Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Government-backed housing developments, including the Mangere project aimed at building up to 10,000 new homes, are fueling the need for energy-efficient climate solutions. ASHPs, known for their high performance - producing over five units of heat per unit of electricity - offer a cost-effective and eco-friendly alternative to conventional heating systems. Their compatibility with renewable energy sources such as solar and wind power further aligns with New Zealand’s carbon reduction strategies, contributing to broader market adoption across residential and commercial sectors.

Key Market Drivers

High Humidity Level Across the Region

Elevated humidity levels in many parts of New Zealand, especially in northern and coastal regions like Auckland, are a major factor driving demand for Air Source Heat Pumps. As of 2023, the country has recorded a 1.26°C rise in its annual average temperature, intensifying issues related to moisture and indoor air discomfort. With annual average humidity frequently surpassing 80%, problems such as condensation, mold, and dampness have become common in homes and buildings. Traditional heating systems often fall short in managing these conditions. In contrast, ASHPs offer dual functionality - regulating indoor temperature while operating in dehumidification mode. This makes them especially valuable in maintaining healthier indoor environments and promoting energy efficiency. As public awareness of air quality grows and health-oriented preferences influence consumer choices, ASHPs are increasingly favored for their performance in both comfort control and moisture management.Key Market Challenges

Lack of Standardized Regulation

A significant hurdle for the New Zealand ASHP market is the absence of unified and comprehensive national standards governing the installation, efficiency, and long-term operation of heat pump systems. The current regulatory landscape lacks cohesion, leading to inconsistent installation quality and variable product performance. This creates challenges for consumers trying to differentiate between high-performing and substandard systems, often resulting in poor purchasing decisions and dissatisfaction. Additionally, improperly installed systems may fail to meet expected energy savings or climate control benefits, negatively impacting consumer perception and slowing overall adoption. The establishment of standardized regulations would provide greater clarity and quality assurance, bolstering consumer trust and supporting the broader goals of energy efficiency and sustainability in the national heating sector.Key Players Profiled in this New Zealand Air Source Heat Pump Market Report

- Rheem New Zealand Limited

- Daikin Air Conditioning New Zealand Limited

- Black Diamond Leisure Ltd

- Panasonic Asia-Pacific Pte., Ltd

- Artimus Limited

- Barilla Ltd

- The Electric Heating Company Ltd

- Enula

- Cinergi Ltd

- Go Geothermal Ltd

Report Scope:

In this report, the New Zealand Air Source Heat Pump Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:New Zealand Air Source Heat Pump Market, by Process:

- Air to Air

- Air to Water

New Zealand Air Source Heat Pump Market, by End Use:

- Residential

- Hotels & Resorts

- Gym & Spas

- Educational Institutes

- Food Service

- Others

New Zealand Air Source Heat Pump Market, by Distribution Channel:

- Direct

- Indirect

New Zealand Air Source Heat Pump Market, by Region:

- North Island

- South Island

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the New Zealand Air Source Heat Pump Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this New Zealand Air Source Heat Pump market report include:- Rheem New Zealand Limited

- Daikin Air Conditioning New Zealand Limited

- Black Diamond Leisure Ltd

- Panasonic Asia Pacific Pte., Ltd

- Artimus Limited

- Barilla Ltd

- The Electric Heating Company Ltd

- Enula

- Cinergi Ltd

- Go Geothermal Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | May 2025 |

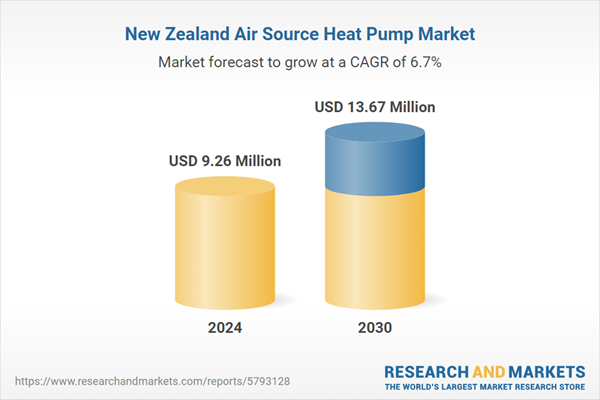

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.26 Million |

| Forecasted Market Value ( USD | $ 13.67 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | New Zealand |

| No. of Companies Mentioned | 11 |