Dental Prosthetic Introduction

Dental prosthetics are artificial devices that replace missing teeth or surrounding tissues. These devices can be removable or permanently attached to existing teeth or implants. They are typically made of materials such as ceramics, metals, or polymers, and can be customized to match the color and shape of the patient's natural teeth.The demand for dental prosthetics is growing due to the increasing prevalence of tooth loss caused by various factors such as aging, dental caries, and periodontal disease. Additionally, the rising geriatric population and the increasing number of people with dental disorders are driving the growth of the dental prosthetics market.

In recent years, there has been a shift towards the use of CAD/CAM technology in the production of dental prosthetics, which has resulted in more precise and efficient manufacturing processes. The use of digital scanning and printing technologies has also increased, allowing for faster and more accurate production of dental prosthetics.

Another trend in the dental prosthetics market is the increasing adoption of implant-supported prosthetics, which offer a more natural and stable solution for patients with missing teeth. The use of zirconia as a material for dental prosthetics is also gaining popularity due to its strength and aesthetic properties

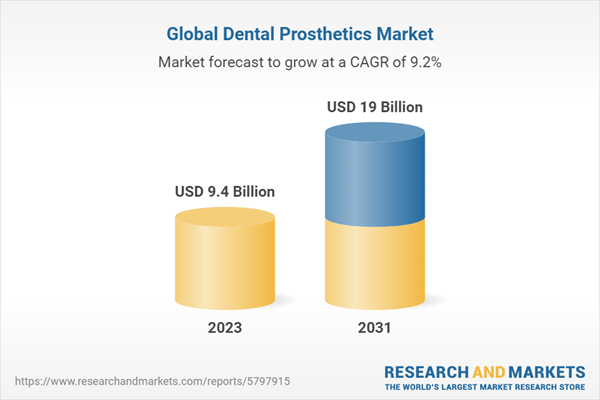

Overall, the dental prosthetics market is expected to continue to grow in the coming years, driven by advancements in technology and the increasing demand for dental care worldwide.

Dental Prosthetic Market Scenario

Dental prosthetics are artificial teeth that are used to replace natural teeth that have been lost or removed. These prosthetics are designed to restore both function and appearance to the patient's mouth. There are many different types of dental prosthetics available, including dentures, bridges, and dental implants. Dental prosthetics are typically custom-made to fit the patient's mouth and can be made from a variety of materials such as porcelain, acrylic, and metal.The market for dental prosthetics is expected to grow steadily in the coming years due to an aging population and increasing demand for cosmetic dentistry. Additionally, technological advancements in materials and manufacturing processes are expected to improve the quality and durability of dental prosthetics. However, cost and reimbursement issues may pose a challenge to market growth.

Dental Prosthetic Market Segmentations

Market Breakup by Type

- Crown

- Bridges

- Abutments

- Dentures

- Others

Market Breakup by Material

- Polymer

- Metal

- Ceramic

- Titanium

- Zirconium

- Others

Market Breakup by End User

- Dental Hospitals and Clinics

- Dental Laboratories

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Trends in the Dental Prosthetic Market

Some key trends in the dental prosthetics market include:

- Increasing demand for cosmetic dentistry: With the growing popularity of dental aesthetics, the demand for dental prosthetics such as veneers, crowns, and bridges is on the rise

- Technological advancements: Advancements in digital dentistry and 3D printing technologies have revolutionized the production of dental prosthetics, making them more precise, efficient, and affordable

- Growing geriatric population: With an aging population, the demand for dental prosthetics such as dentures is increasing. This trend is expected to continue as the global population continues to age

- Rising incidence of dental diseases: The prevalence of dental caries and periodontal diseases is increasing worldwide, leading to a higher demand for dental prosthetics such as fillings, crowns, and implants

- Increasing dental tourism: Dental tourism is a growing trend, with patients travelling to other countries to receive dental treatments at lower costs. This is driving the demand for dental prosthetics in certain regions

Dental Prosthetic Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- 3m Co

- BioHorizons, Inc

- Avinent Implant System, S.L.U

- Danaher Corporation

- Institut Straumann AG

- Ivoclar Vivadent AG

- Alpha-Bio Tec

- KYOCERA Corporation

- T-Plus Implant Tech. Co., Ltd

- TOV Implant LTD

- Zimmer Biomet

- BEGO GmbH & Co. KG

- ProScan

- Neoss Limited

Table of Contents

Companies Mentioned

- 3M Co.

- Biohorizons, Inc.

- Avinent Implant System, S.L.U.

- Danaher Corporation

- Institut Straumann AG

- Ivoclar Vivadent AG

- Alpha-Bio Tec

- Kyocera Corporation

- T-Plus Implant Tech. Co. Ltd

- Tov Implant Ltd

- Zimmer Biomet

- Bego GmbH & Co. Kg

- Proscan

- Neoss Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 9.4 Billion |

| Forecasted Market Value ( USD | $ 19 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |