Global Umbilical Cord Blood Banking Market Analysis

Umbilical cord blood or UCB is the blood collected from the umbilical cord of a newborn baby. It is also retrieved from the placenta post-delivery. UCB is enriched with adult stem cells, which play an important role in controlling all biological activities and in producing tissues in the human body. Umbilical cord blood banking includes collection, processing, and storage of stem cells to treat numerous medical indications including hematologic disorders along with certain genetic diseases. The umbilical cord blood banking market growth is being driven by the rapid prevalence of chronic diseases, along with the rising demand for regenerative medicines. Moreover, several government associations and initiatives are contributing to the market growth for umbilical cord blood bank.The rising awareness around the benefits of umbilical cord blood banking poised to boost the market share in the forecast period. It can be used as a standalone or as an assistance therapy for individuals suffering from leukemia, aplastic anemia, and immune deficiencies. To leverage its maximum benefits and offer improved patient outcomes, Shanghai Cord Blood Bank and China Marrow Donor Program collaborated in December 2023. The partnership was aimed at launching an app that help in searching the two banks for matching donors. It also underscores the increasing utilization of digital solutions, which is one of the most significant umbilical cord blood banking market trends.

To improve the efficiency of existing techniques, the market is witnessing increased advances in stem cell research. This includes development in cryopreservation methods, quality control measures along with cell processing techniques. In addition, to meet the rising umbilical cord blood banking market demand, there has been significant expansion of relevant services in emerging economies. In May 2023, StemCures, a United States based medical clinic which specializes in stem cell therapy invested to develop a manufacturing lab in an Indian state. With a worth of USD 54 billion, the investment is aimed at enabling high quality and affordable technologies to treat serious medical conditions.

The increasing investments in expanding and improving healthcare infrastructure is another key market trend. In recent times, public cord blood banks have experienced a notable global expansion, owing to growing initiatives to encourage and educate people participation in cord blood donations. Along with public alternatives, private UCBs hold a significant umbilical cord blood banking market share. The market value can be attributed to a range of dynamic pricing plans, increased storage options along with additional services such as genetic testing among others.

Global Umbilical Cord Blood Banking Market Segmentation

Umbilical Cord Blood Banking Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Service Type

- Sample Preservation and Storage

- Sample Analysis

- Sample Processing

- Sample Collection and Transportation

Market Breakup by Storage Operation

- Private UCB Bank

- Public UCB Bank

Market Breakup by Application

- Bone Marrow Failure Syndrome

- Metabolic Disorder

- Leukemia

- Immune Deficiencies

- Lymphoma

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Umbilical Cord Blood Banking Market: Competitor Landscape

The key features of the market report include funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- CBR Systems, Inc.

- Cryo-Cell International, Inc.

- Smart Cells International Ltd.

- Global Cord Blood Corporation

- Stemcyte India Therapeutics Pvt. Ltd

- Americord Registry LLC

- China Cord Blood Corporation

- Cordlife Group Limited

- Esperite N.V.

- Lifeforce Cryobank Science Inc

- Cryoholdco DE LatinoAMerica

- AMAG Pharmaceuticals, Inc.

- Singapore Cord Blood Bank

Key Queries Solved in the Global Umbilical Cord Blood Banking Market Report

- How has the market performed so far and how will it perform in the coming years?

- What are the major trends influencing the market?

- What are the major drivers, opportunities, and restraints in the market?

- What will be the effect of each driver, challenge, and opportunity on the market?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- Which disease type is expected to significantly influence umbilical cord blood banking market growth?

- Which service type is expected to dominate the market share?

- Which storage operation is expected to have a high market value in the coming years?

- How will the ongoing technical advancements impact the market value during the forecast period?

- What are the factors driving regional disparities in the treatment and outcomes of umbilical cord blood banking?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, and mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- CBR Systems, Inc.

- Cryo-Cell International, Inc.

- Smart Cells International Ltd.

- Global Cord Blood Corporation

- Stemcyte India Therapeutics Pvt. Ltd

- Americord Registry LLC

- China Cord Blood Corporation

- Cordlife Group Limited

- Esperite N.V.

- Lifeforce Cryobank Science Inc

- Cryoholdco DE LatinoAMerica

- AMAG Pharmaceuticals, Inc.

- Singapore Cord Blood Bank

Table Information

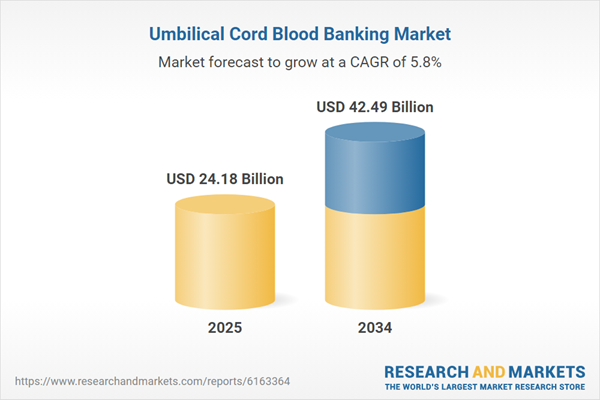

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 24.18 Billion |

| Forecasted Market Value ( USD | $ 42.49 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |