Introduction

Fracture fixation products are medical devices used in orthopedic surgery to stabilize and repair fractured bones. These products play a crucial role in the management and treatment of fractures, enabling proper healing, restoration of bone function, and prevention of complications. Fracture fixation products encompass a wide range of devices, including plates, screws, nails, wires, and external fixation systems.Key Trends in the Fracture Fixation Products Market

Some key trends involved in the fracture fixation products market are as follows:- Technological Advancements: The fracture fixation products market is witnessing continuous technological advancements aimed at improving the efficacy, safety, and ease of use of these devices. Manufacturers are investing in research and development to introduce innovative materials, designs, and manufacturing techniques. For example, the development of bioabsorbable materials has revolutionized fracture fixation, offering temporary stabilization without the need for implant removal

- Minimally Invasive Approaches: There is a growing trend towards minimally invasive fracture fixation techniques. Minimally invasive procedures involve smaller incisions, reduced tissue trauma, and faster recovery times compared to traditional open surgeries. This trend is driven by the desire to minimize patient discomfort, reduce complications, and accelerate the return to normal activities. Advances in instrumentation and surgical techniques, such as percutaneous fixation and intramedullary nailing, have facilitated the adoption of minimally invasive approaches

- Customization and Patient-Specific Implants: Personalized medicine is making its way into the fracture fixation products market. There is an increasing emphasis on patient-specific implants and customized solutions to optimize fracture treatment outcomes. Computer-aided design and manufacturing (CAD/CAM) technologies allow for the creation of patient-specific implants based on preoperative imaging data. These customized implants offer improved anatomical fit, stability, and reduced surgical time

Fracture Fixation Products Market Segmentations

Market Breakup by Product Type

- Internal Fixation Products

- External Fixation Products

Consumable’s

- Plates

- Screws

- Wires

- Nails

- Pins

- Others

Market Breakup by Material Type

- Metal

- Bioabsorbable Materials

- Others

Market by Applications

- Lower Extremities

- Upper Extremities

Market by End User

- Hospitals

- Surgery Centres

- Physiotherapy Centres

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Fracture Fixation Products Market Scenario

The market for fracture fixation products is experiencing steady growth globally. Fracture fixation products are essential in the treatment of fractures, providing stability and support to fractured bones during the healing process. The market is driven by various factors, including the increasing prevalence of fractures, advancements in medical technology, and the growing geriatric population.Fractures can occur due to various reasons such as sports injuries, accidents, and age-related conditions like osteoporosis. The rising incidence of fractures has resulted in a greater demand for fracture fixation products to ensure proper healing and recovery. Additionally, technological advancements in implant materials, surgical techniques, and minimally invasive approaches have improved the effectiveness and outcomes of fracture fixation procedures.

The growing geriatric population is another significant driver of the market. Elderly individuals are more prone to fractures due to decreased bone density and an increased risk of falls. As the geriatric population continues to grow, the demand for fracture fixation products is expected to rise.

Fracture Fixation Products Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- B. Braun Melsungen AG

- Johnson & Johnson Services Inc. (NYSE: JNJ)

- Smith & Nephew Plc

- Stryker Corp

- Zimmer Biomet Holdings Inc.

Table of Contents

Companies Mentioned

- B. Braun Melsungen AG

- Johnson & Johnson Services Inc. (NYSE: JNJ)

- Smith & Nephew Plc.

- Stryker Corp.

- Zimmer Biomet Holdings Inc.

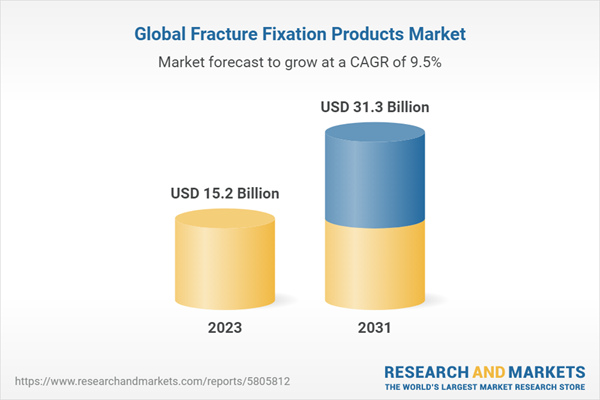

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 15.2 Billion |

| Forecasted Market Value ( USD | $ 31.3 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |