With preventative care procedures, people with diabetes can effectively control and enhance their health. Receiving routine annual foot and eye exams is one of these habits. The prevention of type 1 diabetes has not yet been proven using existing knowledge. However, effective methods for the prevention of type 2 diabetes, as well as the complications and early death that are associated with it, have been developed globally.

Major guidelines and regulations include quitting smoking, controlling blood pressure and cholesterol intake, eating properly, and exercising frequently. Early detection and treatment of diabetes should be a priority for all stakeholders in the healthcare sector, seen from a life-course perspective. Given that even minor cracks, calluses, cuts, or blisters can develop into foot ulcers, foot care is one of the most crucial aspects of diabetes management. Diabetes causes blood circulation to be poor, which interferes with wound healing. Therefore, diabetic socks are very important in preventing infections and foot ulcers.

Additionally, diabetic socks assist the legs, feet, and toes in thwarting infections and avoiding amputation. The making of diabetic socks involves the use of a wide variety of materials. Acrylic, merino wool, and bamboo fibres are a few of these materials. The fibres used to make diabetes socks help to keep feet dry by absorbing moisture. Additionally, these fibres have built-in antibacterial qualities.

COVID-19 Impact Analysis

The world's economy was adversely impacted due to the COVID-19 outbreak. This can be attributed to considerable interruptions encountered by their respective manufacturing and supply-chain operations as a result of a variety of precautionary lockdowns and other limitations that were applied by governing bodies all over the world. These restrictions included a ban on imports of certain products. In addition to this, there has been a subsequent decrease in consumer demand as a result of the fact that individuals are now more interested in reducing expenses that are not vital to their financial plans. These factors were responsible for the declining growth of the diabetic socks market. On the other hand, as soon as the various regulatory bodies uplifted these enforced lockdowns, the market for diabetic socks recovered mainly due to the growth of sales from e-commerce channels.Market Growth Factors

Growing Awareness Regarding Diabetes Prevention

Growing public knowledge of diabetes and its complications has increased consumer demand for goods that can be used to prevent or treat the condition. Diabetes socks offer people support and comfort. As more people become aware of the need to wear specialized footwear in the management of diabetes, these socks are becoming more and more popular. Numerous groups are running awareness campaigns to avoid diabetes. The rising awareness regarding diabetes prevention is predicted to support the growth of the diabetic socks market during the projection period.Rising Occurrence of Diabetes

Diabetes is a chronic condition that develops when the body either cannot use the insulin the pancreas makes properly or does not create enough of it. The hormone insulin controls blood glucose. One hundred eight million individuals had diabetes in 1980; 422 million did so in 2014, according to the WHO. The prevalence has been increasing more quickly in low- and middle-income countries than in high-income countries. Diabetes is a leading factor in renal failure, heart attacks, strokes, blindness, and lower limb amputation. Considering this, it is projected that demand for diabetes socks will increase in the upcoming years along with the prevalence of diabetes.Market Restraining Factors

Lack of Awareness Towards Diabetic Socks

Diabetes patients cannot feel pain, making accidents go unnoticed for a long time, resulting in severe injuries. As a result, diabetic socks are recommended since they guard against the disease's effects on the skin's deterioration. Despite how severe it is, many people still don't understand the protection they need for their feet or the issues that diabetes can cause. Most individuals found it uncomfortable and challenging to wear diabetic socks with sandals. Due to cultural traditions and beliefs, wearing diabetes socks is viewed as inappropriate. Therefore, the main factors limiting demand for diabetic socks in emerging economies are lower consumer spending power and less knowledge about diabetic socks than in developed nations.Distribution Channel Outlook

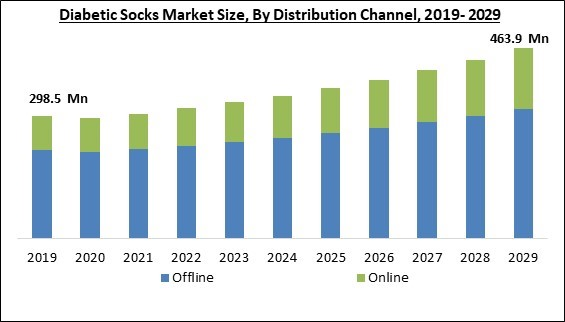

Based on sales channel, the diabetic socks market is bifurcated into offline channels, and online channels. In 2022, the online channel segment garnered a significant revenue share in the diabetic socks market. Market dynamics are anticipated to change in the upcoming years due to the global expansion of e-commerce. Rising shipments of diabetic socks bought through online distribution channels indicate a shift in consumer purchasing behaviour, particularly in developed nations like North America and Europe.Type Outlook

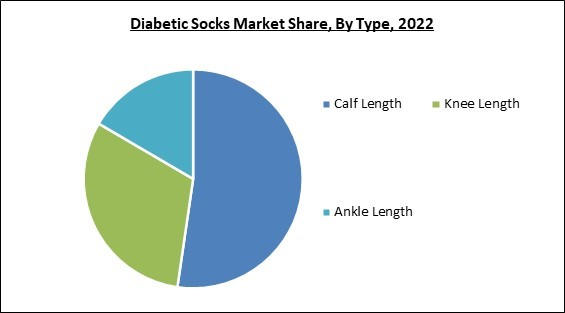

By type, the diabetic socks market is segmented into ankle length, calf length and knee length. In 2022, the calf length segment held the highest revenue share in the diabetic socks market. Most diabetics experience diabetic neuropathy or peripheral vascular disease, which can result in life-threatening infections and complications. For this reason, many producers of diabetic socks are concentrating on tailored solutions to satisfy the distinct medical needs of diabetes patients, which would favourably affect the expansion of the market.Regional Outlook

Region wise, the diabetic socks market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the diabetic socks market by generating the highest revenue share. The region's development is attributed to the presence of a strong healthcare infrastructure and regulatory framework, the presence of significant pharmaceutical companies, favorable government regulations, as well as an increase in the number of hospitals across the United States recommending diabetic socks, which has raised the demand for diabetic socks in this area.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Enovis Corporation, I-Runner (Healer Health LLC), Orthofeet, Inc., Knit-Rite, LLC, Drew Shoe Corporation, Creswell Sock Mills, HJ Sock Group Ltd. (Pantherella International Group Ltd), Syounaa (Nishikaa Garments International LLP), and Simcan Enterprises Inc.

Scope of the Study

By Distribution Channel

- Offline

- Online

By Type

- Calf Length

- Knee Length

- Ankle Length

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Enovis Corporation

- I-Runner (Healer Health LLC)

- Orthofeet, Inc.

- Knit-Rite, LLC

- Drew Shoe Corporation

- Creswell Sock Mills

- HJ Sock Group Ltd. (Pantherella International Group Ltd)

- Syounaa (Nishikaa Garments International LLP)

- Simcan Enterprises Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Enovis Corporation

- I-Runner (Healer Health LLC)

- Orthofeet, Inc.

- Knit-Rite, LLC

- Drew Shoe Corporation

- Creswell Sock Mills

- HJ Sock Group Ltd. (Pantherella International Group Ltd)

- Syounaa (Nishikaa Garments International LLP)

- Simcan Enterprises Inc.