Malaria Diagnostics: Introduction

Malaria is a life-threatening infectious disease caused by the Plasmodium parasite and transmitted through the bite of infected mosquitoes. It is a global health concern, particularly in regions with high malaria prevalence, such as sub-Saharan Africa, Southeast Asia, and Latin America. Early and accurate diagnosis is crucial for effective malaria management and treatment.Malaria diagnostics play a vital role in identifying the presence of malaria parasites in patients and determining the species of the parasite, which helps in guiding appropriate treatment strategies. Over the years, significant advancements have been made in malaria diagnostic tools and technologies, leading to improved accuracy, speed, and accessibility of malaria testing.

Key Trends in the Malaria Diagnostics Market

Some key trends involved in the malaria diagnostics market are as follows:- Point-of-care Testing: There has been a growing trend towards the development and adoption of point-of-care diagnostic tests for malaria. These tests are portable, easy to use, and provide rapid results, enabling healthcare professionals to diagnose malaria quickly and initiate timely treatment. Rapid diagnostic tests (RDTs) based on immunochromatographic assays are widely used as point-of-care tests due to their simplicity, affordability, and reliability

- Molecular Diagnostics: Molecular diagnostic techniques, such as polymerase chain reaction (PCR), have gained prominence in malaria diagnosis. PCR-based tests offer high sensitivity and specificity, allowing for accurate detection and quantification of malaria parasites. These techniques are particularly useful in detecting low-level parasitemia and differentiating between different species of Plasmodium

- Technological Innovations: The malaria diagnostics market has witnessed significant technological advancements, including the development of innovative tools and devices. This includes the use of digital platforms, mobile applications, and remote monitoring systems to improve data collection, transmission, and analysis. These technologies enhance the efficiency of malaria surveillance, enable real-time reporting, and support public health interventions

Malaria Diagnostics Market Segmentations

Market Breakup by Technology

- Microscopy

- Rapid Diagnostic Tests

Molecular Diagnostic Tests

- Conventional PCR

- Real-Time PCR

Market Breakup by Treatment Channel

- Public

- Private

Market Breakup by End User

- Hospitals

- Clinics

- Diagnostic Centres

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Malaria Diagnostics Market Scenario

The market for malaria diagnostics has witnessed significant growth and development in recent years. Malaria remains a major global health concern, particularly in regions with high malaria prevalence. The need for accurate and timely diagnosis is crucial for effective management and treatment of the disease.The market for malaria diagnostics is driven by several factors. First and foremost, the increasing incidence of malaria cases worldwide has created a growing demand for reliable and efficient diagnostic tools. As malaria control and elimination programs are implemented, there is a greater focus on early detection and prompt treatment to reduce the burden of the disease.

Advancements in technology have played a pivotal role in the market growth. There has been a shift towards the development of rapid diagnostic tests (RDTs) that provide quick and accurate results at the point of care. These tests are easy to use, cost-effective, and do not require complex laboratory infrastructure, making them ideal for resource-limited settings.

In conclusion, the market for malaria diagnostics is witnessing significant growth driven by the increasing incidence of malaria, advancements in technology, and efforts to improve accessibility and affordability. With ongoing research and development, technological innovations, and collaborative initiatives, the market is expected to continue expanding, playing a vital role in the global fight against malaria.

Malaria Diagnostics Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- ACCESS BIO. INC

- Abbott

- BioMérieux SA

- Ortho Clinical Diagnostics

- Thermo Fisher Scientific

- PREMIER MEDICAL CORPORATION PVT LTD

- Siemens, Bio-Rad Laboratories, Inc

- Hemex Health

- QuantuMDx Group Ltd

- Meridian Bioscience Europe B.V

- Intellectual Ventures Management LLC

- Novartis AG

- BD

- FYODOR BIOTECHNOLOGIES

- Drucker Diagnostics

- Danaher

- Beckman Coulter, Inc.

Table of Contents

Companies Mentioned

- ACCESS BIO. INC

- Abbott

- BioMérieux SA

- Ortho Clinical Diagnostics

- Thermo Fisher Scientific

- PREMIER MEDICAL CORPORATION PVT LTD.

- Siemens

- Bio-Rad Laboratories Inc.

- Hemex Health

- QuantuMDx Group Ltd.

- Meridian Bioscience Europe B.V.

- Intellectual Ventures Management LLC.

- Novartis AG

- BD

- FYODOR BIOTECHNOLOGIES

- Drucker Diagnostics

- Danaher

- Beckman Coulter Inc.

Table Information

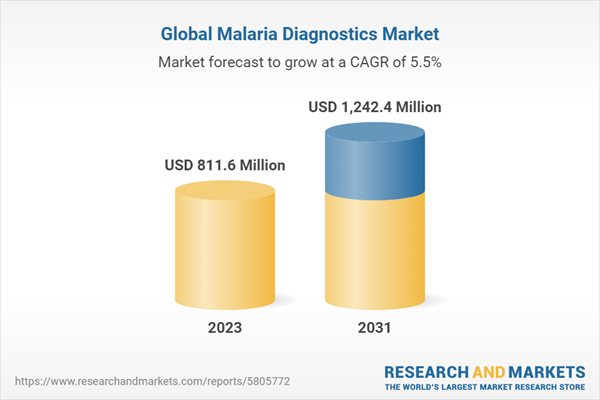

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 811.6 Million |

| Forecasted Market Value ( USD | $ 1242.4 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |