Biosensors: Introduction

Biosensors are analytical devices that combine biological ccomponents, such as enzymes or antibodies, with a physicochemical transducer to detect and quantify various biological or chemical analytes. They are designed to convert the biological response generated by a target molecule into a measurable signal, providing real-time, accurate, and sensitive detection.The main components of a biosensor include a recognition element that selectively interacts with the target analyte, a transducer that converts the biological response into a measurable signal, and a signal processing system that analyzes and presents the data.

Biosensors have found extensive applications in various industries, including healthcare, agriculture, environmental monitoring, food safety, and biodefense. In healthcare, biosensors play a crucial role in medical diagnostics, drug discovery, and patient monitoring. They enable rapid and precise detection of biomarkers, pathogens, and genetic materials, leading to early disease diagnosis, personalized medicine, and improved patient outcomes.

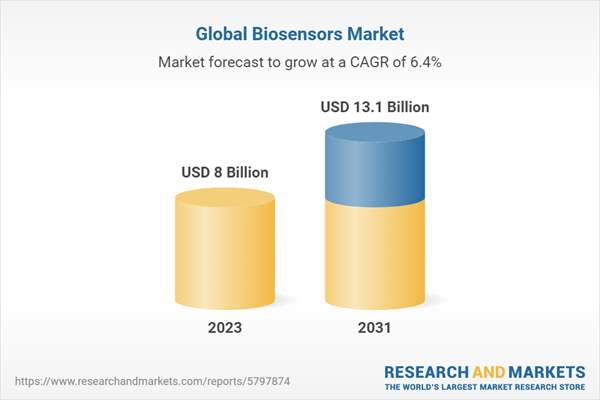

Overall, biosensors are revolutionizing the field of diagnostics and monitoring, offering significant potential for improving healthcare outcomes, enhancing food safety, and protecting the environment. The continuous advancements and increasing commercialization of biosensor technologies are expected to fuel the growth of the global biosensors market in the coming years.

Key Trends in the Biosensors Market

Some key trends in the biosensors market include:

- Miniaturization and wearable biosensors: There is a growing trend towards the miniaturization of biosensor devices, making them smaller, portable, and suitable for wearable applications. These wearable biosensors offer real-time and continuous monitoring of various health parameters, such as heart rate, glucose levels, and activity tracking. They provide convenience, mobility, and personalized healthcare management

- Point-of-care testing (POCT): The demand for rapid and on-site testing has fueled the development of biosensors for point-of-care diagnostics. These biosensors enable quick and accurate detection of diseases and analytes in clinical settings, eliminating the need for laboratory-based testing and reducing turnaround time. POCT biosensors are particularly valuable in remote and resource-limited areas, emergency situations, and home healthcare settings

- Integration with digital health platforms: Biosensors are increasingly integrated with digital health platforms, such as mobile apps and cloud-based systems, allowing for data collection, analysis, and remote monitoring. This integration enables healthcare professionals to track and interpret biosensor data, empowering personalized healthcare management, remote patient monitoring, and telemedicine

Market Breakup by Product

Wearable

- Wristwear

- Eyewear

- Footwear

- Neckwear

- Bodywear

- Others

- Non-Wearable

Market Breakup by Technology

Electrochemical

- Amperometric Sensor

- Potentiometric Sensor

- Conductometric Sensor

Optical

- SPR

- Colorimetric Biosensors

- Fluorescence Biosensors

Piezoelectric

- Acoustic Biosensors

- Microcantilever Biosensors

- Thermal Biosensor

- Nanomechanical

Market Breakup by Component

- Bioreceptor Molecule

- Biological Element

- Transducer

Market Breakup by Application

POC

- Glucose Monitoring

- Cardiac Marker

- Infectious Disease Detection

- Coagulation Monitoring

- Pregnancy Testing

- Blood Gas and Electrolyte Detection

- Detection of Tumor or Cancer Marker

- Urinalysis Testing

- Cholesterol Testing

Home Diagnostic

- Glucose Monitoring

- Pregnancy Testing

- Cholesterol Testing

- Research Labs

- Environmental Monitoring

- Food and Beverages

- Biodefence

Market Breakup by End User

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Biodefence

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Biosensors Market Scenario

The global biosensors market is experiencing significant growth and is poised to revolutionize various industries, including healthcare, agriculture, environmental monitoring, and food safety. Biosensors are innovative analytical devices that combine biological components with transducers to detect and quantify specific analytes in real-time.In healthcare, biosensors are used for a wide range of applications, including disease diagnosis, monitoring of chronic conditions, drug development, and personalized medicine. They offer several advantages, such as rapid results, high sensitivity, specificity, and the ability to perform on-site testing. Biosensors enable early detection of diseases, facilitate remote patient monitoring, and contribute to more targeted and effective treatments.

The market for biosensors is driven by factors such as the increasing prevalence of chronic diseases, the growing demand for point-of-care testing, and advancements in sensor technology. Additionally, the rise of wearable biosensors and the integration of biosensors with digital health platforms are reshaping the way healthcare is delivered and monitored.

Beyond healthcare, biosensors are gaining traction in areas such as agriculture, where they assist in soil analysis, pesticide detection, and livestock health monitoring. They are also utilized in environmental monitoring to detect pollutants and ensure water quality. The food industry utilizes biosensors for rapid and accurate detection of contaminants and pathogens.

As the demand for rapid, accurate, and portable diagnostic solutions continues to rise, the biosensors market is expected to witness substantial growth in the coming years. The increasing adoption of biosensors in diverse sectors and the development of novel applications will further expand the market opportunities, paving the way for advancements in healthcare, agriculture, environmental monitoring, and beyond.

Biosensors Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- AgaMatrix Holdings LLC

- Abbott Laboratories Inc

- Biosensors International Group, Ltd

- Medtronic Inc

- Bio-Rad Laboratories Inc

- Pinnacle Technologies Inc

- Ercon, Inc

- Dupont Biosensors Materials

- Koninklijke Philips N.V

- Qtl Biodetection Llc

- Molecular Devices Corporation

- Nova Biomedical

- Molex Llc

- Zimmer & Peacock As

- Siemens Healthcare

Table of Contents

Companies Mentioned

- Agamatrix Holdings LLC

- Abbott Laboratories Inc.

- Biosensors International Group, Ltd.

- Medtronic Inc.

- Bio-Rad Laboratories Inc.

- Pinnacle Technologies Inc.

- Ercon, Inc.

- Dupont Biosensors Materials

- Koninklijke Philips N.V.

- Qtl Biodetection LLC.

- Molecular Devices Corporation

- Nova Biomedical

- Molex LLC

- Zimmer & Peacock As

- Siemens Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | April 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 13.1 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |