Diabetic Gastroparesis Treatment Market- Analysis

Diabetic gastroparesis is a chronic condition where the stomach takes too long to empty its contents, leading to a range of digestive symptoms. This condition is often associated with diabetes and can significantly impact a patient's quality of life. The treatment of diabetic gastroparesis involves a combination of medications, dietary changes, and sometimes surgical interventions to manage symptoms and improve gastric motility. The market for diabetic gastroparesis treatment is expanding due to the increasing prevalence of diabetes, advancements in treatment options, and growing awareness of the condition.Market Drivers

Rising Prevalence of Diabetes: The increasing prevalence of diabetes is a significant driver of the diabetic gastroparesis treatment market. As more people are diagnosed with diabetes, the incidence of related complications, including gastroparesis, is also rising. This has led to a growing demand for effective treatment options that can alleviate symptoms and improve patient outcomes, thereby driving market growth.Advancements in Treatment Options: Continuous advancements in treatment options for diabetic gastroparesis are propelling the market forward. New drug formulations, improved delivery systems, and innovative therapies such as botulinum toxin injections are enhancing the effectiveness of treatments. These advancements are providing patients with more tailored and effective management strategies, increasing the adoption of these treatments.

Growing Awareness and Diagnosis Rates: There is an increasing awareness of diabetic gastroparesis among both patients and healthcare professionals. As awareness grows, so does the rate of diagnosis, leading to a higher demand for treatments. Educational campaigns and improved diagnostic tools are helping to identify the condition earlier, allowing for more timely and effective intervention, which is driving market expansion.

Supportive Healthcare Policies and Reimbursement: Supportive healthcare policies and favourable reimbursement scenarios are also driving the market. Many regions have implemented policies that support the treatment of chronic conditions like diabetic gastroparesis, including coverage for medications and procedures. This support is crucial in making treatment accessible to a broader patient population, further fuelling market growth.

Market Challenges

High Cost of Treatment: One of the primary challenges facing the diabetic gastroparesis treatment market is the high cost of treatment. Advanced therapies and long-term medication regimens can be expensive, limiting accessibility, particularly in low-income regions. This financial barrier can prevent patients from receiving the necessary treatment, thereby hindering market growth. Efforts to reduce costs through the development of generics and biosimilars are essential to overcoming this challenge.Limited Treatment Options: Despite advancements, the treatment options for diabetic gastroparesis remain limited, particularly in terms of curative therapies. Current treatments primarily focus on symptom management rather than addressing the underlying causes of the condition. This limitation can lead to patient dissatisfaction and challenges in managing the disease effectively over the long term, which may restrict market growth.

Complexity of Disease Management: Managing diabetic gastroparesis is often complex, requiring a multidisciplinary approach that includes medication, dietary modifications, and sometimes surgical interventions. This complexity can be challenging for both patients and healthcare providers, leading to issues with treatment adherence and patient outcomes. Developing more straightforward and effective treatment protocols is crucial for improving patient compliance and expanding the market.

Regulatory Hurdles and Approval Processes: The diabetic gastroparesis treatment market faces significant challenges related to regulatory hurdles and approval processes. The stringent requirements for proving the safety and efficacy of new treatments can delay their introduction to the market. Additionally, the variability in regulatory standards across different regions can complicate market entry, posing a challenge for pharmaceutical companies.

Future Opportunities

Emerging Markets Expansion: Expanding into emerging markets presents significant opportunities for the diabetic gastroparesis treatment market. As healthcare infrastructure improves and the prevalence of diabetes increases in these regions, there is a growing demand for effective treatments. Companies that invest in these markets and tailor their products to meet local needs can capture substantial market share and drive growth in these high-potential areas.Development of Novel Therapies: The development of novel therapies for diabetic gastroparesis offers a promising opportunity for market growth. Research into new drug classes, such as prokinetics and motilin receptor agonists, as well as advancements in neuromodulation techniques, are opening up new avenues for treatment. Companies that focus on bringing these innovative therapies to market can gain a competitive edge and address unmet patient needs.

Collaborative Research and Development: Collaborative research and development initiatives between pharmaceutical companies, research institutions, and healthcare providers can drive innovation in the diabetic gastroparesis treatment market. These partnerships can facilitate the development of new treatment options and improve the understanding of the condition, leading to more effective management strategies. Such collaborations are also crucial for sharing resources and expertise, accelerating the development process.

Increased Focus on Personalised Medicine: The growing focus on personalised medicine presents an opportunity for the diabetic gastroparesis treatment market. By tailoring treatments to individual patient profiles, including genetic factors and specific disease characteristics, personalised therapies can improve treatment efficacy and patient outcomes. Companies that invest in personalised treatment options are well-positioned to meet the needs of a diverse patient population and drive market growth.

Diabetic Gastroparesis Treatment Market Trends

Shift Towards Non-Pharmacological Treatments: There is a growing trend towards the use of non-pharmacological treatments for managing diabetic gastroparesis. Dietary interventions, gastric electrical stimulation, and other non-drug therapies are gaining popularity due to their potential to improve symptoms without the side effects associated with medications. This trend is particularly strong among patients seeking more holistic approaches to managing their condition, driving demand for alternative treatment options.Rising Adoption of Botulinum Toxin Therapy: The use of botulinum toxin injections as a treatment for diabetic gastroparesis is on the rise. This therapy, which involves injecting botulinum toxin into the pyloric sphincter to improve gastric emptying, is gaining acceptance as an effective option for patients with severe symptoms. The increasing adoption of this minimally invasive therapy is contributing to market growth and expanding the range of treatment options available to patients.

Integration of Digital Health Tools: The integration of digital health tools in the management of diabetic gastroparesis is an emerging trend that is transforming the market. Mobile health apps, telemedicine platforms, and wearable devices are being used to monitor symptoms, track medication adherence, and provide personalised treatment recommendations. These tools are enhancing patient engagement and improving the overall management of the condition, driving demand for digital solutions in the market.

Focus on Early Diagnosis and Intervention: There is an increasing focus on early diagnosis and intervention in the management of diabetic gastroparesis. Early detection of the condition allows for timely treatment, which can prevent the progression of symptoms and improve patient outcomes. This trend is driving demand for diagnostic tools and screening programmes, as well as increasing awareness of the importance of early intervention in managing the condition.

Breast Pumps Diabetic Gastroparesis Treatment Market Segmentation

Market Breakup by Drug Class

- Gastroprokinetic Agents

- Antiemetic Agents,

- Botulinum Toxin,

- Others

Market Breakup by Indication

- Compensated Gastroparesis

- Gastric Failure

- Others

Market Breakup by Route of Administration

- Oral

- Injectables

Market Breakup by Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Market Breakup by Region

- United States

- EU-4 and the United Kingdom

- Germany

- France

- Italy

- Spain

- United Kingdom

- Japan

- India

Diabetic Gastroparesis Treatment Market Competitive Landscape

The diabetic gastroparesis treatment market includes key players such as Evoke Pharma Inc., Allergan Plc., Salix Pharmaceuticals, Inc., Theravance Biopharma Inc., Rhythm Pharmaceuticals Inc., AstraZeneca Plc., Cadila Pharmaceuticals Ltd., Neurogastrx Inc., Bausch Health Companies Inc., Bayer AG, Pfizer Inc., Takeda Pharmaceutical, Inc., Altos Therapeutics Inc., Teva Pharmaceutical Inc., and Vanda Pharmaceuticals Inc., Bayer AG. These companies are focusing on innovation, strategic partnerships, and expanding their presence to meet the increasing demand for effective gastroparesis treatments, enhancing their competitive positions in the market.Key Questions Answered in the Report

- What was the estimated value of the diabetic gastroparesis treatment market in 2023?

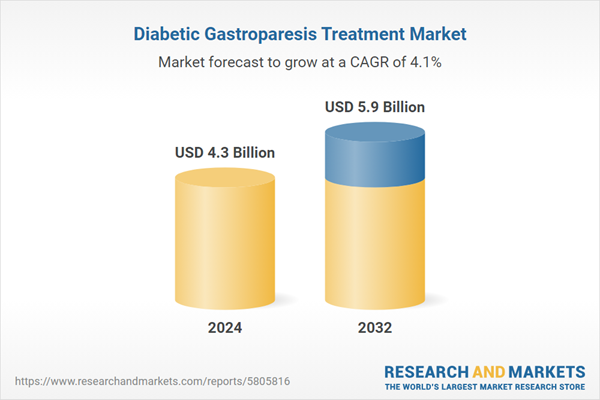

- What is the projected CAGR of the diabetic gastroparesis treatment market during the forecast period 2024-2032?

- What are the key drivers influencing the growth of the diabetic gastroparesis treatment market?

- What challenges are currently facing the diabetic gastroparesis treatment market?

- How do advancements in drug development impact the diabetic gastroparesis treatment market?

- What opportunities exist for market expansion in emerging regions?

- How is the market segmented by drug class in the diabetic gastroparesis treatment market?

- What are the primary indications driving demand in the diabetic gastroparesis treatment market?

- How is the market segmented by route of administration in the diabetic gastroparesis treatment market?

- Who are the leading players in the diabetic gastroparesis treatment market?

- How does the distribution channel segmentation impact market dynamics?

- What are the major trends shaping the future of the diabetic gastroparesis treatment market?

Key Benefits for Stakeholders

The industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the diabetic gastroparesis treatment market from 2017-2032.- The research report provides the latest information on the market drivers, challenges, and opportunities in the diabetic gastroparesis treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets, enabling stakeholders to identify key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders analyse the level of competition within the diabetic gastroparesis treatment industry and its attractiveness.

- The competitive landscape section allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- Evoke Pharma Inc.

- Allergan Plc.

- Salix Pharmaceuticals, Inc.

- Theravance Biopharma Inc.

- Rhythm Pharmaceuticals Inc.,

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | October 2024 |

| Forecast Period | 2024 - 2032 |

| Estimated Market Value ( USD | $ 4.3 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |