Bone Cement Market: Introduction

Bone cement, also known as polymethyl methacrylate (PMMA) cement, is a medical-grade adhesive used to anchor and secure implants in orthopaedic and trauma surgeries. It is a biocompatible material that helps stabilize prosthetic devices, such as joint replacements, within the bone, providing strong and lasting support.Uses of bone cement:

- Joint replacement surgeries: Bone cement is widely used in joint replacement procedures, such as hip, knee, and shoulder replacements. It is applied to secure the prosthetic components within the bone, ensuring a strong bond between the implant and the surrounding bone

- Spinal surgeries: Bone cement can be used in various spinal surgeries, including vertebroplasty and kyphoplasty, to stabilize fractured vertebrae and restore vertebral height

- Fixation of orthopaedic implants: Bone cement is used to anchor orthopaedic implants, such as plates, screws, and other fixation devices, in bone fracture repair surgeries

- Dental applications: In dentistry, bone cement is sometimes used to secure dental implants, such as crowns, bridges, or dentures, providing a stable foundation for the prosthetic device

1. Strong and durable bond: Bone cement provides a strong and durable bond between the implant and the bone, ensuring long-term stability and support for the prosthetic device.

2. Reduced risk of implant loosening: The use of bone cement helps reduce the risk of implant loosening, which is a common cause of implant failure and the need for revision surgeries.

3. Immediate weight-bearing: In joint replacement surgeries, bone cement provides immediate fixation of the implant, allowing patients to bear weight on the affected joint soon after surgery, facilitating early mobilization and rehabilitation.

4. Pain relief and improved function: By stabilizing fractured vertebrae in spinal surgeries or securing joint replacements, bone cement helps alleviate pain and restore function in patients, improving their quality of life.

5. Versatility: Bone cement is compatible with various types of implants and can be used in numerous orthopaedic, trauma, and dental surgeries, making it a versatile and widely applicable adhesive solution.

In summary, bone cement is a biocompatible adhesive used in orthopaedic, trauma, and dental surgeries to anchor and secure implants, such as joint replacements and fixation devices. Its uses and benefits include providing a strong and durable bond, reducing the risk of implant loosening, allowing for immediate weight-bearing, alleviating pain, and improving function, and offering versatility across various surgical applications.

Bone Cement Market Segmentations

The market can be categorised into product, application, end user, and region.Bone Cement Market Breakup by Product

- Calcium Phosphate Cement (CPC)

- Glass Polyalkenoate Cement

- Polymethyl Methacrylate (PMMA) Cement

Bone Cement Market Breakup by Application

- Kyphoplasty

- Arthroplasty

- Vertebroplasty

- Others

Bone Cement Market Breakup by End User

- Hospitals

- Clinics

- Ambulatory Surgical Centres

- Others

Bone Cement Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

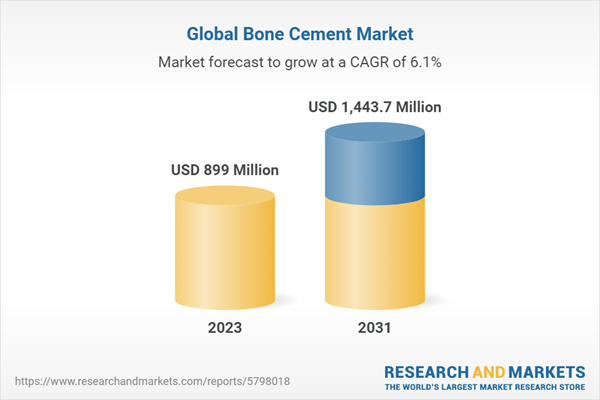

Bone Cement Market Scenario

The global bone cement market is experiencing significant growth, driven by the increasing demand for orthopedic and dental procedures, an aging population, and advancements in medical technology. Bone cement is widely used in joint replacement surgeries, spinal surgeries, and dental applications to anchor and secure implants, providing strong and lasting support.Market Drivers

Key factors driving the bone cement market include the rising prevalence of musculoskeletal disorders, such as osteoarthritis and osteoporosis, the growing geriatric population, increased accessibility to healthcare services, and technological advancements in bone cement and implant materials. As more people require joint replacement surgeries and other orthopaedic interventions, the demand for bone cement is expected to increase, propelling market growth.Product Innovations

The bone cement market has witnessed significant product innovations, such as the development of antibiotic-loaded bone cement and the introduction of bioabsorbable bone cement. These advancements aim to improve the efficacy and safety of bone cement, reduce the risk of infection, and minimize complications, further contributing to market growth and offering more options for healthcare professionals.

Regional Analysis

Geographically, the global bone cement market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market due to its advanced healthcare infrastructure, high awareness of orthopaedic conditions, and the presence of key market players. Europe follows closely, while the Asia-Pacific region is anticipated to be the fastest-growing market due to increasing healthcare expenditures, improving healthcare infrastructure, and rising awareness of orthopaedic disorders.Future Outlook

The bone cement market is expected to continue growing in the coming years, driven by the increasing prevalence of musculoskeletal disorders, an aging population, advancements in technology, and the expanding healthcare sector. As more people require orthopaedic and dental interventions, the demand for bone cement is likely to increase, providing new opportunities for market players and improving overall patient outcomes. Furthermore, ongoing research and development in bone cement materials and implant technologies are expected to drive innovation in the market, leading to the introduction of more advanced and effective products.Key Players in the Global Bone Cement Market

The report gives an in-depth analysis of the key players involved in the bone cement market, sponsors manufacturing the drugs, and putting them through trials to get FDA approvals. The companies included in the market are as follows:- DJO, LLC

- Stryker Corporation

- Smith & Nephew Plc

- Arthrex, Inc

- Tecres S.p.A

- Heraeus Holding GmbH

- Teknimed

- Zimmer Biomet

- DePuy Synthes

Table of Contents

Companies Mentioned

- Djo, LLC

- Stryker Corporation

- Smith & Nephew plc

- Arthrex, Inc.

- Tecres S.P.A.

- Heraeus Holding GmbH

- Teknimed

- Zimmer Biomet

- Depuy Synthes

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | April 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 899 Million |

| Forecasted Market Value ( USD | $ 1443.7 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |