Introduction

Immunomodulators are a class of drugs that have the ability to modify or regulate the functioning of the immune system. They are used in the treatment of various immune-related disorders, including autoimmune diseases, allergies, and certain types of cancer. Immunomodulators work by either stimulating or suppressing the immune response, depending on the specific condition being treated.The immune system plays a crucial role in maintaining overall health by defending the body against pathogens and foreign substances. However, in certain conditions, the immune system becomes dysregulated and either overactive or weakened, leading to various health problems. Immunomodulators help restore the balance and function of the immune system, thereby improving the disease outcome and patient well-being.

Immunomodulators can be classified into several categories, including cytokines, immunosuppressants, immunostimulants, and monoclonal antibodies. Each category targets specific components of the immune system or specific signaling pathways to achieve the desired therapeutic effect.

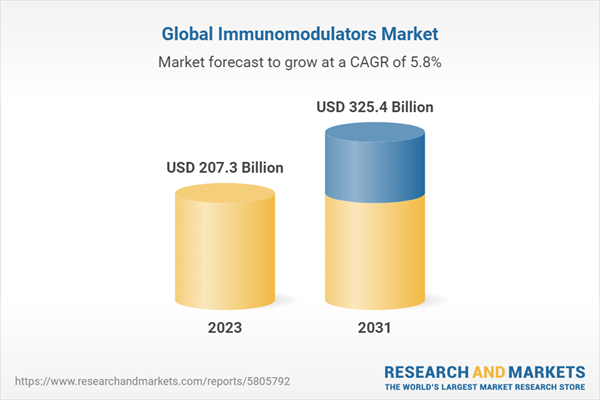

The market for immunomodulators is driven by the increasing prevalence of immune-related disorders, the growing understanding of the immune system and its role in disease, and advancements in drug development technologies. The demand for immunomodulatory therapies is expected to rise as the incidence of autoimmune diseases and cancer continues to increase worldwide.

Key Trends in the Immunomodulators Market

Key trends in the immunomodulators market include:

- Personalized Medicine: There is a growing focus on personalized medicine approaches in immunomodulatory therapy. This involves tailoring treatment strategies based on individual patient characteristics, such as genetic profile, disease subtype, and immune system status. Personalized medicine aims to optimize treatment outcomes and minimize side effects by delivering targeted therapies to specific patient populations

- Biologic Therapies: Biologic immunomodulators, such as monoclonal antibodies, are gaining significant attention in the market. These therapies are designed to specifically target key components of the immune system or disease-causing molecules, leading to more precise and effective treatment outcomes. Biologics offer advantages such as high specificity, reduced toxicity, and improved patient response rates

- Combination Therapies: Combination therapies involving multiple immunomodulators or immunomodulators with other treatment modalities, such as chemotherapy or radiation, are being explored to enhance treatment efficacy. Synergistic effects of combined therapies can improve overall response rates, delay disease progression, and reduce the development of drug resistance

- Focus on Safety and Tolerability: As with any therapeutic intervention, safety and tolerability are important considerations. There is an increasing emphasis on developing immunomodulators that have a favorable safety profile, with minimal side effects and long-term complications. This includes optimizing dosing regimens, monitoring for potential adverse events, and improving patient management strategies

Immunomodulators Market Segmentations

Market Breakup by Product

Immunosuppressant’s

- Calcineurin Inhibitors

- Glucocorticoids

- Antimetabolites

- Others

Immunostimulants

- Immunomodulatorss

- Antibodies

- Others

Market Breakup by Applications

- Respiratory

- Human Immunodeficiency Virus (HIV)

- Oncology

- Others

Market Breakup by Route of Administration

- Oral

- Parenteral

- Others

Market Breakup by End User

- Hospitals

- Specialty Centres

- Clinics

- Others

Market Breakup by Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Immunomodulators Market Scenario

The market for immunomodulators is experiencing significant growth globally, driven by the increasing prevalence of immune-related disorders and the growing demand for effective treatment options. Immunomodulators play a crucial role in managing a wide range of conditions, including autoimmune diseases, allergic disorders, and certain types of cancer.One of the key factors driving the market is the rising incidence of autoimmune diseases, such as rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease. These conditions affect millions of people worldwide and require long-term management. Immunomodulators offer a targeted approach to modulate the immune response, providing relief from symptoms and slowing disease progression.

Furthermore, the growing understanding of the immune system and its role in various diseases has fuelled research and development activities in the field of immunomodulation. Pharmaceutical companies and biotechnology firms are investing in the development of novel immunomodulatory drugs with improved efficacy, safety, and tolerability profiles. The market is witnessing the introduction of advanced biologic therapies, including monoclonal antibodies and immune checkpoint inhibitors, which specifically target key components of the immune system.

Moreover, the market is witnessing a shift towards combination therapies, where immunomodulators are used in conjunction with other treatment modalities such as chemotherapy or radiation therapy. This approach aims to enhance treatment efficacy and overcome drug resistance by targeting multiple pathways involved in disease progression.

Immunomodulators Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- NPO Petrovax Pharm

- ResoTher Pharma

- InDex Pharmaceuticals Holding AB

- Step-Pharma

- Spring Bank Pharmaceuticals

- Horizon Therapeutics plc

- Johnson & Johnson Services, Inc

- BioNTech SE

- ZERIA Pharmaceutical Co., Ltd

- Atox Bio

- Takeda Pharmaceutical Company Limited

- F. Hoffmann-La Roche Ltd

- Amgen Inc

- Novartis AG

- GlaxoSmithKline plc

- Merck & Co., Inc

- Pfizer Inc.

Table of Contents

Companies Mentioned

- NPO Petrovax Pharm

- ResoTher Pharma

- InDex Pharmaceuticals Holding AB

- Step-Pharma

- Spring Bank Pharmaceuticals.

- Horizon Therapeutics plc.

- Johnson & Johnson Services Inc.

- BioNTech SE

- ZERIA Pharmaceutical Co. Ltd.

- Atox Bio.

- Takeda Pharmaceutical Company Limited

- F. Hoffmann-La Roche Ltd.

- Amgen Inc.

- Novartis AG

- GlaxoSmithKline plc.

- Merck & Co. Inc.

- Pfizer Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 207.3 Billion |

| Forecasted Market Value ( USD | $ 325.4 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |