Dental Equipment Introduction

Dental equipment encompasses a wide range of devices, tools, and instruments used by dental professionals to diagnose, treat, and manage various dental and oral health conditions. These include diagnostic equipment, such as dental radiography systems and intraoral cameras, treatment equipment, such as dental chairs and handpieces, and laboratory equipment, such as dental CAD/CAM systems and 3D printers. The dental equipment market plays a crucial role in improving dental care by providing dental practitioners with the necessary tools to deliver safe, effective, and efficient dental treatments.Dental Equipment Market Scenario

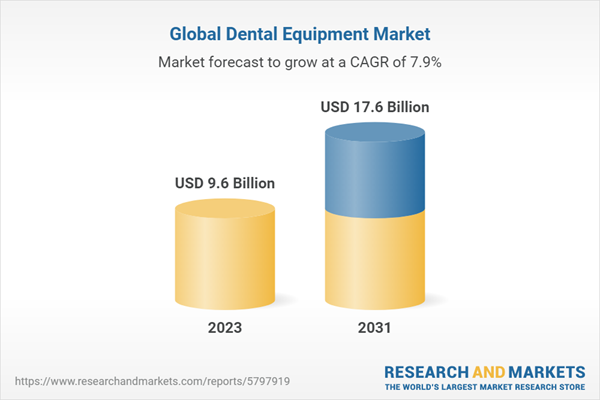

The global dental equipment market has experienced significant growth in recent years, driven by factors such as the rising prevalence of dental disorders, the growing geriatric population, advancements in dental technologies, and the increasing awareness of oral health and hygiene. The growing focus on cosmetic dentistry, the adoption of digital dentistry workflows, and the demand for minimally invasive procedures have further contributed to the expansion of the dental equipment market.The adoption of dental equipment has been increasing steadily due to factors such as the rising prevalence of dental disorders, the growing geriatric population, advancements in dental technologies, and the increasing awareness of oral health and hygiene. The growing focus on cosmetic dentistry, the adoption of digital dentistry workflows, and the demand for minimally invasive procedures have further contributed to the expansion of the dental equipment market.

North America: The largest market for dental equipment, driven by factors such as advanced healthcare infrastructure, a growing focus on cosmetic dentistry, and the presence of leading dental equipment manufacturers.

Europe: The second-largest market, with increasing demand for dental equipment solutions and a growing emphasis on improving dental care outcomes and reducing healthcare costs.

Asia-Pacific: Expected to witness the highest growth rate due to factors such as a rapidly aging population, increasing prevalence of dental disorders, and growing investments in healthcare and research infrastructure.

Dental Equipment Market Segmentations

Market Breakup by Product Type

Dental Radiology Equipment

- Intraoral Radiology Equipment

- Extraoral Radiology Equipment

Dental Lasers

- Diode Lasers

- Carbon Dioxide Lasers

- Yttrium Aluminium Garnet Lasers

System and Parts

- Instrument Delivery Part

- Vacuums and Compressors

- Cone Beam CT Systems

- Cast Machines

- Furnace and Ovens

- Electrosurgical Equipment

- CAD/CAM

- Other System and Parts

Dental Laboratory Machines

- Ceramic Furnaces

- Hydraulic Press

- Electronic Waxer

- Suction Unit

- Micro Motor

Hygiene Maintenance Devices

- Sterilisers

- Air Purification and Filters

- Hypodermic Needle Incinerator

- Others

Market Breakup by End User

1. Market Overview2. Hospitals and Clinics

3. Academic and Research Institute

4. Other Enduser

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Trends in the Dental Equipment Market

Some key trends of the market are as follows:- Digital dentistry: The integration of digital technologies, such as dental CAD/CAM systems, intraoral scanners, and digital radiography, has revolutionized dental workflows and improved the accuracy and efficiency of dental treatments

- Adoption of minimally invasive procedures: The growing demand for minimally invasive dental procedures has driven the development and adoption of advanced dental equipment, such as dental lasers and piezosurgery devices

- Focus on patient comfort and ergonomics: Dental equipment manufacturers are increasingly focusing on enhancing patient comfort and ergonomics in their products, such as dental chairs and handpieces, to improve the overall dental experience for patients

Dental Equipment Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Danaher Corporation

- Institute Straumann AG

- Dentsply Sirona

- BIOLASE, Inc

- A-DEC Inc

- 3M COMPANY

- Teva Pharmaceutical Industries Ltd

- PATTERSON COMPANIES INC

- PLANMECA OY

- CARESTREAM HEALTH INC

- GC CORPORATION

- Osstem Implant Co. Ltd

- envista

- Henry Schein Inc

- Zimmer Biomet dental

- Algin Technology

Table of Contents

Companies Mentioned

- Danaher Corporation

- Institute Straumann Ag.

- Dentsply Sirona

- Biolase, Inc.

- A-Dec Inc.

- 3M Company

- Teva Pharmaceutical Industries Ltd

- Patterson Companies Inc

- Planmeca Oy

- Carestream Health Inc

- Gc Corporation

- Osstem Implant Co. Ltd

- Envista

- Henry Schein Inc.

- Zimmer Biomet Dental

- Algin Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 17.6 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |