Healthcare Interoperability Solutions Market Overview

A healthcare interoperability solutions enables seamless data exchange between different healthcare systems, ensuring that patient information is accessible, accurate, and secure across platforms. It integrates electronic health records (EHRs), lab systems, imaging tools, and other healthcare applications to streamline workflows and enhance collaboration among providers. By using standards like HL7, FHIR, and DICOM, it promotes consistency and reduces errors. These solutions support patient-centred care, improve clinical decision-making, and enhance operational efficiency. They also enable patients to access their data, fostering transparency. Healthcare interoperability is vital for achieving coordinated care, reducing costs, and meeting regulatory requirements in a digital health ecosystem.Healthcare Interoperability Solutions Market Growth Drivers

Innovation in Patient Data Exchange Fuels Market Growth for Interoperability

With increasing digitalisation in healthcare and a growing demand for seamless patient data exchange, healthcare interoperability solutions are witnessing significant growth. In July 2024, Alcidion, a leader in healthcare informatics, launched its Portable Patient Summary feature within its Miya Precision platform. This new feature enables healthcare providers to exchange patient records using the International Patient Summary (IPS) standard, ensuring smooth and secure transfer of critical health data across different providers and into patient health applications. The adoption of such innovative solutions is poised to drive growth in the global healthcare interoperability market during the forecast period. As more organisations implement these standards, interoperability will improve, reducing silos and enhancing patient care coordination, ultimately supporting market expansion.Regulatory Compliance Drives Growth in Healthcare Interoperability Solutions Market Size

The increasing need for regulatory compliance and operational efficiency in healthcare is accelerating the adoption of interoperability solutions. In February 2024, Edifecs, Inc. introduced enhancements to its healthcare interoperability solutions to comply with the recently published Centers for Medicare & Medicaid Services’ (CMS) Interoperability and Prior Authorization Final Rule (CMS-0057-F). This update, which includes improvements to its EDI and FHIR Gateways, streamlines prior authorisation processes, reducing administrative burdens. By offering a robust solution that aligns with CMS-0057-F provisions, Edifecs is poised to support healthcare organisations in meeting the rule’s requirements. This development is set to fuel market growth by increasing demand for compliance-ready interoperability solutions and driving cost savings across the healthcare system, further accelerating the market's expansion in the forecast period.Increased Demand for Data Sharing Solutions to Drive Healthcare Interoperability Solutions Market Value

The increasing adoption of value-based care models and the growing need for data interoperability are two major market drivers that will accelerate the global Healthcare Interoperability Solutions market growth. In October 2024, Arcadia, a leader in healthcare data platforms, announced its new standards-based interoperability commitments. These initiatives aim to streamline data sharing and offer faster, more cost-effective insights, improving the performance of healthcare organizations, particularly in specialty areas like oncology. By advancing interoperability, Arcadia’s innovations are expected to foster better patient care and operational efficiency. This progress in data exchange will be a key driver of market expansion, particularly as healthcare providers focus on improving value-based care over the forecast period.

Healthcare Interoperability Solutions Market Trends

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:Cloud-Based Solutions Driving Healthcare Interoperability Market Growth and Development

Cloud-based healthcare interoperability solutions are gaining momentum due to their scalability, cost-effectiveness, and flexibility. With healthcare organisations focusing on reducing IT infrastructure costs, cloud solutions enable seamless data sharing across multiple systems and locations. Cloud platforms provide secure, centralised access to healthcare data, improving collaboration and enabling remote healthcare services. This trend supports improved patient care and reduces operational inefficiencies, positioning cloud-based solutions as a key driver in the growth of the Healthcare Interoperability Solution market. As the demand for remote healthcare services rises, the adoption of cloud-based platforms will continue to accelerate in the coming years.Value-Based Care Driving Growth in Healthcare Interoperability Solution Market Demand

The healthcare industry is increasingly shifting towards value-based care models, where improving patient outcomes at lower costs is a primary focus. This transition drives the demand for interoperability solutions, enabling the exchange of accurate, real-time patient data across different healthcare systems. By facilitating coordinated care, these solutions ensure that healthcare providers can track patient outcomes effectively, which is critical for value-based care success. The need for seamless data flow across care settings, combined with the rise of population health management strategies, is a significant trend that will continue to fuel growth in the market.AI and Machine Learning Integration Boosting Healthcare Interoperability Solution Market Growth

The integration of artificial intelligence (AI) and machine learning (ML) into healthcare interoperability solutions is revolutionising data analysis. AI and ML algorithms enable predictive analytics, helping healthcare providers to make informed decisions based on real-time, interoperable data. These technologies improve the accuracy and speed of diagnoses, treatment plans, and patient management. By automating data analysis and providing actionable insights, AI and ML enhance clinical workflows and patient outcomes. As healthcare organisations continue to embrace these technologies, their integration with interoperability solutions is expected to drive innovation and market growth over the forecast period.Regulatory Pressure Enhancing Healthcare Interoperability Solution Market Value and Growth

Increasingly stringent regulations and compliance standards are pushing healthcare organisations to adopt robust interoperability solutions. Governments and regulatory bodies are setting higher expectations for secure, transparent data sharing, particularly under frameworks like the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and GDPR in Europe. These regulations emphasise the importance of secure, interoperable systems that can handle sensitive patient data while ensuring privacy and data protection. As regulatory pressure mounts, healthcare providers and payers are accelerating the adoption of interoperability solutions to meet compliance requirements, driving market growth and development.Healthcare Interoperability Solutions Market Segmentation

"Healthcare Interoperability Solutions Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Software Solutions

- EHR Interoperability Solutions

- Healthcare Information Exchange Interoperability Solutions

- Lab System Interoperability Solutions

- Imaging System Interoperability Solutions

- Enterprise Interoperability Solutions

- Services

Market Breakup by Level of Interoperability

- Foundational

- Structural

- Semantic

Market Breakup by Mode of Deployment

- Cloud Based

- On-Premises

Market Breakup by End User

- Healthcare Providers

- Hospitals and Clinics

- Diagnostic and Imaging Centers

- Others

- Healthcare Payers

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Healthcare Interoperability Solutions Market Share

Software Solutions to Dominate the Market by Type

Software solutions, particularly EHR interoperability and healthcare information exchange interoperability solutions, are projected to hold the largest market share market. The rising adoption of electronic health records (EHRs) and the growing demand for seamless healthcare data exchange are major drivers behind this dominance. As healthcare organisations strive to improve patient care and reduce operational inefficiencies, software solutions enable faster, more accurate data sharing. The increasing reliance on digital health technologies, coupled with advancements in AI and machine learning for enhanced data analysis, positions this segment for substantial growth in the forecast period.Semantic Interoperability to Lead the Healthcare Interoperability Solutions Market Segmentation by Level of Interoperability

Semantic interoperability is poised to dominate the market share by the level of interoperability. This level enables healthcare systems to not only exchange data but also interpret and understand it in a consistent way, ensuring the most accurate information is shared. As healthcare providers strive for more efficient and patient-centric care, the ability to make sense of complex data through standardised formats like FHIR (Fast Healthcare Interoperability Resources) is becoming critical. This approach enhances clinical decision-making and facilitates improved patient outcomes, making it a key growth driver in the market throughout the forecast period.

Mode of Deployment to Witness Significant Growth in the Healthcare Interoperability Solutions Market

Cloud-based deployment is estimated to hold a major share of this sector. The rising need for flexible, scalable, and cost-effective solutions in healthcare is driving the adoption of cloud platforms. Cloud-based solutions enable healthcare organisations to securely share data across multiple platforms without the heavy infrastructure costs associated with on-premises solutions. Additionally, the increasing trend of remote healthcare services and telemedicine is further propelling the demand for cloud-based deployment. As organisations focus on improving accessibility and reducing operational costs, this segment is expected to witness strong growth in the coming years.Healthcare Interoperability Solutions Market Share by End User to Hold a Considerable Size

Healthcare providers, especially hospitals and clinics, will likely lead the market by end-user segment. The increasing adoption of electronic health records (EHRs) and the need for seamless integration across diverse healthcare systems are primary drivers for this segment’s growth. As healthcare providers seek to improve patient outcomes and streamline operations, interoperability solutions offer significant benefits in terms of data accuracy and timeliness. Furthermore, the rise in chronic diseases and demand for specialised care models, such as value-based care, is likely to drive substantial growth in this segment throughout the forecast period.Healthcare Interoperability Solutions Market Analysis by Region

North America holds the largest market share primarily driven by the advanced healthcare infrastructure, widespread adoption of electronic health records (EHR), and strong government initiatives aimed at improving healthcare data exchange. The U.S., in particular, has seen significant investments in healthcare IT, with initiatives such as the Health Information Technology for Economic and Clinical Health (HITECH) Act, which has led to the rapid adoption of interoperability solutions. Furthermore, the presence of leading healthcare technology companies and an increased focus on value-based care models contributes to North America's dominance. As healthcare organisations strive for operational efficiency and improved patient outcomes, North America remains at the forefront of market growth.Leading Players in the Healthcare Interoperability Solutions Market

The key features of the market report comprise patent analysis, grant analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Orion Health Group of Companies

Headquartered in Auckland, New Zealand, Orion Health was established in 1993. It is a global leader in health technology solutions, offering integrated platforms for healthcare data management and interoperability. The company’s portfolio includes electronic health records (EHR), population health management, and clinical decision support systems. Orion Health serves healthcare providers, payers, and government agencies, helping them enhance patient care, reduce costs, and improve outcomes through data-driven solutions. Their innovative technologies are widely used across public and private healthcare systems worldwide.Veradigm LLC

Veradigm, founded in 2016 and headquartered in Chicago, USA, is a leading provider of data-driven healthcare solutions. As a subsidiary of Allscripts Healthcare Solutions, Veradigm focuses on delivering advanced healthcare data, analytics, and connectivity solutions. Its portfolio includes Electronic Health Records (EHR), practice management software, and real-time clinical insights that support physicians, healthcare providers, and payers in enhancing clinical workflows, improving patient outcomes, and reducing costs. Veradigm’s solutions drive operational efficiency and promote value-based care models, positioning it as a key player in healthcare data interoperability.Infor

Established in 2002 and headquartered in New York, USA, Infor is a global leader in enterprise software solutions, providing advanced cloud-based applications for various industries, including healthcare. Infor’s portfolio for the healthcare sector includes solutions for clinical, financial, and supply chain management, as well as workforce management. Their technologies focus on improving operational efficiency, reducing costs, and enhancing patient care through data-driven insights. With a strong emphasis on AI, machine learning, and cloud computing, Infor helps healthcare organisations optimise performance and deliver value-based care.Oracle

Oracle, founded in 1977 and headquartered in Redwood City, USA, is a multinational technology corporation renowned for its cloud computing and database management solutions. In the healthcare sector, Oracle offers a wide range of solutions, including healthcare data management, electronic health records (EHR), and cloud-based healthcare platforms. Oracle’s portfolio supports healthcare providers, payers, and life sciences companies by facilitating data interoperability, improving patient outcomes, and enabling more efficient healthcare delivery. Its cloud applications empower organisations to transform their operations, optimise decision-making, and enhance patient care with advanced data analytics.Other key players in the market include iNTERFACEWARE Inc., NXGN Management, LLC, Epic Systems Corporation, Koninklijke Philips N.V., ViSolve.com, Jitterbit, and SAKSOFT.

Key Questions Answered in the Healthcare Interoperability Solutions Market

- What was the global healthcare interoperability solutions market value in 2024?

- What is the global healthcare interoperability solutions market forecast outlook for 2025-2034?

- What is market segmentation based on type?

- How is the market segmented based on the level of interoperability?

- How is the market segmented based on the mode of deployment?

- How is the market segmented based on end user?

- What are the major factors aiding the global healthcare interoperability solutions market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- What are the major global healthcare interoperability solutions market trends?

- Which type will lead the market segment?

- Which level of interoperability will lead the market segment?

- Which mode of deployment will lead the market segment?

- Which end user will lead the market segment?

- Who are the key players involved in the global healthcare interoperability solutions market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Orion Health Group of Companies

- Veradigm LLC

- Infor

- Oracle

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

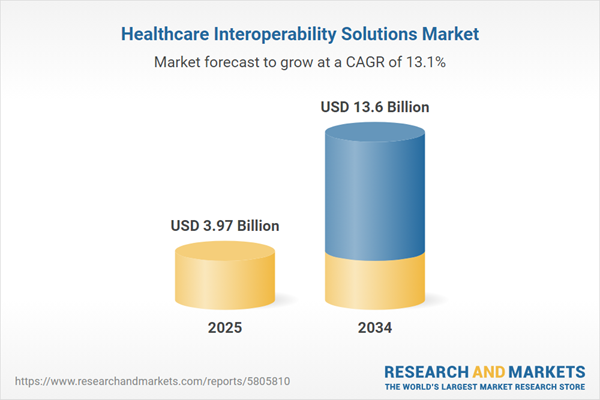

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.97 Billion |

| Forecasted Market Value ( USD | $ 13.6 Billion |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |