Global Capsule Endoscopy Market Overview

Capsule endoscopy is a diagnostic test that allows gastroenterologists to see into the gastrointestinal tract (GI) of a patient. The procedure involves swallowing a capsule fitted with a tiny camera, a transmitter, and a light. The capsule takes multiple pictures which are recorded and later visualized to detect any digestive tract-related issue. The market demand is significantly impacted by the rising prevalence of gastrointestinal diseases. It acts as a reliable screening method in numerous critical diseases such as colorectal cancer.Colorectal cancer is the third most common type of cancer, accounting for 10% of all cancer cases. It is estimated that around 3.2 million new colorectal cancer cases will arise by 2040. Early detection of the cancer through capsule endoscopy can help in the successful treatment of the disease. With the rise in various gastrointestinal diseases and the heightened awareness among patients, the capsule endoscopy market share is anticipated to experience a surge in the coming years.

The rising healthcare expenditure is fuelling the demand for effective diagnostic procedures to screen chronic diseases. The market growth is also driven by the robust government support to improved healthcare services along with the growth in the approvals from health regulatory agencies such as the United States Food and Drug Administration (FDA). Furthermore, the evolving preference of patients for minimally invasive procedures, the increasing geriatric population size, and the introduction of technologically advanced endoscopy capsules in healthcare facilities are poised to boost market growth.

Surge in FDA Clearances to Meet Capsule Endoscopy Market Demand

There has been a significant surge in approvals by health regulatory bodies related to capsule endoscopy technology, which are projected to boost the market size in the forecast period. In January 2024, AnX Robotica's (a United States-based medical equipment manufacturing company) artificial intelligence (AI)-integrated reading tool received the United States Food and Drug Administration (FDA) clearance to assist in small bowel capsule endoscopy. The AI-assisted reading tool NaviCam ProScan, trained using over 150,000 images from 1,971 patients, can detect abnormal images and help in making well-informed clinical decisions for gastrointestinal bleeding cases. With a sensitivity of 99.88% in per-patient analysis, the NaviCam platform can significantly improve capsule endoscopy diagnostic workflows.Rise in AI-integrated Novel Products

The technological advancements in endoscopy procedures through increasing artificial intelligence integration is one of the significant capsule endoscopy market trends. In July 2023, Sheba Medical Center (Israel) entered a strategic partnership with Intel (a technology company headquartered in California) to develop an artificial intelligence algorithm that takes only minutes to analyze the images generated by the capsule endoscope. The application can assist physicians in selecting the best treatment options for Crohn's disease patients and has the potential to reduce the risk of medical complications. The AI algorithm coupled with the capsule endoscopy has proved to be a highly effective diagnostic tool, carrying an accuracy of 86% in data and image analysis as compared to the 68% accuracy of an experienced gastroenterologist.Global Capsule Endoscopy Market Segmentation

Capsule Endoscopy Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Small Bowel Capsule

- Colon Capsule

- Esophageal Capsule

Market Breakup by Type

- Wireless Capsule Endoscopy

- Receiver Capsule Endoscopy

- Others

Market Breakup by Component

- Camera Capsule

- Workstation

- Data Recorder

Market Breakup by Application

- Intestine Disease

- Crohn's Disease

- Gastrointestinal Bleeding

- Tumours

- Others

Market Breakup by End User

- Hospitals

- Diagnostic Laboratories

- Ambulatory Surgery Centres

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Capsule Endoscopy Market Regional Analysis

North America is a significant regional market for capsule endoscopy due to the rising cases of colon cancer in the region. The improvement in the healthcare sector supported by various initiatives and funding from the government is expected to augment the capsule endoscopy market growth. In January 2023, Keck Hospital (University Hospital in California) and the School of Medicine of USC (University of Southern California) adopted tele-GI, a telehealth platform, which addressed the limitations of conventional gastrointestinal diagnostics. This innovative solution was developed in collaboration with GI Digital (a tele-GI company), leveraging capsule endoscopy to offer minimally invasive procedures. To support telehealth solutions and bring imaging technologies online, Keck Hospital and School of Medicine of USC was awarded USD 895,102 from FCC's (Federal Communications Commission) telehealth grant program.Asia Pacific is also anticipated to hold a significant capsule endoscopy market share in the coming years. The market growth can be attributed to a huge population size and the rising disease burden which is increasing the demand for effective screening procedures. In addition, technological advancement in capsule endoscopes and the growing focus of the government to improve healthcare facilities are expected to accelerate the market size.

Global Capsule Endoscopy Market: Competitor Landscape

In March 2023, NexOptic Technology Corp., a Canada-based technology company specialised in developing artificial intelligence (AI) and imaging products signed a non-binding memorandum of understanding (MOU) with IntroMedic Co., Ltd (headquartered in South Korea), a medical device company known for its capsule endoscopy products. IntroMedic's capsule endoscope MicroCam offers superior diagnostic capabilities with its 12-hour operational time and a 170-degree view of the digestive system. The collaboration aims to leverage NexOptics artificial intelligence-based imaging solutions to enhance image quality recorded during capsule endoscopy procedures and improve patient outcomes. Such strategic collaborations among the market players are expected to fuel the capsule endoscopy market growth in the forecast period.The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:

- Boston Scientific Corporation

- The Guidant Group

- CapsoCam Plus

- ConMed Corporation

- IntroMedic Co., Ltd.

- JINSHAN Science & Technology

- Medtronic Plc

- Olympus Corporation

- RF Co., Ltd.

- Fujifilm Holdings Corporation

- Check-Cap.

- Accu-Read, INC.

- Interscope

- Shangxian Minimal Invasive Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Boston Scientific Corporation

- The Guidant Group

- CapsoCam Plus

- ConMed Corporation

- IntroMedic Co., Ltd.

- JINSHAN Science & Technology

- Medtronic Plc

- Olympus Corporation

- RF Co.,Ltd.

- Fujifilm Holdings Corporation

- Check-Cap.

- Accu-Read, INC.

- Interscope

- Shangxian Minimal Invasive Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

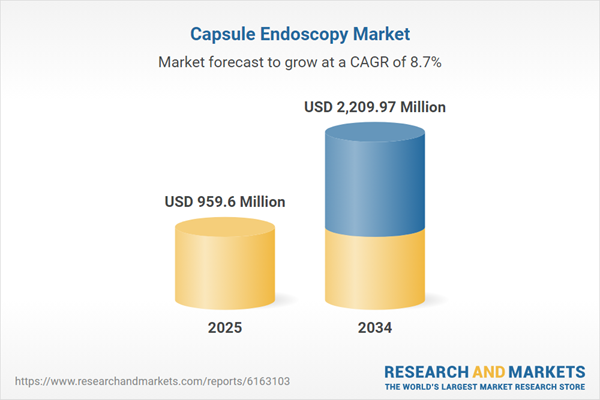

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 959.6 Million |

| Forecasted Market Value ( USD | $ 2209.97 Million |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |