption of electric vehicles is driving the growth of the vehicle-to-grid technology market.

The expansion of charging infrastructure is driving the growth of the vehicle-to-grid technology market. The charging infrastructure comprises stations and related equipment enabling electric vehicle charging. Vehicle-to-grid technology integrates with charging infrastructure, offering grid reliability, load management, renewable energy integration, and reduced carbon footprint. By 2030, there's an anticipated installation of 12.9 million publicly accessible EV charging stations, reflecting the significant growth in charging infrastructure contributing to the vehicle-to-grid technology market.

In the vehicle-to-grid technology market, major players are introducing cutting-edge products such as the EvoCharge max EV charging station by EvoCharge Inc. Released in April 2023, this level 2 EV charger offers quick charging for higher amperage, delivering up to 19.2 kW of power (80 amps on a 240V circuit). It aims to cater to commercial and domestic usage, prioritizing speed and scalability while maintaining affordability. EvoCharge's emphasis on reliability and security positions it strategically in the competitive charging station landscape.

Within the vehicle-to-grid technology market, major corporations are forging strategic partnerships to fortify their market positions and develop new products. A case in point is Toyota Motor Corporation's collaboration in November 2023 with San Diego Gas & Electric Company (SDG&E), a US-based utility provider. This alliance aims to optimize energy use by exploring grid-to-power capabilities in electric vehicles (EVs), enabling them to contribute back to the grid when necessary. The partnership seeks to align the demands of battery electric vehicle (BEV) owners with grid requirements for mutual benefit.

In April 2022, BorgWarner Inc., a US-based automotive supplier, acquired Rhombus Energy Solutions for $185 million. This strategic acquisition marks BorgWarner's entry into the vehicle-to-grid (V2G) direct current rapid charging service sector. By integrating Rhombus Energy Solutions, BorgWarner aims to fortify its position in supporting critical components of electric mobility infrastructure, especially focusing on charging services.

Major companies operating in the vehicle-to-grid technology market include Volkswagen AG, Toyota Corporation, Ford Motor Company, MercGroup AG, General Motors Company, Bayerische Motoren Werke AG, Hyundai Motor Co Ltd., Robert Bosch GmbH, Nissan Motor Co Ltd., Kiaon, BYD Company Limited, Audi AG, Volvo Group AB, Mitsubishi Electric Corporation, Jaguar Land Rover Automotive plc, NIO Inc., Li Auto Inc., XPeng Inc., Rivian Automotive Inc., Polestar AB, Lucid Motors Inc., Fisker Inc., Lordstown Motors Corp, Canoo Inc., Arrival Ltd., Proterra Inc., Faraday Future Inc.

North America was the largest region in the vehicle-to-grid technology market in 2024. The regions covered in the vehicle-to-grid technology market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the vehicle-to-grid technology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Vehicle-to-grid technology refers to an intelligent charging method that enables electric vehicle (EV) batteries to recharge the electrical grid, utilizing surplus battery capacity to support renewable energy generation.

Vehicle-to-grid technology incorporates several key components, including electric vehicle supply equipment (EVSE), home energy management (HEM) systems, smart meters, and software solutions. Electric vehicle supply equipment (EVSE) refers to charging stations designed to provide electrical power for plug-in electric vehicle charging. This technology encompasses various charging types, such as unidirectional and bidirectional charging, utilized in charge battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). These systems are applied across different power supply modes such as reactive power, baseload power, spinning reserves, peak power sales, and other electricity management processes.

The vehicle-to-grid technology market research report is one of a series of new reports that provides vehicle-to-grid technology market statistics, including vehicle-to-grid technology industry global market size, regional shares, competitors with vehicle-to-grid technology market share, detailed vehicle-to-grid technology market segments, market trends, and opportunities, and any further data you may need to thrive in the vehicle-to-grid technology industry. This vehicle-to-grid technology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The vehicle-to-grid technology market includes revenues earned by entities by providing vehicle-to-home, vehicle-to-building, and regular smart charging services. The market value includes the value of related goods sold by the service provider or included within the service offering. The vehicle-to-grid technology market also includes sales of direct current charger devices and alternating current charger devices. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. The IT market is segmented into IT services, computer hardware, telecom, and software products.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Vehicle-to-Grid Technology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on vehicle-to-grid technology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vehicle-to-grid technology? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The vehicle-to-grid technology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Electric Vehicle Supply Equipment (EVSE); Home Energy Management (HEM) System; Smart Meters; Software Solutions2) By Charging Type: Unidirectional Charging; Bidirectional Charging

3) By Vehicle Type: Battery Electric Vehicle (BEV); Plug-in Hybrid Electric Vehicle (PHEV); Fuel Cell Electric Vehicle (FCEV)

4) By Application: Reactive Power; Baseload Power; Spinning Reserves; Peak Power Sales; Other Applications

Subsegments:

1) By Electric Vehicle Supply Equipment (EVSE): Level 1 Chargers; Level 2 Chargers; DC Fast Chargers2) By Home Energy Management (HEM) System: Energy Monitoring Systems; Demand Response Systems; Battery Storage Integration

3) By Smart Meters: Advanced Metering Infrastructure (AMI) Meters; Bidirectional Smart Meters

4) By Software Solutions: V2G Management Platforms; Data Analytics Software; Integration and Communication Software

Key Companies Mentioned: Volkswagen AG; Toyota Corporation; Ford Motor Company; MercGroup AG; General Motors Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Volkswagen AG

- Toyota Corporation

- Ford Motor Company

- MercGroup AG

- General Motors Company

- Bayerische Motoren Werke AG

- Hyundai Motor Co Ltd.

- Robert Bosch GmbH

- Nissan Motor Co Ltd.

- Kiaon

- BYD Company Limited

- Audi AG

- Volvo Group AB

- Mitsubishi Electric Corporation

- Jaguar Land Rover Automotive plc

- NIO Inc.

- Li Auto Inc.

- XPeng Inc.

- Rivian Automotive Inc.

- Polestar AB

- Lucid Motors Inc.

- Fisker Inc.

- Lordstown Motors Corp

- Canoo Inc.

- Arrival Ltd.

- Proterra Inc.

- Faraday Future Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.14 Billion |

| Forecasted Market Value ( USD | $ 11.86 Billion |

| Compound Annual Growth Rate | 23.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |