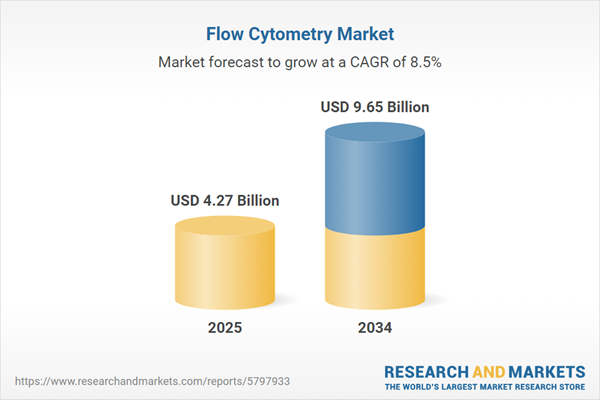

The flow cytometry market is experiencing rapid expansion, driven by technological advancements and its growing application in clinical diagnostics, biopharmaceutical R&D, and precision medicine. The increasing adoption of AI and machine learning enhances data analysis, improving efficiency and accuracy in cell characterization. Innovations in instrumentation and reagents are fuelling flow cytometry growth, making it indispensable for immunophenotyping, cancer diagnostics, and drug discovery. The demand for high-throughput solutions and automation is reshaping the landscape, accelerating research in immunology, microbiology, and stem cell therapy. Furthermore, advancements in multi-parameter analysis and single-cell technologies are expanding its potential. As the industry continues to evolve, flow cytometry is expected to remain a crucial tool in both research and clinical applications.

Global Flow Cytometry Market Dynamics

Driver: Advancements in Flow Cytometry Technology Drive Market Expansion

Continuous technological advancements in flow cytometry are revolutionising its applications across research, clinical diagnostics, and drug development. New-generation instruments offer improved sensitivity, automation, and high-throughput capabilities, enhancing cellular analysis accuracy. Innovations such as spectral flow cytometry, microfluidic platforms, and AI-driven data processing streamline workflows, reducing errors and boosting efficiency. For instance, in January 2024, Thermo Fisher Scientific Inc. collaborated with C-CAMP to launch a Centre of Excellence in Bengaluru, reinforcing India's position in scientific innovation and medical research. With ongoing research and product development, companies are improving user-friendly software, reagent formulations, and cost-efficient instruments to enhance market accessibility.Restraint: High Equipment Costs

Despite its growing significance in clinical diagnostics and research, the high cost of flow cytometry instruments remains a major barrier to widespread adoption. Advanced cell analysers and sorters require significant investment, making them less accessible to smaller research labs, hospitals, and emerging markets. Additionally, the operational costs, including maintenance, reagents, and software upgrades, further add to the financial burden. While manufacturers are introducing cost-effective models and rental options to address this issue, affordability continues to be a key challenge, particularly in developing regions. Limited funding for academic institutions and small-scale biopharmaceutical companies further restricts the uptake of high-end flow cytometry systems.Opportunity: Expanding Clinical Applications and Infectious Disease Diagnostics

The increasing demand for flow cytometry in clinical diagnostics, including haematological disorders, cancer, and immunological diseases, presents a lucrative market opportunity. Its ability to provide rapid, high-precision cellular analysis makes it a preferred tool for precision medicine and personalised therapies. Additionally, the global rise in infectious diseases, such as COVID-19, tuberculosis, and HIV, has accelerated the use of flow cytometry in disease detection and monitoring. The technology's ability to analyse immune responses at a cellular level enhances early diagnosis and treatment planning. With regulatory approvals expanding for flow cytometry-based assays, the clinical segment is expected to witness sustained growth, driven by the need for advanced diagnostic tools.Challenge: Reagent Development and Standardisation

One of the primary challenges in the flow cytometry market is the complexity of reagent development and standardisation. Reagents, including antibodies, fluorescent dyes, and buffers, must be highly specific and optimised for various applications, requiring extensive validation processes. Variability in reagent performance across different platforms can lead to inconsistent results, affecting data reproducibility in research and clinical settings. Furthermore, the emergence of spectral flow cytometry and multiplex assays demands the development of novel reagents compatible with evolving technologies. Regulatory constraints and quality control standards further complicate reagent production, posing challenges for manufacturers in maintaining consistency and reliability. Addressing these issues through enhanced manufacturing protocols and collaboration between industry players will be crucial for the market’s long-term growth.Global Flow Cytometry Market Ecosystem Analysis

Comprehensive Structure of the Flow Cytometry Market

The flow cytometry market ecosystem comprises multiple interconnected segments, including instrument manufacturers, reagent suppliers, software developers, service providers, and end users such as research institutes, clinical laboratories, and biopharmaceutical companies. These stakeholders collaborate to enhance technological advancements, streamline workflows, and improve data accuracy. Market growth is driven by innovations in cell analysis technologies, increasing demand for clinical diagnostics, and automation in laboratory workflows. Additionally, integration with artificial intelligence (AI) and cloud-based data management systems is further shaping the ecosystem by offering real-time analysis, remote accessibility, and improved efficiency.Dominance of the Reagents and Consumables Segment

The reagents and consumables segment holds the largest share in the flow cytometry market due to the continuous demand for essential components such as antibodies, dyes, buffers, and bead-based assays. The frequent use of these consumables in both research and clinical settings ensures a recurring revenue stream for manufacturers. Advances in reagent formulations, including multiplexing capabilities and spectral analysis compatibility, further drive adoption. Additionally, the rise in high-throughput screening applications and the expansion of precision medicine initiatives contribute to the growing demand for high-quality reagents and consumables across laboratories worldwide.Rapid Growth of Academic and Research Institutes Segment

The academic and research institutes segment is expected to grow significantly at a notable CAGR throughout the forecast period. Increasing government funding, academic collaborations, and industry partnerships are supporting research in areas such as immunology, oncology, and regenerative medicine. The expanding use of flow cytometry in fundamental research, drug discovery, and biomarker identification further propels market expansion. Additionally, the rising number of PhD and postdoctoral research projects focusing on cell-based analysis methods continues to drive instrument and reagent demand, fostering a dynamic academic research landscape.North America to Lead the Flow Cytometry Market with Strong Adoption and Innovation

North America dominates the flow cytometry market, driven by advanced healthcare infrastructure, substantial biopharmaceutical R&D, and expanding clinical diagnostics applications. The region benefits from key industry players, strong government funding, and the widespread adoption of precision medicine. The rising prevalence of cancer, infectious diseases, and autoimmune disorders further boosts demand. Additionally, ongoing technological advancements and regulatory approvals enhance market growth. For instance, In January 2024, Cytek Biosciences, Inc. partnered with CRG and UPF to foster innovation and accelerate scientific progress in flow cytometry, reinforcing North America’s leadership in the global market.Recent Developments of Flow Cytometry Market

- In May 2024, Agilent launched the NovoCyte Opteon Spectral Flow Cytometer, enhancing flow cytometry accessibility with advanced spectral analysis and support for up to 73 detectors. It enables high-marker detection, benefiting drug discovery, therapy development, and biomedical research.

- In March 2024, Beckman Coulter introduced the CytoFLEX nano Flow Cytometer, improving nanoparticle detection with enhanced sensitivity and multiparameter analysis. It enables higher-resolution characterization of extracellular vesicles (EVs), offering laboratories an advanced tool for detailed cell population studies.

- In June 2023, BD unveiled an automated sample preparation instrument for clinical diagnostics using flow cytometry, providing a walkaway workflow solution. It enhances standardization and reproducibility, improving cellular diagnostics and laboratory efficiency in medical research and healthcare applications.

Key Market Players

The key features of the market report include patent analyses, funding and investment analysis, strategic initiatives by the leading key players. The major companies in the market are as follows:Becton, Dickinson and Company (BD)

Becton, Dickinson and Company (BD) is a global leader in the flow cytometry market, offering advanced cell analyzers, sorters, and reagents. BD’s innovations support applications in clinical diagnostics, biopharmaceutical research, and precision medicine. The company’s strong portfolio, technological advancements, and strategic collaborations drive market growth, enhancing data analysis and AI-driven automation in flow cytometry.Sony Corporation

Sony Corporation, through its subsidiary Sony Biotechnology, develops high-performance flow cytometry instruments for cell analysis and sorting. The company integrates cutting-edge technology with AI-driven data processing, enabling precise clinical diagnostics and biopharmaceutical research. Sony’s expertise in imaging and sensor technology enhances flow cytometry efficiency, making it a key player in the evolving market.Enzo Biochem, Inc

Enzo Biochem, Inc. specializes in diagnostic solutions and life sciences research, offering a broad range of reagents, consumables, and labeling technologies for flow cytometry applications. The company focuses on clinical diagnostics and precision medicine, providing innovative products that enhance data analysis and technological advancements in cell-based research, immunophenotyping, and infectious disease detection.bioMérieux

bioMérieux is a leading player in infectious disease diagnostics and clinical applications, leveraging flow cytometry to develop high-quality reagents and solutions. The company’s expertise in biopharmaceutical R&D and precision medicine strengthens its position in automated flow cytometry systems. bioMérieux’s focus on AI-driven data analysis and rapid diagnostics drives innovation in the global flow cytometry market.Other companies in the market include:

- Cytonome/ST, LLC

- Sartorius AG

- Cytek Biosciences

- Danaher Corporation

- Becton, Dickinson, and Company

- Beckman Coulter, Inc

- SYSMEX CORPORATION

- Agilent Technologies, Inc

- Apogee Flow Systems Ltd

- Bio-Rad Laboratories, Inc

- Thermo Fisher Scientific, Inc

- Stratedigm, Inc

- DiaSorin S.p.A.

- Miltenyi Biotec

- Sony Biotechnology, Inc

- Merck KGaA

- Nanocellect Biomedical, Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Becton, Dickinson and Company (BD)

- Sony Corporation

- Enzo Biochem, Inc.

- bioMérieux

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.27 Billion |

| Forecasted Market Value ( USD | $ 9.65 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |