Dental 3D Printing Market Overview

Dental 3D printing is the process of developing three-dimensional objects based on computer-aided design models for various applications like dental implants, crowns, and bridges, among others. Such technologies offer increased efficiency, better patient experience, high quality, and lower costs to dental practices. The utilization of 3D printing in dental clinics reduces product turnaround time, eliminates the wastage of materials, facilitates the designing and printing of more complex models, and offers more accurate results. Moreover, advancements in software applications and computer technologies, such as CAD, are benefitting the dental 3D printing market.The rapid expansion of dental clinics and the emergence of new dental practices worldwide are aiding the market growth. Innovations in 3D printing technologies are expected to further strengthen the market for dental 3D printing over the forecast period. The rising demand for cosmetic dentistry due to the increasing focus on physical appearance and improved living standards is elevating the market value. Moreover, the increasing prevalence of oral diseases worldwide, such as tooth decay, tooth loss, and gum diseases, due to unhealthy lifestyles, is boosting the adoption of dental procedures, hence contributing to the market growth of dental 3D printing.

Dental 3D Printing Market Growth Drivers

Rise in Regulatory Approvals for Dental 3D Printing Materials to Affect the Market Landscape _x000D__x000D_In August 2024, Formlabs, a 3D printing technology company announced the FDA 510(k) Medical Device Clearance approval of its Premium Teeth Resin. The nano-ceramic-filled biocompatible material is used for a wide range of dental applications such as for 3D printing of temporary crowns, onlays, inlays, bridges, and veneers. Premium Teeth Resin, already cleared in the EU, United Kingdom, Canada, and Switzerland, is designed to mimic the opalescence and translucency of real teeth. The resin is available for Form 3BL, Form 3B+, and Form 4B 3D printers, and is considered to be an efficient and affordable option for dental practices. Thus, the rise in regulatory approval of such advanced 3D printing materials is expected to fuel market growth.

Dental 3D Printing Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:

Increased Investment in 3D Printing Technology Poised to Impact Market Growth

In April 2023, Germany-based Quantica, an advanced additive manufacturing technology startup, secured funding amounting to EUR 14 million to boost the growth of its 3D printing technology. Its advanced multi-material 3D printing technology, NovoJet™, can print complex and high-quality products without the need for extensive post-processing. The financial support will aid in manufacturing the first product as well as fuel the marketing efforts. Such substantial investment in the 3D printing sector is anticipated to bolster the market growth.Growing Demand for Dental Implants and Prosthetics Set to Influence Dental 3D Printing Market Size

There is a growing demand for dental implants and prosthetics propelled by the increasing aging population and the rising prevalence of dental disorders. 3D printing technology helps in the efficient and accurate production of dental implants, crowns, bridges, and dentures. Thus, as the need for advanced dental restoration solutions continues to grow among patients, the market for dental 3D printing is anticipated to witness a surge in demand.Integration of Artificial Intelligence to Elevate the Dental 3D Printing Market Value

One of the major market trends is the rising integration of artificial intelligence (AI) and machine learning (ML) into dental 3D printing processes. This integration improves the speed of workflow and also reduces errors. Further, AI-powered software can optimize design parameters and predict the best treatment outcomes. Thus, such advancements are projected to elevate the market value in the forecast period.Expansion of Dental Service Providers Likely to Bolster Dental 3D Printing Market Demand

The market is experiencing a rising expansion of dental service providers, including dental laboratories and large dental chains. Such dental care centers often use 3D printing technology to improve service delivery and attract more customers. Moreover, large dental chains are increasingly investing in advanced 3D printers to fuel their production capacity and ensure high-quality offerings. Thus, the rising adoption of 3D printing technology in the dental industry is set to increase the market demand.Dental 3D Printing Market Segmentation

The report titled “Dental 3D Printing Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Materials

- Plastic

- Metal

- Others

- Equipment

- Dental 3D Scanner

- Dental 3D Printers

Market Breakup by Application

- Dental Implants

- Dentures

- Crown and Bridges

- Others

Market Breakup by Technology

- Vat Photopolymerization

- Poly Jet Technology

- Fused Deposition Modelling

- Selective Laser Sintering

- Others

Market Breakup by End User

- Dental Hospitals

- Dental Clinics and Laboratories

- Academic and Research Institutes

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Dental 3D Printing Market Share

The Vat Photopolymerization Segment Based on Technology Represents a Significant Market Share

Based on technology, the increasing adoption of vat photopolymerization is driving the market growth of dental 3D printing. Vat polymerization, a 3D printing process, uses a light source to solidify liquid photocurable resins and develop a solid part. The technology is used in many applications in the dental sector, such as dental models, surgical guides, crowns, and bridges, among others. In addition, it provides multiple advantages, like high accuracy, availability of a wide range of resin materials, and offers fine pieces with a smooth surface finish.The growing popularity of vat polymerization technologies, such as stereolithography (SLA) and digital light processing (DLP) 3D technologies, is stimulating the development of dental 3D printing market. As digital light processing technology uses a conventional source of light rather than UV light, offers high-speed printing, and uses fewer resins, its preference is increasing to facilitate low-cost and efficient resource utilization. The rising advancements in vat photopolymerization technologies and the development of automated systems are likely to further aid the market over the forecast period.

Dental 3D Printing Market Analysis by Region

North America constitutes a significant share of the market owing to the high prevalence of dental disorders such as tooth decay and periodontal diseases. Further, in regions like the United States and Canada, the growing demand for aesthetic dental solutions like veneers and aligners drives the adoption of 3D printing technology in cosmetic dentistry. Moreover, the presence of robust healthcare infrastructure in the region ensures access to advanced dental care technologies, including 3D printing, thereby supporting market growth.Leading Players in the Dental 3D Printing Market

The key features of the market report comprise patent analysis, funding and investment analysis, and strategic initiatives by the leading key players including mergers, collaborations and new product launches. The major companies in the market are as follows:3D Systems, Inc.

Headquartered in Rock Hill, South Carolina, 3D Systems, Inc. boasts a robust portfolio of comprehensive 3D printing solutions. The company engineers, manufactures, and markets 3D printing materials, 3D printers, and software, among other products and services.

Stratasys Ltd.

American-Israeli manufacturing company Stratasys Ltd. is a global leader in 3D printing and additive manufacturing solutions. Stratasys' range of dental 3D printers and materials helps in the production of dental models, clear aligners, and others.

Roland DGA Corporation

California-based Roland DGA Corporation is a prominent player in the market known for its innovative 3D printing technologies for dental applications. The company employs advanced software solutions to improve workflow efficiency in the design and production process.Dentsply Sirona

Dentsply Sirona, a leading dental equipment and supplies manufacturing company, is headquartered in North Carolina, United States, and has a market presence in more than 120 countries. Dentsply Sirona holds a strong portfolio of dental 3D printing solutions, including printers, materials, and software, for various dental applications.Other key players in the market include Institut Straumann AG, Formlabs Inc., Prodways Tech, and Planmeca.

Key Questions Answered in the Dental 3D Printing Market Report

- What was the global dental 3D printing market value in 2024?

- What is the global dental 3D printing market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on type?

- What is the market breakup based on application?

- What is the market breakup by technology?

- Who are the major end users in the market?

- What are the major factors aiding the global dental 3D printing market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- How do the technological innovations in 3D printing affect the market landscape?

- What are the major global dental 3D printing market trends?

- How does the expansion of dental clinics impact the market size?

- Which type of dental 3D printing will dominate the market share?

- Which application is expected to have a high market value in the coming years?

- Which technology will experience the highest demand in the market segment?

- Which end user is projected to contribute to the highest market growth?

- Who are the key players involved in the dental 3D printing market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

More Insights On:

Dental Implant Abutment Systems Market Dental Crowns and Bridges Market Dental Hygiene Devices Market Dental Compressors Market Dental Laboratories Market Dental Prosthetics Market Dental Equipment Market Dental Insurance Market Dental Implants Market Dental Lasers MarketThis product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- 3D Systems, Inc.

- Stratasys Ltd.

- Roland DGA Corporation

- Dentsply Sirona

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

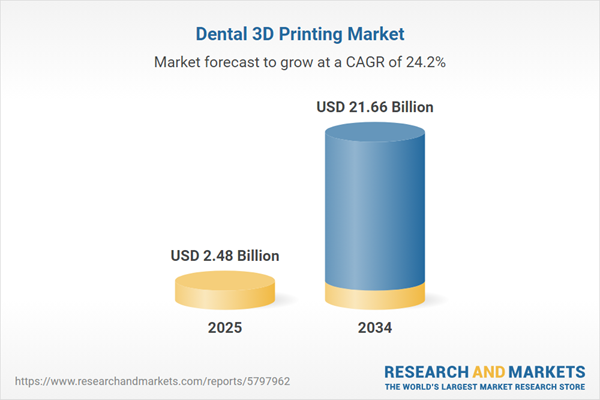

| Estimated Market Value ( USD | $ 2.48 Billion |

| Forecasted Market Value ( USD | $ 21.66 Billion |

| Compound Annual Growth Rate | 24.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |