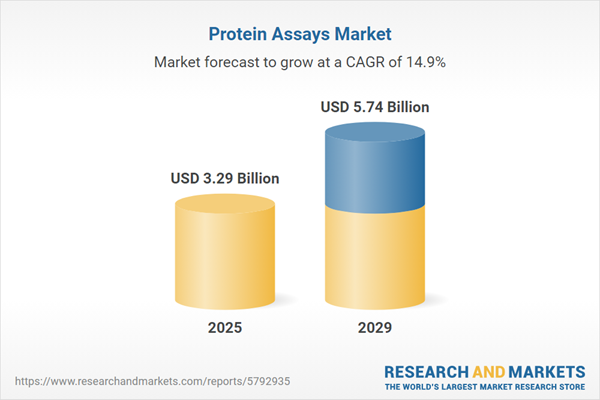

The protein assays market size is expected to see rapid growth in the next few years. It will grow to $5.74 billion in 2029 at a compound annual growth rate (CAGR) of 14.9%. The growth in the forecast period can be attributed to expanding applications in clinical diagnostics, growing emphasis on biomarker discovery, biopharmaceutical production and quality control, technological integration in research platforms, rise in proteomic profiling for personalized therapies. Major trends in the forecast period include increased use of proteomics in drug discovery, development of high-sensitivity assay kits, focus on standardization and assay reproducibility, integration of proteomic data with other omics data, expansion of protein assays in clinical diagnostics.

The expansion of the pharmaceutical industry is anticipated to propel the protein assay market in the coming years. This sector focuses on the research, development, manufacturing, and distribution of drugs and medications aimed at preventing, diagnosing, and treating diseases. Several factors contribute to the growth of the pharmaceutical industry, including rising global health demands, increased healthcare spending, and a growing emphasis on preventive care. Protein assays play a crucial role in this industry by providing accurate measurements of protein concentration and activity, essential for drug discovery, development, and quality control. For example, in August 2024, data from the Government of Canada indicated that domestic exports in the pharmaceutical trade rose from 10.71 billion CAD in 2021 to 12.79 billion CAD in 2022, while imports increased from 26.63 billion CAD to 30.21 billion CAD during the same period. This growth in both exports and imports highlights the expanding pharmaceutical trade sector. Thus, the growth of the pharmaceutical industry is driving the protein assay market forward.

The increasing prevalence of chronic diseases is another factor propelling the growth of the protein assay market. Chronic diseases, characterized by lasting a year or longer and requiring continuous medical care, are on the rise. Conditions such as cancer and neurodegenerative disorders are driving the demand for protein assays, which are crucial for biomarker identification and understanding diseases. As projected by the National Center for Biotechnology Information (NCBI) in January 2023, the number of individuals aged 50 years and older with at least one chronic illness is expected to increase by 99.5%, reaching 142.66 million by 2050, up from 71.522 million in 2020. Consequently, the increasing prevalence of chronic diseases contributes significantly to the growth of the protein assay market.

Major players in the protein assay market are directing their efforts towards the creation of innovative solutions, such as 3D spatial analysis kits. These kits, encompassing tools, software, and resources, are tailored for the examination and visualization of spatial data in three dimensions. For instance, in June 2023, Pixelgen Technologies AB, a biotechnology company based in Sweden, introduced the 'Pixelgen Single Cell Spatial Proteomics Kit.' Grounded in MPX technology, this kit has the potential to significantly enhance the understanding of cellular activity. It aims to drive advancements in scientific knowledge, expedite drug discovery and development processes, and enhance diagnostic capabilities. The initial release of the Pixelgen SCSP Kit includes 76 protein assays and 4 controls for simultaneous testing.

Leading companies in the protein assay sector are channeling their focus into the development of innovative solutions, such as high-plex proteomics platforms. These platforms, constituting proteomic technologies or systems, enable the simultaneous analysis of a high number of proteins in a single experiment. For instance, in November 2023, SomaLogic Inc., a US-based proteomics technology company, launched the 'somaScan 11K Platform.' This platform provides 11,000 total protein measurements, offering researchers a significant advantage in uncovering biomarkers and identifying potential drug targets for translational medicine. The addition of 3,500 proteins to the 11K assay is anticipated to reveal new biomarkers previously beyond measurement, potentially contributing to the development of diagnostics with heightened accuracy.

In October 2023, Thermo Fisher Scientific Inc., a biotechnology company based in the US, completed the acquisition of Olink Holding for $3.1 billion. This acquisition is intended to bolster Thermo Fisher Scientific Inc.'s capabilities in protein analysis and biomarker discovery, thereby expanding its range of tools and services for both research and clinical applications. Olink Holding, headquartered in Sweden, is a biotechnology firm that focuses on the discovery and development of protein biomarkers.

Major companies operating in the protein assays market include F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Roche Diagnostics International AG, Danaher Corporation, Merck KGaA, Siemens Healthineers AG, R&D Systems Inc., Lonza Group AG, PerkinElmer Inc., Bio-Rad Laboratories Inc., Takara Bio Inc., Qiagen N.V., Promega Corporation, Abcam plc, Cell Signaling Technology Inc., BioVision Inc., Cayman Chemical Company, Enzo Life Sciences Inc., Novus Biologicals LLC, Abnova Corporation, Elabscience Biotechnology Co Ltd., Geno Technology Inc., Cytoskeleton Inc.

North America was the largest region in the protein assays market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global protein assays market report during the forecast period. The regions covered in the protein assays market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the protein assays market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Protein assay refers to the process of determining how much or how many distinct proteins there are in a sample, depending on the case. Many clinical and research procedures include the isolation and detection of proteins. The protein assay is used to quantify the presence of a particular protein, or a variety of proteins, in a sample.

Protein assays encompass two primary product types reagents and kits, and instruments. Reagents, substances chosen for their chemical or biological action, are utilized in manufacturing, image development, or component detection. Protein assays employ various technologies, including absorbance-based, colorimetric, and fluorescence-based methods. These assays find applications in diverse industries such as pharmaceuticals, biotechnology, clinical laboratories, hospitals, and academic research institutes.

The protein assays market research report is one of a series of new reports that provides protein assays market statistics, including protein assays industry global market size, regional shares, competitors with a protein assays market share, detailed protein assays market segments, market trends and opportunities, and any further data you may need to thrive in the protein assays industry. This protein assays market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The protein assay services market includes revenues earned by entities by providing different protein quantitation methods such as enzyme-linked immunosorbent assay (ELISA), western blot analysis, and more recently, mass spectrometry, among others. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Protein Assays Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on protein assays market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for protein assays? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The protein assays market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Reagents and Kits; Instruments2) By Technology Type: Absorbance Based Protein Assays; Colorimetric Protein Assays; Fluorescence Based Protein Assays

3) By End User: Pharmaceutical Industry; Biotechnology Industry; Clinical Laboratories; Hospitals; Academic Research Institutes

Subsegments:

1) By Reagents and Kits: Colorimetric Assay Kits; Fluorescent Assay Kits; Luminescent Assay Kits; Other Assay Kits2) By Instruments: Spectrophotometers; Microplate Readers; Other Analytical Instruments

Key Companies Mentioned: F. Hoffmann-La Roche AG; Thermo Fisher Scientific Inc.; Roche Diagnostics International AG; Danaher Corporation; Merck KGaA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Roche Diagnostics International AG

- Danaher Corporation

- Merck KGaA

- Siemens Healthineers AG

- R&D Systems Inc.

- Lonza Group AG

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Takara Bio Inc.

- Qiagen N.V.

- Promega Corporation

- Abcam plc

- Cell Signaling Technology Inc.

- BioVision Inc.

- Cayman Chemical Company

- Enzo Life Sciences Inc.

- Novus Biologicals LLC

- Abnova Corporation

- Elabscience Biotechnology Co Ltd.

- Geno Technology Inc.

- Cytoskeleton Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.29 Billion |

| Forecasted Market Value ( USD | $ 5.74 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |