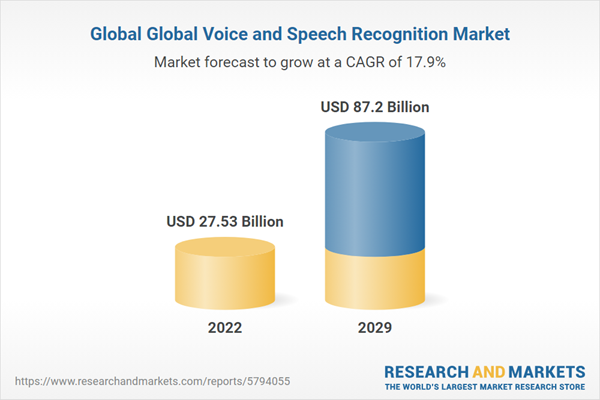

The voice and speech recognition market is expected to experience a CAGR of 17.91% throughout the forecast period, reaching a market size of US$87.200 billion by 2029. This represents a substantial increase from US$27.527 billion recorded in 2022.

The market is anticipated to experience significant growth, driven by various factors. The rising popularity of virtual assistants such as Alexa, Siri, and Google Assistant in both homes and workplaces is a key contributor. These digital assistants are becoming integral parts of daily life, fostering increased adoption of voice recognition tools. One notable aspect proposing the market is the enhanced accessibility provided by voice recognition technology. As the number of internet-connected devices continues to proliferate, voice recognition is to become a pivotal interface for controlling smart homes, wearables, and various other connected devices. The seamless integration of voice commands into these technologies enhances user experience and contributes to the growing reliance on voice-based interactions.Rising demand for virtual assistants in smartphones propels the market

The integration of major virtual assistants like Siri, Google Assistant, and Alexa with smartphone operating systems has significantly expanded their accessibility, making them easily available to a broad user base. This accessibility, in turn, has contributed to a substantial increase in their demand for speech and voice recognition software.Smartphones play a crucial role as they serve as the primary platform for these virtual assistants. The advanced features of smartphones, such as GPS, enable functionalities like location-based reminders and voice-commanded navigation assistance. This integration of virtual assistants with smartphone technologies adds a layer of convenience and practicality to everyday tasks. Furthermore, smartphones function as portable hubs, connecting virtual assistants to a myriad of other smart devices in homes or cars. This interconnected system creates a centralized control hub for users, enabling them to manage various aspects of their environment with voice commands and creating a more integrated and streamlined user experience.According to data by USITC, in 2021, U.S. imports of cellular phones experienced a notable increase, rising by $11 billion (22.5 percent) to reach $59.8 billion from previous year. This upward trend continued in 2022, with U.S. imports of cellular phones growing by $2.8 billion (4.7 percent) to reach $62.6 billion. The surge in the import value of cellular phones during these years is likely attributed to the increased demand for 5G-enabled phones. Overall, the combination of virtual assistants and smartphones has led to a revolutionary shift in the way individuals interact with technology. This integration has made technology more intuitive, convenient, and personalized than ever before. With the continued rise in smartphone adoption among the general population, there is a corresponding increase in the ubiquity and utilization of virtual assistants, reflecting a broader transformation in the digital landscape.

North America is projected for significant growth in the market.

The voice and speech recognition industry in the United States has grown rapidly due to several factors. Voice recognition technology's popularity has been driven by the growing need for hands-free gadgets, especially in the automobile and consumer electronics sectors. The accuracy and efficiency of these systems have greatly increased due to advancements in natural language processing, which has encouraged integration in virtual assistants, customer support applications, and communication devices. Furthermore, voice commands are being widely used to operate linked devices due to the rise of smart home gadgets and the trend towards home automation.As per the National Center of Education Statistics, in 2021, the proportion of 3- to 18-year-olds who had access to the internet at home was 97%, compared to 92% in 2016. In a similar vein, the proportion of people with home internet connection in 2021 was greater than it was in 2019 (95%), before the coronavirus pandemic. As cell phones proliferate, they provide a broad platform for voice-activated services and apps. Voice recognition technology is becoming more in demand due to features like speech-to-text capabilities, voice-activated commands, and virtual assistants. The Department of Homeland Security Science and Technology Directorate (S&T) has partnered with the Johns Hopkins University Applied Physics Laboratory (JHU/APL) to develop potential Automated Speech Recognition (ASR) technology solutions as part of its mission to support the identification and integration of existing and emerging technologies. Additionally, speech recognition has been adopted by the healthcare industry for clinical documentation and transcribing services, which has improved efficiency. The widespread use of virtual assistants, like Google Assistant and Amazon Alexa, has been greatly aided by their popularity. Moreover, improved precision and dependability, together with growing applications in business environments to boost efficiency, have further propelled the market's growth.

Market Key Developments

- August 2022, JCB Co., Ltd., Japan's exclusive international payment brand, and Kyndryl, the IT infrastructure services provider. Their joint venture resulted in the launch of an AI-based interactive automatic speech response system, aimed at elevating customer satisfaction and service quality.

- May 2023, Apple showcased software features dedicated to cognitive, vision, hearing, and mobility accessibility. Additionally, the company introduced groundbreaking tools catering to individuals who are nonspeaking or at risk of losing their ability to speak. Leveraging advancements in both hardware and software, Apple emphasized on-device machine learning to create inclusive products for everyone.

Segmentation:

By Technology:

- Speaker Identification and Verification

- Automatic Speech Recognition (ASR)

- Speech To Text

By Deployment:

- Cloud

- On-premise

By End-User:

- Automotive

- BFSI

- Government

- Retail

- Healthcare

- Hospitality

- Education

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

Table of Contents

Companies Mentioned

- LumenVox

- SESTEK

- Apple Inc.

- IBM

- Microsoft

- Alphabet Inc. (Google LLC)

- Meta

- Sensory Inc.

- AssemblyAI

- Amazon Web Services, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | February 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 27.53 Billion |

| Forecasted Market Value ( USD | $ 87.2 Billion |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |