Allergy Treatment Market: Introduction

Allergy treatment refers to a range of therapies that are used to reduce the symptoms associated with allergies. Allergies are caused by an overactive immune response to a harmless substance, such as pollen or pet dander, and can result in a range of symptoms, including sneezing, itching, runny nose, and hives.The most common treatments for allergies include medications, such as antihistamines, decongestants, and nasal corticosteroids, which work to reduce inflammation and relieve symptoms. Immunotherapy, also known as allergy shots or allergy drops, is another treatment option that involves gradually exposing patients to small amounts of the allergen that triggers their allergy symptoms, with the goal of building up their tolerance to the allergen over time.

In addition to these traditional treatments, there are a range of alternative therapies that are used to treat allergies, including acupuncture, herbal remedies, and homeopathy. These therapies are often used in conjunction with traditional treatments to provide additional relief from allergy symptoms.

The benefits of allergy treatment include relief from allergy symptoms, improved quality of life, and the prevention of more serious allergic reactions, such as anaphylaxis. Allergy treatment can also reduce the need for emergency medical care and the associated costs.

Allergy treatment is typically administered by allergists or immunologists in a clinical setting. Patients undergoing allergy treatment require close monitoring for potential side effects, particularly with immunotherapy, which can cause allergic reactions.

In summary, allergy treatment refers to a range of therapies that are used to reduce the symptoms associated with allergies. These treatments include medications, immunotherapy, and alternative therapies, and are typically administered by allergists or immunologists in a clinical setting. The benefits of allergy treatment include relief from allergy symptoms, improved quality of life, and the prevention of more serious allergic reactions. Allergy treatment is a long-term treatment option that requires close monitoring for potential side effects.

Allergy Epidemiology

The prevalence of allergies is increasing globally, leading to a rise in the demand for allergy treatment. Allergies affect individuals of all ages and genders and can be triggered by a variety of environmental factors and lifestyle habits.

Based on prevalence, the allergy treatment market is segmented into seasonal allergies, perennial allergies, food allergies, and others. Seasonal allergies are the most common type of allergy, with a high prevalence of allergic rhinitis and hay fever during the spring and fall months. Perennial allergies, such as allergies to pet dander and dust mites, are also prevalent throughout the year. Food allergies are another common type of allergy, affecting individuals of all ages and leading to potentially life-threatening reactions in some cases.

Based on age, the allergy treatment market is divided into children and adults. Allergies can develop at any age, with many individuals experiencing their first allergy symptoms during childhood. Children are a significant market for allergy treatment, as early intervention with treatment can prevent the development of asthma in children with allergies.

Based on gender, the allergy treatment market is segmented into male and female. Allergies affect individuals of all genders, with certain types of allergies, such as food allergies, being more prevalent in females.

Based on lifestyle habits, the allergy treatment market is divided into urban and rural populations. Urban populations are more likely to experience allergies, with exposure to air pollution and other environmental factors contributing to the development of allergies.

In summary, the allergy treatment market is segmented based on prevalence, age, gender, and lifestyle habits. Allergies affect individuals of all ages and genders and can be triggered by a variety of environmental factors and lifestyle habits. The allergy treatment market is expected to grow in response to the increasing prevalence of allergies and the growing demand for safe and effective allergy treatments.

Allergy Treatment Market Segmentations

The market can be categorised into product type, treatment, route of administration, end user, and region.Market Breakup by Type

- Eye Allergy

- Rhinitis

- Asthma

- Skin Allergy

- Food Allergies

- Others

Market Breakup by Treatment

- Anti-Allergy Drugs

- Antihistamine

- Corticosteroids

- Decongestants

- Other Drugs

- Immunotherapy

- Sub-Cutaneous Immunotherapy (SCIT)

- Sub-Lingual Immunotherapy (SLIT)

Market Breakup by Route of Administration

- Oral

- Inhalation

- Intranasal

- Others

Market Breakup by End User

- Hospitals

- Specialty Clinics

- Homecare

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Allergy Treatment Market Scenario

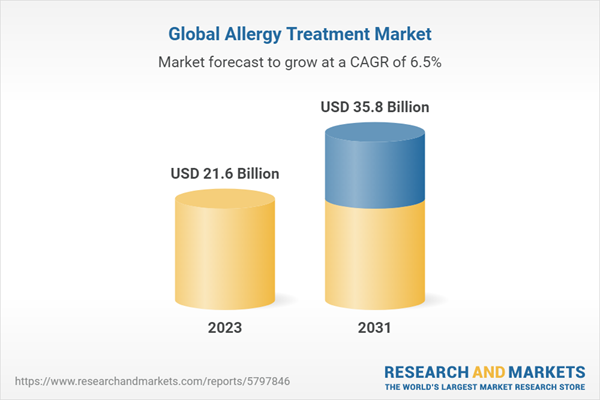

The global market for allergy treatment is growing rapidly, driven by the increasing prevalence of allergies and the development of new and innovative treatments. Allergies affect millions of people worldwide, leading to a significant burden on healthcare systems and a reduced quality of life for those affected.The market for allergy treatment is highly competitive, with many players offering a wide range of products to cater to the diverse needs of healthcare providers and patients. The market is segmented based on product type, allergy type, distribution channel, and geography.

Based on product type, the market is divided into medications, immunotherapy, and alternative therapies. Medications are the largest segment of the market, with a high demand for antihistamines, decongestants, and nasal corticosteroids. Immunotherapy, also known as allergy shots or allergy drops, is another important segment of the market, particularly for patients with moderate to severe allergy symptoms that are not effectively controlled with medications.

Based on allergy type, the market is divided into seasonal allergies, perennial allergies, and food allergies. Seasonal allergies are the largest segment of the market, driven by the high prevalence of allergic rhinitis and hay fever during the spring and fall months.

Based on distribution channel, the market is divided into hospitals, specialty clinics, and pharmacies. Specialty clinics are the largest distribution channel segment of the market, owing to the specialized care required for allergy treatment and the growing demand for immunotherapy.

The market for allergy treatment is expected to continue to grow at a steady pace, driven by the increasing prevalence of allergies and the growing demand for safe and effective allergy treatments. Advances in technology and research are expected to lead to the development of new and innovative treatments, which may provide more effective treatment options for patients with allergies.

Overall, the market for allergy treatment is expected to continue to grow, driven by the increasing demand for safe and effective allergy treatments. Advances in technology and research are expected to lead to the development of new and innovative treatments, which may provide more effective treatment options for patients with allergies.

Key Players in the Global Allergy Treatment Market

The report gives an in-depth analysis of the key players involved in the allergy treatment market, sponsors manufacturing the drugs, and putting them through trials to get FDA approvals. The companies included in the market are as follows:- AbbVie Inc

- Sanofi S.A

- Johnson & Johnson Services, Inc

- LETI Pharma, S.L.U

- GlaxoSmithKline Plc

- Zenomed Healthcare Private Limited

- F. Hoffmann-La Roche AG

- Cadila Pharmaceuticals

- Bayer AG

- Teva Pharmaceutical Industries Ltd

- Akorn, Incorporated

- Prestige Consumer Healthcare Inc

- Astellas Pharma Inc

- Eli Lilly and Company

- Almirall, S.A

Table of Contents

Companies Mentioned

- Abbvie Inc.

- Sanofi S.A.

- Johnson & Johnson Services, Inc.

- Leti Pharma, S.L.U.

- GlaxoSmithKline plc.

- Zenomed Healthcare Private Limited

- F. Hoffmann-La Roche AG

- Cadila Pharmaceuticals

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Akorn, Incorporated

- Prestige Consumer Healthcare Inc.

- Astellas Pharma Inc.

- Eli Lilly and Company

- Almirall, S.A

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | April 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 21.6 Billion |

| Forecasted Market Value ( USD | $ 35.8 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |