Global Dialyzer Market Overview

A dialyzer that acts as an artificial kidney utilizes a thin and fibrous membrane to create a semipermeable membrane that allows tiny particles and liquids to flow through. When the kidneys are unable to work effectively, it is a cost-effective therapy that eliminates excess fluids and wastes from the blood, preventing salt accumulation and poisoning.There has been a significant rise in the population suffering from diabetes, hypertension, heart disease, and end-stage renal disease (ESRD). This, combined with the world's growing geriatric population, is one of the primary drivers driving global dialyzer market growth. The growing funding for improving dialysis products and services by governments of several countries is propelling the market's growth. Also, the higher efficiency of high flux dialyzers to remove large size toxin molecules during hemodialysis has been bolstering the growth of the market. Further, the shortage of kidneys for transplantation across the globe is offering lucrative growth opportunities to key market players. The rising utilization of novel products to treat chronic kidney conditions is catalyzing the demand for dialyzers worldwide.

The dialyzer market demand is also influenced positively by the availability of qualified medical staff in dialysis centers who provide better services to patients. Additionally, the expanding healthcare industry, rising medical tourism, improving reimbursement regulations, and technological advancements in product manufacture are some of the other growth-inducing factors. The global dialyzer market is likely to benefit from technological improvements that lead to increased usage and demand in developing countries.

Rising Prevalence of Diabetes

The dialyzer market growth is impacted by the rising prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular diseases, along with several other diseases that are leading causes of kidney failure, requiring renal replacement therapy like dialysis regularly. According to the factsheet released by the World Health Organization, diabetes claimed nearly 1.5 million deaths in 2019.Additionally, in June 2023, the Institute for Health Metrics and Evaluation mentioned there are around half a billion people who are suffering from diabetes globally including kids, men, and women. This number is anticipated to double in the upcoming 30 years. Being one of the top 10 leading causes of mortality, Diabetes is most prevalent in North Africa and the Middle East at 9.3% and is projected to jump to 16.8% by 2050. The rate in Latin America and the Caribbean is projected to increase to 11.3%.

Prevalence of Cardiovascular Diseases

CVDs are one of the leading causes of death around the world. By 2019, CVD accounted for 18.6 million deaths (9.6 million males and 8.9 million females). These numbers represent 33% of all deaths with ischemic heart disease (9.1 million deaths) and stroke (6.6 million deaths) totaling 85% of all CVD deaths worldwide. The major reason for CVD is the rising geriatric population. With rising age, people are more susceptible. Fluid management plays a crucial role in CVD patients as it may act as a major obstacle to heart pumping blood if left unattended. Dialysis is a process that removes excess fluids from the body. The global dialyzer market growth is expected to be driven by the increasing prevalence of such conditions that require dialysis to get rid of excess fluid from the body.Independent Dialyzer Innovations in the Market

In July 2023, Baxter decided to release its kidney care division as an independent portfolio of dialysis, machines, acute renal therapies, and services. Baxter announced that Vantive is expected to debut by July 2024. This announcement is expected to make Vantive a successful new source for hospitals, clinics, and homes with hemodialysis machines, organ support hardware for intensive care units, and self-performed peritoneal dialysis systems. Coming out of Baxter, the authenticity of devices and quality is expected to be high-class class which is expected to attract investors and collaborators to work with Vantive. The step forward toward independence could enable Vantive to focus more on the development of kidney dialysis devices and self-performed peritoneal dialysis systems.Significant Fund-Raising Activities

In September 2023, AWAK Technologies (AWAK), a pioneering medical technology company focused on dialysis using regeneration technology for end-stage renal disease, announced it has successfully raised more than USD 20 million in Series B funding. This milestone represented the most substantial MedTech fundraising event in Singapore for 2023, but also one of the largest in Southeast Asia.AWAK PDs are wearable and ultraportable peritoneal dialysis (PD) system offering patients the convenience of undergoing dialysis on the go, overcoming the challenge of long hours of stationary therapy, and connection to large-size dialysis machines in hospitals and clinics. Static dialysis sessions are a major inconvenience which is faced by patients globally.

This patented technology by AWAK has an innovative approach that reconstitutes used dialysis fluid into fresh fluid, which reduces fluid usage by 90%. Their tech also allows for smaller, portable dialysis machines, making treatment more convenient and improving patients' quality of life. Such innovations reduce the burden of therapy and enhance the patient's quality of life by providing convenience and time, making a preferred choice among people, contributing to increasing demand for convenient dialysis procedures, and bolstering the global dialysis market demand during the forecast period.

Collaborative Research Activities

In April 2023, Dimitrios Stamatialis (Advanced Organ Bioengineering and Therapeutics, AOT (Faculty of S&T)) announced that they will lead a research project towards developing a new generation of dialysis membranes, in collaboration with BASF (Ludwigshafen, Germany). This collaborative research project is anticipated to aid millions of patients who could benefit from technological improvements in the membranes. Such projects align greatly with the TechMed strategic impulse programme KETs4PM on ‘Personalised Renal Health' focused on transforming healthcare and well-being with technological advancements, driving the market growth further.Global Dialyzer Market Segmentations

Dialyzer Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Flux Type

- High-Flux

- Low-Flux

Market Breakup by Usage Type

- Disposable Dialyzer

- Reusable Dialyzer

Market Breakup by End User

- Dialysis Centres and Hospitals

- Home Dialysis

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Dialyzer Market Regional Analysis

North America is expected to dominate the global market for dialyzer in the forecast period of 2025-2034. The increasing prevalence of diseases, such as hypertension, end-stage renal disease (ESRD), diabetes, and other chronic diseases in the region is expected to drive the dialyzer market growth. The rise in the number of patients suffering from end-stage renal disease (ESRD) increases the need for haemodialysis, propelling the market's growth. The improved diagnosis, growing per capita health care spending, and high disposable income of the population are further expected to propel the market growth of dialyzers in North America. The regional growth is further driven by the companies asking for expanded application of their dialysis systems.For instance, In September 2023, Quanta Dialysis Technologies® announced submitting a 510(k) premarket notification to the U.S. Food and Drug Administration (FDA) for indication expansion of the Quanta™ Dialysis System, a compact and easy-to-use hemodialysis device. Quanta Dialysis Technologies® is a medical technology company that is determined to make kidney care more accessible. The Quanta Dialysis System is currently indicated for use in chronic and acute care settings. The new submission has been made to expand use to include self-care and in-home hemodialysis. If approved Quanta Dialysis System which is expected in 2024, will be the third device in the United States indicated for home hemodialysis in patients with end-stage kidney disease (ESKD). Such developments are expected to spark competition among market players, further boosting the global dialyzer market demand.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period owing to the higher adoption of haemodialysis to treat kidney-related diseases in the geriatric population. Along with this, the infrastructure development in the healthcare sector is serving a favourable environment for the installation of dialyzers and has ample space for performing the procedure. This is anticipated to propel the market growth of dialyzer in the Asia Pacific region during the forecast period. The increasing health care expenditure, presence of developing economies, and constantly growing population further contribute to the rising dialyzer market share.

In May 2023, the Australian government donated 5 dialysis machines to support patients with kidney disease in provincial hospitals in Bokeo, Xayabouly, Bolikhamxay, and Xekong provinces located in Asia. The Australian government handed over the machines to the Minister of Health HE Dr. Bounfeng Phoummalaysith by the Australian Embassy's First Secretary Vanessa Hegarty and WHO Representative Dr Ying-Ru Lo at the Ministry of Health in Vientiane. The generous donation by the Australian government is expected to ensure better assistance to patients suffering from kidney diseases and strengthen the healthcare system. The Australian government donated almost USD 2 million to the WHO (World Health Organization) in Laos to help with COVID-19 prevention, treatment, vaccination, and other health issues across the country.

Global Dialyzer Market: Competitor Landscape

In April 2023, Medtronic plc (NYSE: MDT) and DaVita Inc. (NYSE: DVA) announced the launch of Mozarc Medical, an independent new company committed to reshaping kidney health and driving patient-centered technology solutions.The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:

- B. Braun SE

- Fresenius Medical Care Asia Pacific Limited

- Baxter International

- Nipro

- Nikkiso Co. Ltd.

- Asahi Kasei Corporation

- JMS Co. Ltd.

- Toray Industries, Inc.

- Medtronic Plc

- SB-Kawasumi Laboratories, Inc.

- Jihua Medical Apparatus & Instruments Co., Ltd.

- Allmed Medical Care Holdings Limited

- Weigao Group

- Wesley Biotech

- Medica Group

- Medivators, Inc.

- Bain Medical Equipment

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- B. Braun SE

- Fresenius Medical Care Asia Pacific Limited

- Baxter International

- Nipro

- Nikkiso Co. Ltd.

- Asahi Kasei Corporation

- JMS Co. Ltd.

- Toray Industries, Inc.

- Medtronic Plc

- SB-Kawasumi Laboratories, Inc.

- Jihua Medical Apparatus & Instruments Co., Ltd.

- Allmed Medical Care Holdings Limited

- Weigao Group

- Wesley Biotech

- Medica Group

- Medivators, Inc.

- Bain Medical Equipment

Table Information

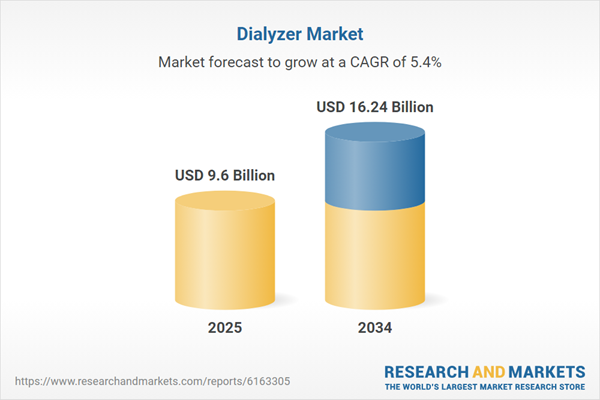

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 16.24 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |