Diamonds, comprising pure carbon, are a unique mineral and the Earth's hardest substance. They occur naturally deep within the planet's high-temperature, high-pressure conditions and can also be synthetically created in labs. These versatile gems find applications in both jewelry and various industrial uses. The industry's value chain comprises downstream, midstream, and upstream stages. The upstream phase covers rough diamond exploration, production, and sorting. The midstream phase encompasses the cutting and polishing of rough diamonds to create the final product. The downstream phase encompasses jewelry design and setting using polished diamonds, followed by retail sales.

The dynamic growth of the global diamond market growth can be attributed to several key factors. The industry's expansion is primarily linked to the increased demand for jewelry. In addition, the industry's growth is primarily driven by increased jewelry demand, particularly in emerging economies like China and India. Furthermore, there's a growing need for lab-grown diamonds for industrial applications due to their customizable properties. For instance, in August 2023, Cullen Jewellery, a prominent advocate for sustainable luxury, is excited to unveil its debut collection of colored lab-grown diamonds named 'Love in Colour.' Featuring shades inspired by a vibrant sunset, including pink, yellow, and blue, this exquisite line reimagines the concept of conscious elegance. In addition, in February 2023, the Indian Central Government awarded a research project to IIT-Madras aimed at developing domestic lab-grown diamond (LGD) technology, seeds, and formulas. The Indian Institutes of Technology (IITs) will receive a five-year research grant from the government in support of this initiative. The project also includes plans for establishing an India Centre for Lab-Grown Diamonds (InCent-LGD) at IIT Madras, with an estimated budget of US$ 29.3 million over five years.

Moreover, the preference for branded purchases has led to a surge in diamond jewelry sales. According to the De Beers Group's Diamond Insight Report for 2023, in China, millennials spent an average of RMB 10,300 on a piece of diamond jewelry in 2022, while Gen Z spent an average of RMB 8,400, accelerating the growth of the market growth, according to the De Beers Group's Diamond Insight Report for 2023.

The De Beers Group's Diamond Insight Report 2023 states that there is a steady increase in the demand for polished and natural diamonds worldwide. Global consumer demand for jewelry made of real diamonds remained stable in 2022 at USD 87.5 billion, not much changed from 2021.

Furthermore, the diamond market is influenced by a variety of social, political, and economic factors, including shifts in consumer behavior, government policies, and financial conditions. In July 2023, De Beers Group signed an agreement with the Botswana government to augment the supply of rough diamonds allocated to the African nation. The initiative aims to bolster the company's processing facility and elevate the volume of rough diamonds by 50% within the coming decade.

Rising consumer demand across the globe

The diamond industry expansion is primarily driven by increased consumer demand for jewelry. This demand significantly impacts diamond pricing, supply, and production, making it a crucial factor in the industry's expansion. Factors such as the rising middle class and evolving cultural attitudes towards diamonds, especially for engagement rings, have contributed to the growing desire for diamond jewelry. In India, diamonds are a favored choice for special occasion gifts and traditional jewelry designs. Moreover, the preference for branded purchases has led to a surge in diamond jewelry sales. According to the De Beers Group's Diamond Insight Report for 2023, in China, millennials spent an average of RMB 10,300 on a diamond jewelry piece in 2022, while Gen Z spent an average of RMB 8,400, thus accelerating its growth.According to the De Beers Group, the Diamond Insight Report 2023, global demand for diamonds both in the natural and polished categories shows stable growth. In 2022, global consumer demand for natural diamond jewelry held steady at USD 87.5 billion, showing not much significant change compared to 2021. Additionally, the global demand for polished diamonds in 2022 remained stable, amounting to USD 27.8 billion, without significant variation from the previous year. According to the same report, the demand in the United States experienced minimal year-on-year growth, while the positive value growth observed in India was counterbalanced by a decline in China, primarily attributed to COVID-19-related lockdowns.

Furthermore, the diamond market is influenced by a variety of social, political, and economic factors, including shifts in consumer behavior, government policies, and financial conditions. In July 2023, De Beers Group signed an agreement with the Botswana government to augment the supply of rough diamonds allocated to the African nation. The initiative aims to bolster the company's processing facility and elevate the volume of rough diamonds by 50% within the coming decade.

The United States diamond market is projected to grow

The increasing imports of diamonds from major diamond-producing countries to the USA coupled with the recovering retail sales are projected to boost the market for diamonds in the country over the next few years. In addition, technological developments by companies operating in the country for safer and more efficient transactions of diamonds are further expected to fuel market growth.As per the April-September 2021 Gem & Jewellery Trade Trends Half Yearly Report published by the Statistics Department of the Gem & Jewellery Export Promotion Council (GJEPC) India, USA is observing a strong consumer demand for diamonds, especially post the covid pandemic period. The source further stated that imports of cut and polished diamonds to the USA from India increased from US$3,672.61 million in April to September 2019 to US$5,150.94 million in April to September 2021, exhibiting a 40.25% growth.

The dynamic growth of the global diamond market growth can be attributed to several key factors. The industry's expansion is primarily linked to the increased demand for jewelry. In addition, the industry's growth is primarily driven by increased jewelry demand, particularly in emerging economies like China and India. Furthermore, there's a growing need for lab-grown diamonds for industrial applications due to their customizable properties.

One of the driving factors behind the market's growth is the introduction of new and inventive diamond designs through recent product launches. An example of this occurred in September 2023, when Swarovski debuted its Diamond Collection in the United States and Canada. The Austrian jewelry brand expanded its presence in the fine jewelry sector during the autumn season with a new collection inspired by the cosmos, developed by Global Creative Director Giovanna Engelbert.

In addition, as per the August 2023 Diamond Sector Outlook release by Care Ratings Limited, the USA accounts for approximately 80% of the lab-grown diamond consumption in the world and thereby remains a strong export destination from major diamond processing and producing countries like India.

Furthermore, the USA-operating diamond company De Beers Group, in its May 2022 news release, introduced the world’s first blockchain-backed diamond source platform at scale named Tracr™. The platform has the capability for the provision of provenance assurance for 100% of the company’s diamonds from the source to the sightholder to store.

Key Players:

- ALROSA Group is a consortium of Russian diamond mining firms renowned for their expertise in diamond exploration, extraction, processing, and distribution. They hold the top position globally in terms of diamond production quantity.

- De Beers Group is a South African-British corporation that specializes in diamond mining, exploration, retail, trading, and industrial diamond manufacturing sectors.

- Petra Diamonds is a prominent provider of high-quality uncut diamonds, operating in four locations spanning South Africa and Tanzania for mining purposes.

Segmentation:

By Application

- Jewelry

- Industrial

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Russia

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- South Africa

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Vietnam

- Others

Table of Contents

Companies Mentioned

- ALROSA Group

- De Beers Group

- Petra Diamonds Limited

- Debswana Diamond

- Rio Tinto

- Arctic Canadian Diamond Company

- Lucara Diamond

- Trans Hex group

- Mountain Province Diamond

- Gem Diamonds

Table Information

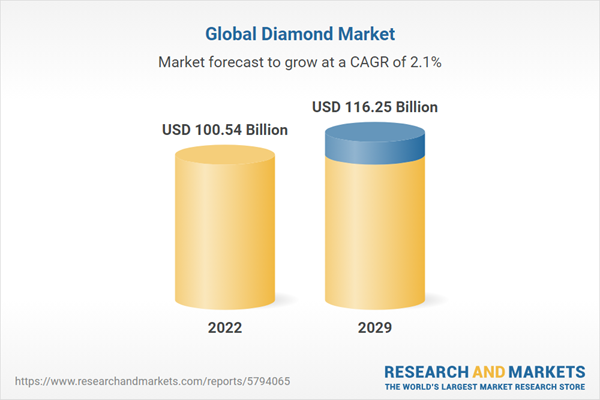

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | March 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 100.54 Billion |

| Forecasted Market Value ( USD | $ 116.25 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |