Global Oil and Gas Pipes Market - Key Trends & Drivers Summarized

How Do Oil and Gas Pipes Shape the Industry?

Oil and gas pipes are the arteries of the energy sector, crucial for transporting hydrocarbons from extraction points to refineries and distribution centers. These pipes, made from materials like steel and composite, ensure the efficient and safe movement of oil and gas across vast distances, including challenging terrains and deep underwater environments. The design and material selection for these pipes are critical, as they must withstand extreme pressures, temperatures, and corrosive substances. Advanced technologies such as corrosion-resistant alloys and internal coatings are often employed to enhance the durability and longevity of these pipelines, ensuring uninterrupted energy supply and reducing maintenance costs.What Are the Technical and Environmental Challenges?

The construction and maintenance of oil and gas pipelines face numerous technical and environmental challenges. Technically, the pipelines must be engineered to handle high-pressure environments, potential seismic activities, and temperature fluctuations. Environmentally, the installation of these pipelines can disrupt ecosystems, and leaks or spills pose significant risks to surrounding areas. To mitigate these challenges, rigorous regulatory standards and monitoring technologies are in place. For instance, smart pipeline technology utilizes sensors and automation to detect leaks or weaknesses in the pipeline structure, allowing for prompt maintenance and reducing the environmental impact. Additionally, environmental impact assessments and sustainable practices are increasingly being integrated into pipeline projects to balance energy needs with ecological preservation.How Is Technology Revolutionizing Pipeline Safety and Efficiency?

Technological advancements are revolutionizing the safety and efficiency of oil and gas pipelines. Innovations such as inline inspection tools, often referred to as 'smart pigs,' travel through pipelines to detect anomalies, corrosion, and other potential issues before they lead to failures. Real-time monitoring systems equipped with advanced sensors and data analytics provide continuous oversight of pipeline integrity and performance. The integration of artificial intelligence and machine learning algorithms further enhances predictive maintenance capabilities, enabling operators to address potential issues proactively. Moreover, developments in material science have led to the creation of more robust and flexible pipeline materials, capable of withstanding harsher environmental conditions and reducing the likelihood of leaks and ruptures.What Drives the Growth in the Oil and Gas Pipeline Market?

The growth in the oil and gas pipeline market is driven by several factors. One of the primary drivers is the rising global demand for energy, which necessitates the expansion of pipeline networks to transport increasing volumes of oil and gas. Technological advancements in pipeline construction and maintenance have also contributed to market growth, making it feasible to lay pipelines in previously inaccessible regions. The shift towards natural gas as a cleaner energy source compared to coal and oil has spurred the development of extensive gas pipeline infrastructures. Additionally, regulatory frameworks aimed at enhancing pipeline safety and environmental protection have led to significant investments in upgrading and modernizing existing pipelines. Lastly, the emergence of new energy markets and the geopolitical need for energy security are propelling investments in cross-border pipeline projects, further fueling the growth of the oil and gas pipeline market.Report Scope

The report analyzes the Oil and Gas Pipes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Stainless Steel Pipes, HDPE Pipes, PVC Pipes, Other Materials); Application (External Transportation & Distribution Application, Internal Process Application); End-Use (On-Shore Activities End-Use, Off-Shore Activities End-Use).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the External Transportation & Distribution Application segment, which is expected to reach US$68.7 Billion by 2030 with a CAGR of 6.9%. The Internal Process Application segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $22.4 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $20.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oil and Gas Pipes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oil and Gas Pipes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oil and Gas Pipes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Cast Iron Pipe Company, Arcelor Mittal S.A., EUROPIPE GmbH, EVRAZ North America, JFE Steel Corporation. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 98 companies featured in this Oil and Gas Pipes market report include:

- American Cast Iron Pipe Company

- Arcelor Mittal S.A.

- EUROPIPE GmbH

- EVRAZ North America

- JFE Steel Corporation.

- Maharashtra Seamless Ltd.

- National Oilwell Varco / NOV, Inc.

- Nippon Steel Corporation

- Saipem S.p.A

- TechnipFMC Plc

- Tenaris S.A.

- TMK Group

- Valourec S.A.

- Welspun Corp Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Cast Iron Pipe Company

- Arcelor Mittal S.A.

- EUROPIPE GmbH

- EVRAZ North America

- JFE Steel Corporation.

- Maharashtra Seamless Ltd.

- National Oilwell Varco / NOV, Inc.

- Nippon Steel Corporation

- Saipem S.p.A

- TechnipFMC Plc

- Tenaris S.A.

- TMK Group

- Valourec S.A.

- Welspun Corp Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 629 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

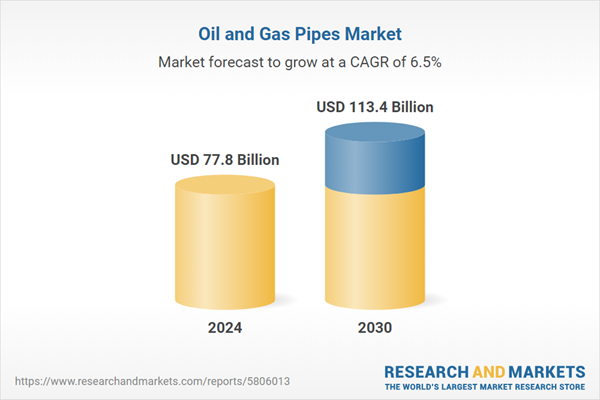

| Estimated Market Value ( USD | $ 77.8 Billion |

| Forecasted Market Value ( USD | $ 113.4 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |