Drug Screening Introduction

Drug screening is the process of detecting the presence of illicit drugs or their metabolites in biological samples, such as blood, urine, saliva, or hair. It plays a crucial role in various settings, including workplace drug testing, pre-employment screening, law enforcement, sports doping control, and clinical toxicology. The global drug screening market encompasses a wide range of products and services, including analytical instruments, rapid testing devices, consumables, and laboratory services.Drug Screening Market Scenario

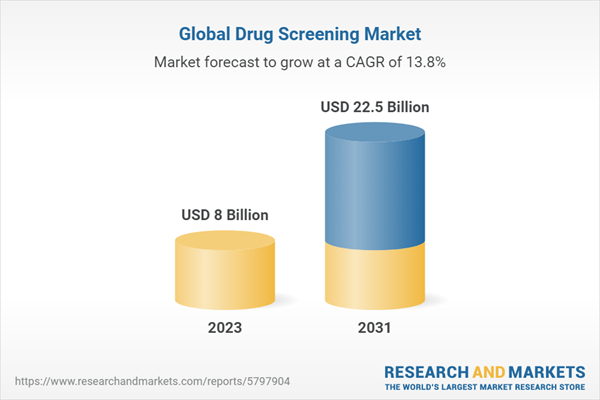

The global drug screening market has experienced substantial growth in recent years, driven by factors such as the increasing prevalence of drug abuse, rising awareness about the negative consequences of substance use, and growing emphasis on workplace safety. Furthermore, advancements in drug testing technologies, the development of novel drug screening products, and supportive regulatory policies have contributed to the market's expansion.North America: The largest market for drug screening, driven by factors such as the high prevalence of substance abuse, advanced healthcare infrastructure, and a strong focus on research and development.

Europe: The second-largest market, with increasing demand for drug screening products and services due to a growing awareness of the importance of drug testing and a supportive regulatory framework.

Asia-Pacific: Expected to witness the highest growth rate due to factors such as a rapidly growing population, increasing prevalence of substance abuse, and growing investments in healthcare infrastructure.

Drug Screening Market Segmentations

Market Breakup by Product and Services

- Drug Screening Services

Drug Screening Products

- Analytical Instruments

- Breathalyzers

- Law Enforcement Agencies Breathalyzers

- Fuel Cell Breathalyzers

- Semi-Conductor Breathalyzers

- Others

- Immunoassay Analyzers

- Chromatography Instruments

Rapid Testing Devices (RTD)

- Urine Testing Devices

- Drug Testing Cups

- Dip Cards

- Drug Testing Cassettes

- Oral Fluid Testing Devices

Consumables

- Assay Kits

- Sample Collection Devices

- Calibrators & Controllers

- Others

Market Breakup by End User

- Workplace and Schools

- Criminal Justice Systems and Law Enforcement Agencies

- Drug Testing Laboratories

- Drug Treatment Centers

- Hospitals

- Personal Users

- Pain Management Centers

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Trends in the Drug Screening Market

Some key trends of the market are as follows:- Growing adoption of rapid testing devices: There is an increasing demand for rapid, on-site drug testing devices, such as lateral flow immunoassays and oral fluid testing kits, due to their ease of use, quick results, and non-invasive sample collection methods

- Advancements in drug testing technologies: The development of innovative drug testing technologies, such as liquid chromatography-mass spectrometry (LC-MS) and high-resolution mass spectrometry (HRMS), has improved the sensitivity, specificity, and efficiency of drug screening processes

- Expansion of drug testing in the workplace: The growing emphasis on workplace safety and the enforcement of stringent drug testing regulations have resulted in a higher demand for drug screening products and services in the corporate sector

Drug Screening Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- LabCorp

- Quest Diagnostics

- Abbott

- Thermo Fisher Scientific, Inc

- Alfa Scientific Designs, Inc

- OraSure Technologies, Inc

- Siemens

- F. Hoffmann-La Roche Ltd

- MPD Inc

- Shimadzu Corporation

- Lifeloc Technologies, Inc

- Drägerwerk AG & Co. KGaA

- Premier Biotech, Inc

- Omega Laboratories, Inc

- Psychemedics Corporation

- Clinical Reference Laboratory Inc.,

- American Bio Medica Corporation

- ACM Global Laboratories

- Sciteck, Inc

- Synens SAS

Table of Contents

Companies Mentioned

- Labcorp

- Quest Diagnostics

- Abbott

- Thermo Fisher Scientific, Inc.

- Alfa Scientific Designs, Inc.

- Orasure Technologies, Inc.

- Siemens

- F. Hoffmann-La Roche Ltd

- Mpd Inc.

- Shimadzu Corporation

- Lifeloc Technologies, Inc.

- Drägerwerk AG & Co. Kgaa

- Premier Biotech, Inc.

- Omega Laboratories, Inc.

- Psychemedics Corporation

- Clinical Reference Laboratory Inc.

- American Bio Medica Corporation

- Acm Global Laboratories

- Sciteck, Inc.

- Synens Sas

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 22.5 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |