The electrical digital twin allows utilities to facilitate the process of data maintenance as well as exchange. An object or system's "digital twin" is essentially a virtual representation that spans its lifecycle, is updated with real-time data, and employs simulation, machine learning, and reasoning to support decision-making. The demand for real-time healthcare services is likely to increase. Predictive maintenance using digital twins is also becoming more popular to prevent unplanned outages.

Additionally, it is anticipated that the market will increase during the projected period due to the increasing acceptance of advanced technologies for implementing digital twin applications. By adding an information layer to smart grids, AI makes it possible for utilities and consumers to communicate with each other via electrical networks. In addition, this layer enables interaction between the various grid parts so they can better react to sudden changes in energy demand or emergencies.

Installing smart meters & sensors, which enable data collecting, storage, analysis, and the development of a digital twin, establishes this information layer. Power system and utility operators should be able to examine the sizable amount and varied structure of the datasets produced by digital twins with the aid of virtual reality, AI, IoT, machine learning, and other emerging technologies.

This analysis can be utilized for several tasks, such as seamless problem detection in meters, anticipatory maintenance requirements, quality monitoring of sustainable energy, and forecasting for renewable energy. Additionally, machine learning and artificial intelligence (AI) can automatically provide insights to power system operators and enhance business outcomes.

COVID-19 Impact Analysis

The COVID-19 outbreak has dealt a fatal blow to the world economy & the energy industry, upsetting supply networks and stifling demand. The power industry faced several difficulties, including a smaller and more distant workforce, declining commercial energy demand, rising customer calls, and using digital or self-serve channels amid lockdowns. Utility companies and grid operators were compelled by these difficulties to speed up their operations' automation, digitalization, and decentralization. The shift in working habits brought on by COVID-19-related limitations has accelerated utilities' and grid operators' efforts to convert into digital businesses. The market has so greatly profited from COVID-19's widespread use.Market Growth Factors

Incorporation of variable renewable energy and decentralization of DER using digital twin

In order to monitor, regulate, automate, and run their power networks, utilities, and grid operators need quicker and more effective solutions, such as electrical digital twins. The challenges posed by grid modernization programs, particularly DER integration, can be addressed by electrical digital twins. These tools aid in planning, analyzing, and developing the grid modernization process as well as assessing the impact of DER. As a result, utilities are able to simplify the DER interconnection procedure, which enhances customer response times, makes cost-effective investments possible, and boosts operational effectiveness. In light of this, the electric digital twin market is estimated to witness significant growth during the projection period.Advent of energy 4.0 supporting growth

Electric utilities globally are adopting advanced technologies such as machine learning, AI, Industrial Internet of Things (IIoT), and cloud computing to enhance their predictive & prescriptive maintenance, smart metering, asset performance monitoring & management, automation of distributed energy resources (DER), and analysis of fluctuations in decentralized renewable generation systems. Implementing an electrical digital twin empowers utility companies to proactively anticipate, evaluate, and optimize various transmission, power generation, and distribution models, as well as renewable energy integration scenarios.Market Restraining Factors

Complexity in systems and access to accurate models

A digital twin should be supplied with information on equipment failure modes to predict failures. Maintaining the digital duplicate becomes more challenging when there are adjustments to the equipment, assets, or operating status. Any change to the physical system would necessitate equivalent adjustments to its digital model & algorithms. Since modeling some scenarios, such as the installation of new parts at the machine level or operational level modifications, may not be accurate, the likelihood of errors may increase as complexity levels rise. These issues limit many power industry players' widespread use of electrical digital twins.Type Outlook

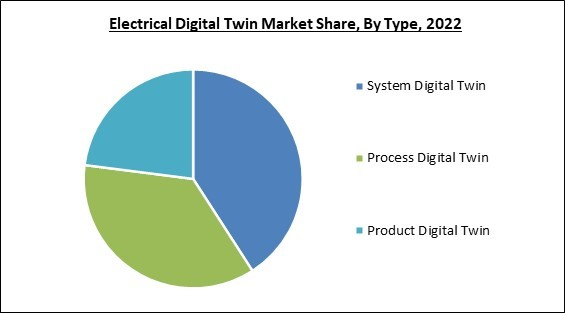

By type, the electrical digital twin market is segmented into product digital twin, process digital twin and system digital twin. The system digital twin segment registered the maximum revenue share in the electrical digital twin market in 2022. The necessity for network-level optimization is the reason behind this. A group of goods and procedures that operate together to carry out system- or network-wide tasks make up the system digital twin. Substations, wind farms, power plants, and distributed energy resources are a few examples of systems or networks that can be stimulated using this technique.Application Outlook

Based on application, the electrical digital twin market is fragmented into asset performance management, and business & operations optimization. Businesses use digital twins to evaluate the performance of their physical assets under circumstances or to monitor the performance of assets in real time. Using data from sensors attached to actual assets enables the creation of reliable failure models. The vast array of commercial digital twin software offerings developed by numerous companies is estimated to increasingly support market growth in this segment.End-user Outlook

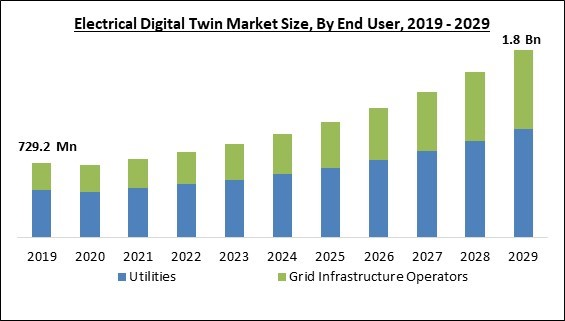

On the basis of end user, the electrical digital twin market is divided into utilities and grid infrastructure operators. In 2022, the utilities segment held the highest revenue share in the electrical digital twin market. The increasing use of renewable energy sources and cutting-edge digital technologies is responsible for the segment's expansion. To establish strong long-term asset management and business strategies and minimize operational costs, several utilities have invested in installing electrical digital twins. These twins can analyze and visualize data in real-time.Regional Outlook

Region wise, the electrical digital twin market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the electrical digital twin market by generating the maximum revenue share. The development of the North American market is fueled by the rise in investments being made to adopt cutting-edge digital technologies to update aging power generation and distribution infrastructure. Additionally, two significant aspects that encourage investments in digital technology like electrical digital twins are the rising demand for clean, dependable energy and the strong emphasis on renewable energy generation.The Cardinal Matrix - Electrical Digital Twin Market Competition Analysis

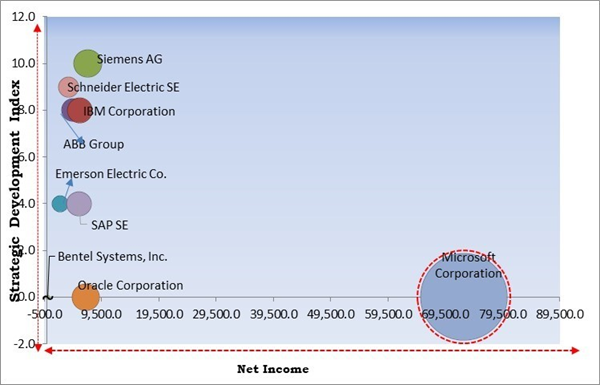

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include ABB Group, Emerson Electric Co., General Electric Company, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Schneider Electric SE, Siemens AG, and Bentel Systems, Inc.

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix, Microsoft Corporation is the forerunner in the Electrical Digital Twin Market. Companies such as Siemens AG, Schneider Electric SE, and IBM Corporation are some of the key innovators in Electrical Digital Twin Market.

Recent Strategies Deployed in Electrical Digital Twin Market

Partnerships, Collaborations and Agreements:

- Jan-2023: IBM extended its collaboration with Dassault Systemes, a France-based provider of computer-assisted design software. The collaboration aims at addressing the sustainability challenges faced by asset-intensive industries, by integrating their respective technologies.

- Nov-2022: SAP signed an agreement with Schneider Electric, a France-based provider of multiple products including, ground-level equipment, analytics, execution software, etc. The collaboration focuses on IT/OT integration applications. The collaboration with Schneider reflects SAP's support for Industry 4.0.

- Jul-2022: Siemens came into partnership with NVIDIA, a US-based designer of discrete graphic processing units. The partnership aims at boosting the deployment of AI-based digital twins through Siemens' Xcelerator tool, and NVIDIA's Omniverse 3D design platform.

- Nov-2021: Siemens Digital Industries Software extended its collaboration with Amazon Web Services, a US-based provider of the cloud-based web platform. The collaboration involves integrating Siemens' deep knowledge of the industry, and cloud services offered by AWS to help companies advance digital transformation to the cloud.

- Aug-2021: IBM came into collaboration with Black & Veatch, a US-based management consulting firm. The collaboration involves collectively marketing asset performance management (APM) solutions. The collaboration aims at enhancing the performance of assets and increasing their lifetime.

- Jun-2021: Schneider Electric teamed up with ETAP, a US-based provider of energy management & engineering solutions. The collaboration focuses on offering end-to-end lifecycle digitalization and improving efficiency, resiliency, and sustainability to an expanded customer base. Further, through this collaboration with ETAP, the company is able to equip its customers and partners with new tools to make more informed and better decisions.

- Apr-2021: SAP extended its partnership with Siemens Digital Industries Software. The expansion of the partnership allows both companies to offer solutions intended for the service and asset lifecycle. Further, this partnership supports their customers in advancing Industry 4.0.

Product Launches and Product Expansions:

- Feb-2023: ABB added cloud-enabled functionality to its RobotStudio robot programming and simulation software. Through this product expansion, the company aims to enable transparency, real-time collaboration, and flexibility, during the test phase of virtual robot cell designs. The RobotStudio Cloud works with any device, and reduces time, as well as costs.

- Jun-2022: Siemens introduced Siemens Xcelerator. Siemens Xcelerator is an open digital business platform, that supports accelerating digital transformation and value addition for organizations of all sizes, across multiple verticles including industry, grids, mobility, and buildings.

- May-2022: Schneider Electric unveiled EcoStruxure Machine Expert Twin, a digital twin software solution intended to manage the entire machine lifecycle including sales, design, concept, operation, and manufacturing. The new solution allows OEMs to design models of real machines. Further, the new software solution digitizes all the processes, resulting in decreased factory acceptance testing (FAT).

Acquisitions and Mergers:

- Jan-2022: Schneider Electric took over Zeigo, a UK-based operator of energy technology platforms. The addition of Zeigo perfectly complements the acquiring company's existing digital energy solution, and further accelerates the company's vision to transform digital energy.

- May-2021: IBM took over myInvenio, an Italy-based provider of process mining software. The acquisition benefits organizations by equipping them with data-driven software that possesses the capacity to recognize the business processes to automate through artificial intelligence.

Scope of the Study

By End-user

- Utilities

- Grid Infrastructure Operators

By Application

- Asset Performance Management

- Business & Operations Optimization

By Type

- System Digital Twin

- Process Digital Twin

- Product Digital Twin

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- ABB Group

- Emerson Electric Co.

- General Electric Company

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

- Bentel Systems, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- ABB Group

- Emerson Electric Co.

- General Electric Company

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

- Bentel Systems, Inc.