Dental Crown and Bridges Market: Introduction

Dental crowns and bridges are dental prosthetic devices that are designed to restore the function and aesthetics of damaged or missing teeth. Dental crowns are caps that are placed over a damaged tooth to improve its strength and appearance, while bridges are prosthetic devices that are used to replace one or more missing teeth.The dental crown and bridges market is driven by factors such as the growing prevalence of dental disorders, increasing demand for cosmetic dentistry, and the rising geriatric population. The market is also expected to benefit from technological advancements, such as the development of computer-aided design/computer-aided manufacturing (CAD/CAM) technology, which allows for the production of highly precise and customized dental prosthetics.

However, the market may face challenges such as the high cost of dental procedures, a shortage of skilled dental professionals, and the availability of alternative treatments. Nonetheless, the market is expected to continue to grow due to increasing demand for dental services and the development of new and innovative dental technologies.

Key Trends in the Dental Crown and Bridges Market

Some key trends in the dental crown and bridges market are:- Growing demand for cosmetic dentistry: The increasing desire for aesthetic dentistry is driving the demand for dental crown and bridges. Patients are more inclined towards dental restorative procedures that give a natural appearance

- Technological advancements: The development of new materials and technology for manufacturing dental crowns and bridges has led to improved durability and aesthetics of these products

- Rising geriatric population: The growing aging population is increasing the demand for dental crown and bridges as they are more prone to dental problems, such as tooth decay, chipping, and breakage

- Increasing awareness and accessibility: The rising awareness about oral hygiene and the availability of dental care services are driving the growth of the dental crown and bridges market

- Adoption of CAD/CAM technology: The use of computer-aided design/computer-aided manufacturing (CAD/CAM) technology has revolutionized the manufacturing process of dental crown and bridges, making them more precise, efficient, and convenient

Market Breakup by Product

- Dental Crowns

- Dental Bridges

Market Breakup by Material

- Ceramic Dental Crowns and Bridges

- Metal Dental Crowns and Bridges

Market Breakup by End User

- Hospitals

- Dental Clinics

- Dental Laboratories

- Others

Market by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Dental Crown and Bridges Market Scenario

Dental crowns and bridges are restorative dental devices used to restore damaged or missing teeth. Crowns are dental caps that cover damaged teeth to improve their strength, shape, size, and appearance, while bridges are prosthetic devices that replace missing teeth by attaching to adjacent teeth. These devices are custom made to fit each patient's unique dental structure and are typically made from materials such as porcelain, ceramic, or metal alloys.The growth of dental crown and bridges market is driven by factors such as the growing prevalence of dental diseases, an ageing population, and the increasing demand for cosmetic dentistry. The increasing awareness about dental health and the availability of advanced dental technologies are also contributing to the growth of the market.

However, the high cost of these devices and the lack of reimbursement policies in developing countries can hinder market growth. The dental industry is constantly evolving, and the market is expected to witness further growth with the introduction of advanced materials, technologies, and procedures in the future.

Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the dental crown and bridges market are as follows:- Ivoclar Vivadent AG

- Straumann Group AG

- Zimmer Biomet Holdings Inc

- Dentsply Sirona Inc

- 3M Company

- Nobel Biocare Services AG

- Avinent Group

- Danaher Dental

- CAMLOG Biotechnologies GmbH

- Osstem Implants

Table of Contents

Companies Mentioned

- Ivoclar Vivadent AG

- Straumann Group AG

- Zimmer Biomet Holdings Inc.

- Dentsply Sirona Inc.

- 3M Company

- Nobel Biocare Services AG

- Avinent Group

- Danaher Dental

- Camlog Biotechnologies GmbH

- Osstem Implants

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

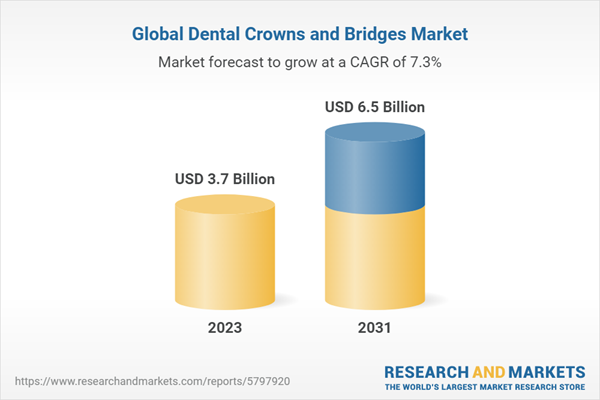

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 6.5 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |