Favourable reimbursement policies in developed economies are bolstering the adoption of digital health solutions, making them more accessible to patients. Market growth is also driven by application, including chronic disease management, behavioural health, and medication adherence solutions. For instance, in November 2023, the Digital Therapeutics Alliance (DTA) introduced the Policymaker & Payor DTx Evaluation Toolkit to support stakeholders in assessing digital therapeutics. The toolkit includes market access pathways, prescription classifications, and guidelines on clinical and economic impact, security, privacy, and usability. While regulatory hurdles and data security concerns remain challenges, government initiatives and advancements in AI and machine learning are expected to drive sustained market expansion.

Government initiatives promoting digital health, coupled with technological advancements such as AI and machine learning, are further propelling the industry forward. However, challenges such as regulatory hurdles and data security concerns may impact adoption. Despite this, continuous innovation in digital therapeutics is expected to drive sustained market expansion over the coming years.

Digital Therapeutics Market Trend

The rising internet penetration and smartphone penetration are driving the adoption of digital therapeutics globally. According to the GSM Association (GSMA) Mobile Economy 2024 report, mobile connectivity is expanding, enabling seamless access to intelligent health monitoring solutions. This growth is accelerating the use of digital therapeutics, particularly in remote healthcare management and chronic disease monitoring. Increasing smartphone usage facilitates real-time data tracking, enhancing patient engagement and adherence to treatment plans. As digital therapeutics become more integrated with mobile technologies, their role in preventive and personalised medicine is expected to strengthen significantly in the coming years.The expansion of network infrastructure is fostering the global adoption of digital therapeutics by improving connectivity and healthcare accessibility. Growing investments in digital health and investment opportunities from both public and private sectors are enhancing the capabilities of digital therapeutics. The widespread adoption of smartphones supports the seamless delivery of digital therapeutic solutions, particularly in telehealth, mental health management, and chronic disease treatment. In March 2023, NeuroRPM received FDA clearance for its AI-enabled remote monitoring app for Parkinson’s disease, which continuously tracks bradykinesia, tremor, and dyskinesia using proprietary algorithms. This approval reflects the growing trend of digital solutions in healthcare, with similar technologies being applied to migraine, PTSD, psychiatric conditions, and chronic lung diseases like CAD. As artificial intelligence (AI) and machine learning (ML) advancements progress, digital therapeutics are expected to deliver more personalised, data-driven interventions, significantly improving treatment outcomes and overall healthcare efficiency.

The COVID-19 pandemic accelerated the adoption of digital therapeutics, as healthcare providers sought remote treatment options. The crisis prompted regulatory flexibility, enabling faster approvals of digital health products and increasing their accessibility. This shift has led to sustained patient demand for remote healthcare solutions, ensuring continued growth in digital therapeutics. Governments and regulatory bodies are now developing long-term policies to integrate digital therapeutics into standard healthcare practices. With continuous technological advancements and supportive regulations, digital therapeutics are poised to revolutionise patient care by providing cost-effective, scalable, and highly personalised treatment solutions.

Market Concentration & Characteristics

The global digital therapeutics market is moderately concentrated, with key players investing in research and development to enhance product offerings. Market concentration is influenced by technological advancements, strategic partnerships, and regulatory approvals. Companies are focusing on integrating artificial intelligence (AI) and machine learning (ML) into digital therapeutics to improve treatment outcomes. Additionally, increasing investments in digital health startups are intensifying competition. Established firms are acquiring emerging players to expand their market presence and strengthen their product portfolios, leading to consolidation trends within the industry.The market is characterised by a strong emphasis on personalised medicine and patient-centric healthcare solutions. Digital therapeutics are designed to provide tailored treatment plans using real-time patient data and analytics. The rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and mental health conditions is driving demand for digital solutions that offer remote monitoring and behavioural interventions. Furthermore, regulatory agencies are actively defining guidelines to ensure the efficacy and safety of digital therapeutics, fostering credibility and widespread adoption.

Strategic collaborations between pharmaceutical companies, tech firms, and healthcare providers are shaping the competitive landscape. Technology firms are leveraging their expertise in AI, cloud computing, and data analytics to enhance digital therapeutics applications. Additionally, government initiatives promoting digital health innovation are encouraging the development of advanced digital therapeutics solutions. These factors are leading to increased accessibility and affordability of digital healthcare solutions across various demographics.

Despite the market’s growth, challenges such as data privacy concerns, regulatory complexities, and reimbursement limitations remain significant barriers. Companies are addressing these issues by enhancing cybersecurity measures and collaborating with policymakers to establish comprehensive regulatory frameworks. As the industry matures, digital therapeutics are expected to become a mainstream component of global healthcare, driving improved patient outcomes and healthcare efficiency.

Application Insights

The application of digital therapeutics is expanding as healthcare providers focus on early intervention strategies. In diabetes, digital therapeutics help track glucose levels and provide personalised lifestyle modifications to prevent disease progression. Similarly, solutions targeting obesity offer behavioural coaching, diet tracking, and physical activity recommendations to support weight management.Digital therapeutics play a crucial role in managing chronic conditions. Diabetes management solutions assist patients with glucose monitoring, medication adherence, and personalised interventions. Respiratory care applications provide real-time feedback on inhaler usage and lung function, improving treatment outcomes for asthma and COPD patients. Mental health solutions, including cognitive behavioural therapy (CBT)-based apps, are gaining traction for managing depression, anxiety, and PTSD. Cardiovascular digital therapeutics support hypertension and heart disease management through continuous monitoring and lifestyle interventions. The growing adoption of these solutions is driving innovation in personalised treatment plans.

Regional Insights

North America remains a dominant region in the global digital therapeutics market, supported by advanced healthcare infrastructure, high smartphone penetration, and strong regulatory frameworks. The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and mental health disorders has driven demand for digital therapeutics solutions. In December 2023, ObvioHealth launched a new API tailored for digital therapeutic clinical trials, integrating electronic clinical outcome assessment (eCOA) technology to enhance study design and patient engagement. This innovation supports the region’s expanding focus on telehealth, remote patient monitoring, and AI-driven healthcare solutions. Favorable reimbursement policies and growing investments further accelerate the adoption of digital therapeutics.U.S. Digital Therapeutics Market Trends

The U.S. digital therapeutics market is expanding due to the increasing adoption of digital health solutions and strong regulatory support. The collaboration between Bayer AG and Mahana Therapeutics in September 2023 to commercialize Mahana IBS, a cognitive behavioral therapy (CBT)-based digital treatment for irritable bowel syndrome (IBS), highlights the growing investment in consumer-centric digital health tools. Such strategic partnerships are expected to drive innovation and accessibility, significantly impacting market growth. With rising healthcare costs and the demand for remote patient management solutions, digital therapeutics are expected to become a key component of the United States healthcare system.Europe Digital Therapeutics Market Trends

Europe is witnessing a surge in digital therapeutics adoption, driven by advancements in AI-driven healthcare solutions and increased government support. The region's emphasis on preventive healthcare and remote patient monitoring has led to a growing acceptance of digital therapies for conditions such as diabetes, cardiovascular diseases, and mental health disorders. Several European countries are integrating digital therapeutics into their healthcare systems, with reimbursement policies increasingly covering digital health solutions. As a result, market players are focusing on launching innovative digital therapeutics platforms to address the rising prevalence of chronic diseases, ensuring sustained market expansion in the region.UK Digital Therapeutics Market

The UK digital therapeutics market is expanding due to strong government initiatives and high levels of smartphone penetration. The National Health Service (NHS) has been actively promoting the integration of digital therapeutics into patient care, particularly for mental health treatment and chronic disease management. Increasing investments in artificial intelligence (AI) and machine learning (ML) technologies have facilitated the development of personalized treatment solutions. Additionally, collaborations between health-tech startups and pharmaceutical companies are driving the availability of advanced digital therapeutics in the United Kingdom. As regulatory frameworks become more flexible, the UK market is expected to witness continued growth in the coming years.Germany Digital Therapeutics Market

Germany is leading the way in digital therapeutics adoption in Europe, driven by the DiGA (Digital Health Applications) framework, which enables physicians to prescribe digital therapeutics (DTx). Strong government support and a well-established network infrastructure have contributed to the sector’s rapid expansion. In October 2023, Sidekick Health acquired aidhere, a pioneer in prescription digital therapeutics, further strengthening its portfolio. This acquisition includes zanadio, one of Germany’s most successful PDTs, with over 50,000 prescriptions. With stringent data privacy regulations ensuring patient security and growing regulatory approvals, Germany remains a key market for digital therapeutics developers and global health insurers.Asia Pacific Digital Therapeutics Market Trends

The Asia Pacific digital therapeutics market is growing rapidly due to increasing smartphone adoption and government investments in digital health infrastructure. Countries such as China, Japan, and India are at the forefront of digital therapeutics adoption, leveraging advancements in artificial intelligence (AI) and big data analytics. With rising cases of chronic diseases like diabetes and hypertension, there is a strong demand for digital therapeutics solutions that facilitate remote patient monitoring. Additionally, initiatives promoting telehealth and mobile health applications are driving market expansion across the region.Japan Digital Therapeutics Market

Japan is embracing digital therapeutics due to its rapidly aging population and increasing healthcare costs. The government has been actively supporting digital health technologies to improve chronic disease management and mental health care. The high adoption of wearable health devices and AI-driven healthcare solutions has further accelerated digital therapeutics integration into Japan’s healthcare system. Pharmaceutical and tech companies in Japan are increasingly investing in digital therapeutics to cater to the growing demand for remote healthcare services.The Digital Therapeutics Market in China

China is witnessing significant growth in the digital therapeutics market, driven by government initiatives promoting digital health innovation. The integration of AI, big data, and cloud computing in healthcare has led to the rapid expansion of digital therapeutics solutions. The country has a vast telehealth market, with tech giants such as Tencent and Alibaba investing heavily in digital therapeutics platforms. Additionally, China’s 5G network expansion has enhanced the delivery of digital health services, improving accessibility for rural and urban populations. With increasing government support and private sector investments, China is poised to emerge as a key player in the global digital therapeutics market.Latin America Digital Therapeutics Market Trends

The Latin America digital therapeutics market is growing due to increased government efforts to digitize healthcare and improve telemedicine adoption. Countries such as Mexico, Brazil, and Argentina are witnessing a surge in digital therapeutics usage, particularly for chronic disease management. Investments in mobile health applications (mHealth) and AI-driven healthcare technologies are expected to drive market expansion. However, challenges such as limited internet access in remote areas and regulatory barriers may slow adoption rates.Brazil Digital Therapeutics Market

Brazil is leading the market in Latin America, driven by a growing telemedicine sector and increasing smartphone penetration. The Brazilian government is actively promoting digital health initiatives, encouraging the adoption of AI-driven healthcare solutions. Digital therapeutics platforms focusing on mental health, diabetes management, and cardiovascular diseases are gaining traction. With favorable government policies and rising investments in health tech startups, Brazil is expected to witness robust growth in digital therapeutics adoption.Middle East & Africa Digital Therapeutics Market Trends

The Middle East and Africa digital therapeutics market is gradually expanding due to increasing investments in telehealth and mobile health solutions. Governments across the region are prioritizing healthcare digitization, with countries such as Saudi Arabia and the UAE leading the way. The adoption of AI-driven healthcare technologies and increased mobile phone penetration are driving the growth of digital therapeutics. However, challenges such as limited healthcare infrastructure in certain regions may hinder market penetration.South Africa Digital Therapeutics Market

South Africa is at the forefront of digital therapeutics adoption in Africa, driven by a rising burden of chronic diseases and increasing smartphone penetration. The South African government is supporting telemedicine initiatives to improve healthcare accessibility, particularly in rural areas. Investments in AI and big data analytics are enabling the development of personalized digital therapeutics solutions. However, challenges such as limited digital literacy and internet connectivity issues may slow market expansion. With continued government support and investment in health-tech innovations, the South African digital therapeutics market is expected to witness steady growth.Key Digital Therapeutics Company Insights

The key features of the market report comprise patent analysis, grants analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:HYGIEIA

HYGIEIA is a leader in AI-driven insulin management solutions, offering its d-Nav® Insulin Management Program, which helps patients with diabetes optimise insulin therapy. The company’s adaptive AI technology personalises dosing recommendations, improving patient outcomes and reducing the risk of complications.DarioHealth Corp.

DarioHealth Corp. specialises in digital chronic disease management, providing AI-powered health monitoring solutions for diabetes, hypertension, and behavioural health. Its integrated digital platform offers real-time health insights and personalised interventions, enhancing patient engagement and adherence.

Big Health

Big Health focuses on digital therapeutics for mental health, offering clinically validated solutions like Sleepio (for insomnia) and Daylight (for anxiety). These CBT-based digital treatments provide non-drug alternatives for mental wellness, improving accessibility and patient outcomes.Limbix Health, Inc

Limbix Health, Inc. develops prescription digital therapeutics (PDTs) for adolescent mental health, with its flagship product, SparkRx, designed to address teen depression through CBT-based interventions. The company aims to bridge the gap in youth mental health treatment.Other companies in the market include Noom, Inc., Teladoc Health, Inc., Omada Health Inc., Welldoc's BlueStar, CogniFit Inc., Digital Therapeutics Alliance, Boehringer Ingelheim Pharmaceuticals, Inc., 2Morrow® Inc., Canary Health and Click Therapeutics, Inc

Recent Developments

- In October 2024, Minze Health, a leader in digital health solutions for urology, raised USD 5.3 million in a funding round led by White Fund, Capricorn Digital Growth Fund, and PMV, with new investment from imec.istart future fund. The funds will support the development of Prescription Digital Therapeutics (PDTs) for urinary dysfunctions, initially targeting Germany and France, while also facilitating Minze’s expansion into the U.S. market with its at-home diagnostic solutions. This investment highlights the growing interest in digital therapeutics for urological conditions.

- In August 2024, Otsuka’s digital health subsidiary launched Rejoyn, a digital therapeutic for major depressive disorder (MDD), co-developed with Click Therapeutics. The app, which received FDA 510(k) clearance in March 2024, improves emotional processing through cognitive exercises involving facial expressions. A six-week pivotal trial demonstrated a statistically significant improvement in depression symptoms, as measured by the Montgomery-Åsberg Depression Rating Scale. This marks an important step in integrating prescription digital therapeutics (PDTs) into mainstream mental health treatment, offering patients an alternative approach to managing MDD.

- In October 2024, Click Therapeutics announced the launch of Click SE, a new category of Software-Enhanced Drug therapies. This launch responds to U.S. FDA draft guidance on Prescription Drug-Use Related Software (PDURS). Click SE™ combines proprietary AI-driven digital therapeutic technology with pharmacotherapy, aiming to enhance medication efficacy and patient outcomes. By enabling pharmaceutical companies to develop software-integrated drug formulations, Click Therapeutics is pioneering a new approach to prescription digital therapeutics, helping to optimise treatments for targeted patient populations and specific medications.

- In January 2024, Click Therapeutics and Boehringer Ingelheim announced that their investigational CT-155 prescription digital therapeutic (PDT) for schizophrenia received FDA Breakthrough Device designation. CT-155, a mobile-based digital therapeutic, is designed to be used alongside standard pharmaceutical treatments to address negative symptoms of schizophrenia. This designation expedites regulatory review for innovative medical technologies that offer significant clinical benefits over existing treatments. The approval highlights the increasing role of digital therapeutics in mental health care, particularly for severe conditions like schizophrenia.

- In July 2024, a study published in Endocrine Connections examined the role of digital therapeutics (DTx) in managing diabetes mellitus (DM). While conventional DM therapies have improved, challenges such as medication adherence and long-term disease management remain. The study found that DTx can enhance patient engagement and disease monitoring, offering promising results for chronic disease management. However, concerns regarding regulatory policies, safety, privacy, and ethical issues persist. More clinical trials and policy frameworks are needed to fully integrate digital therapeutics into diabetes treatment protocols.

Global Digital Therapeutics Market Report Segmentation

Digital Therapeutics Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Offerings

- Software/Platforms

- Programs

- Virtual Reality/Games

Market Breakup by Application

- Diabetes

- Obesity

- CVD

- Respiratory Diseases

- Smoking Cessation

- CNS Diseases

- Others

Market Breakup by Sales Channel

- B2B Sales Channel

- Payers

- Employers

- Pharmaceutical Companies

- Providers

- Other Buyers

- B2C Sales Channel

- Caregivers

- Patients

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- HYGIEIA

- DarioHealth Corp.

- Big Health

- Limbix Health, Inc.

Table Information

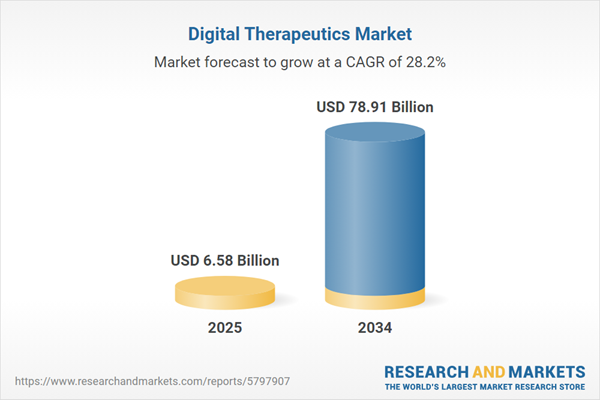

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.58 Billion |

| Forecasted Market Value ( USD | $ 78.91 Billion |

| Compound Annual Growth Rate | 28.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |