Sometimes referred to as corneal inlays, corneal implants are optical devices placed into the cornea to improve eyesight. In addition to treating hyperopia, myopia, and astigmatism, the corneal implant technique is performed in cases of keratoconus and other degenerative disorders. Corneal implants are mostly used to treat presbyopia in adults by enhancing close vision and lowering the need for glasses.

A corneal transplant replaces the cornea with a donor or synthetic cornea. In this surgery, artificial or donor corneas are used to replace the cornea. The donor corneas used for transplantation are stored at eye banks in a storage medium. A synthetic cornea can also be chosen by transplant patients who can't accept a human donor cornea.

The cornea in the eye serves several crucial functions, including safeguarding interior eye tissues, assisting with refractive power, and focusing light on the retina with minimal possible scatter and optical degradation. Depending on their severity, certain disorders require corneal transplantation, including Fuchs dystrophy, keratoconus, keratitis, corneal ulcers, corneal scarring, and corneal edema.

The market for corneal implants is expanding as corneal problems are becoming more common. Also, the rise in corneal blindness in developing nations and the demand for corneal transplants contribute to the market's expansion. The expansion of the corneal implant market is anticipated to be fueled by an increase in healthcare spending and infrastructure, a shift in government policy in the healthcare sector, an increase in disposable income, and the development of the pharmaceutical industry.

COVID-19 Impact Analysis

The COVID-19 pandemic had a damaging effect on the Corneal Implant market. To save cost and lower the danger of infection, many hospitals and clinics had to postpone or cancel non-urgent procedures, such as corneal transplants, which caused a significant setback for the corneal implants market. Particularly during the early stages of the pandemic, patients' hospital trips for non-essential treatments were restricted by the severe lockdown regulations imposed by the local and national authorities. The classification of ophthalmic procedures, such as keratoplasty and sight-restoring surgeries, as elective surgical procedures that can be postponed further hindered the market's financial performance.Market Growth Factors

Rising cases of corneal blindness and other vision impairment diseases

With an estimated 10 million patients diagnosed with bilateral corneal blindness globally, corneal disorders are one of the leading causes of blindness. At 3.2% of all cases, corneal opacity ranks amongst the world's most common causes of blindness. Six million people, including 2 million with trachoma, have cornea-related blindness or moderate to severe visual impairment, according to a new World Health Organization (WHO) report. Near- or distance vision impairment impacts approximately 2.2 billion people globally. At least 1 billion of these cases, roughly half involved vision impairment that could have been prevented or was not addressed.The surging requirement for artificial cornea

The artificial cornea can overcome ocular surface disease, immunological rejection, and immune graft danger. The artificial cornea has reduced swellability, which means it will have less light scattering and water accumulation. A significant rate of growth is anticipated for corneal implant manufacturers due to the high prevalence of corneal blindness and the absence of corneal donors. Furthermore, the artificial cornea implant is anticipated to grow significantly due to the increasing prevalence of corneal infections. Thus, the presence of the artificial cornea with various benefits over the traditional one is expected to surge the corneal implant market growth. This will expedite the market's growth.Market Restraining Factors

Issues restricting wider adoption of corneal implants

Most healthcare facilities in developing nations treat corneal implants as outpatient procedures. This has made corneal implants less popular in these parts of the world. If there isn't enough healthcare infrastructure in these areas, it would be hard for existing and new businesses to break into the market. Since promising alternatives have become available, the acceptance rate of intrastromal corneal ring segment implantation has been going down over the past few years. Thus, the need for high capital to establish surgery centers for cornea implants, lack of donors, and other factors are expected to hinder the market growth.Procedure Type Outlook

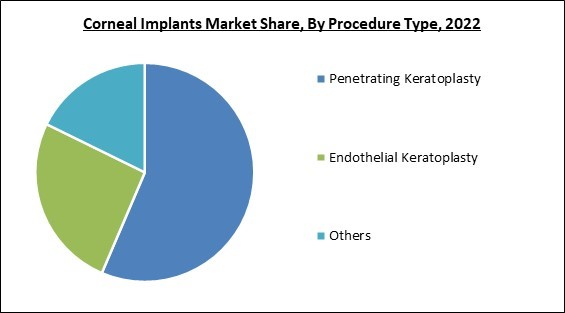

Based on procedure type, the corneal implants market is segmented into penetrating keratoplasty, endothelial keratoplasty and others. The endothelial keratoplasty segment acquired a substantial revenue share in the corneal implants market in 2022. This is because the most recent kind of corneal transplant uses endothelial keratoplasty, which replaces only the damaged tissue rather than the entire thickness of the cornea. This procedure aids in quicker and better sight recovery due to its features like less possibilities of infection and eye surface injuries.Disease Type Outlook

On the basis of disease type, the corneal implants market is divided into keratoconus, fuchs' dystrophy, infectious keratitis and others. The fuchs' dystrophy segment witnessed the largest revenue share in the corneal implants market in 2022. This is owing to the increased knowledge of ocular health and Fuchs' dystrophy being more common. The clear layer (cornea) on the front of the eye becomes clogged with fluid when a person has Fuchs' dystrophy, which causes the cornea to enlarge and thicken. As a result, glare, clouded or impaired vision, and eye discomfort may result.End-user Outlook

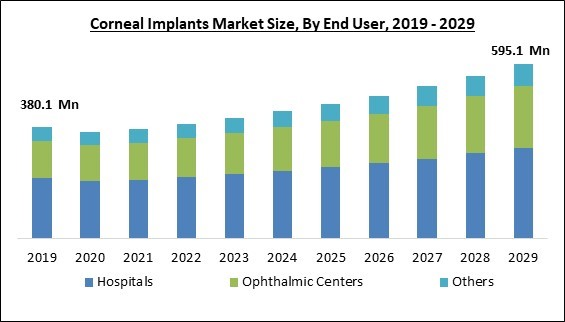

By end-user, the corneal implants market is classified into hospitals, ophthalmic centers and others. The hospitals segment registered the highest revenue share in the corneal implants market in 2022. This is due to the availability of highly qualified healthcare professionals and the expansion of private & group insurance plans' coverage of hospital-based healthcare services. Hospitals also have specialist equipment and facilities, such as operating rooms, intensive care units, and units for specialty eye surgery. Hence, with the presence of specialists and high-tech machinery to perform these surgeries, the hospital segment growth is expected to boost in the projected period.Regional Outlook

Region-wise, the corneal implants market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the corneal implants market by generating the maximum revenue share in 2022. This is because of a rise in the infrastructure for healthcare and an increase in the prevalence of corneal illnesses. Also, a surge in the number of significant producers of artificial corneal implants and a rise in public awareness of health and well-being contribute to the market growth in this area. Furthermore, the prevalence of keratoconus is also anticipated to enhance demand for corneal implants, which is anticipated to spur market expansion in North America.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Presbia PLC, CorNeat Vision Ltd., Alcon, Inc., AJL Opthalmic SA, LinkoCare Life Sciences AB, CorneaGen, DIOPTEX GmbH, Mediphacos Industrias Medicas S.A., EyeYon Medical Ltd., and KeraMed, Inc.

Strategies Deployed in Corneal Implants Market

- Nov-2022: Alcon took over Aerie Pharmaceuticals, a US-based clinical-stage pharmaceutical company. The addition of Aerie expands Alcon's market presence in the ophthalmic pharmaceutical market. Moreover, Aerie's deep technical expertise supports the company's endeavor to develop a comprehensive portfolio of ophthalmic pharmaceuticals.

- Apr-2022: CorneaGen introduced EndoSerter-PL, an FDA-approved insertion device. The single-use graft insertion device is equipped with masterly processed tissue to smoothen the DSEK surgeries.

- Jan-2022: Alcon took over Ivantis, a US-based manufacturer of surgical devices for the treatment of eye diseases. The acquisition brings in Ivantis' Hydrus Microstent, which would be added to the acquiring company's global portfolio. Further, the addition of Ivantis reinforces Alcon's global surgical portfolio.

- Jan-2022: CorneaGen signed an agreement with MellingMedical, a provider of pharmaceuticals, surgical, wound care, and etc. products. The agreement involves Melling providing Federal Health facilities with CorneaGen tissue. The partnership broadens CorneaGen's devotion to transforming the lives of people with corneal diseases, particularly America's veterans.

- Jun-2021: EyeYon Medical for its EndoArt received CE Mark. EndoArt is a synthetic implant, which takes place of human endothelium that a body cannot regenerate. This approval enables the company to work in close relations with the healthcare providers to make patients live a better quality of life.

- Mar-2021: CorNeat Vision came into partnership with LiveU and Alcon, a US-based provider of live video streaming services. Alcon is a US-based Ophthalmology company. The partnership focuses on implementing a remote surgeon virtual presence (RSVP) solution. The partnership involves cashing on Alcon's NGENUITY 3D Visualization System to carry out remote training of cornea experts located in Toronto. The partnership further boosts CorNeat's CorNeat KPro sales, as it would allow the company to train physicians across the world without physical presence.

- Mar-2019: Alcon completed the acquisition of PowerVision, a US-based developer of implantable intraocular lenses. The acquisition reflects Alcon's devotion to driving forward the growth and innovation in AT-IOLS, advanced technology intraocular lenses.

- Feb-2019: CorneaGen took over KeraLink Domestic Eye Bank Operations, a US-based provider of eye bank services. The acquisition broadens the company's surgical product offerings. Further, the addition of KeraLink Domestic Eye Bank Operations also brings in partnerships with industry and research communities which would further enhance the acquiring company's access to major and important discoveries in corneal disease treatment.

Scope of the Study

By Disease Type

- Fuchs' Dystrophy

- Keratoconus

- Infectious Keratitis

- Others

By Procedure Type

- Penetrating Keratoplasty

- Endothelial Keratoplasty

- Others

By End-user

- Hospitals

- Ophthalmic Centers

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Presbia PLC

- CorNeat Vision Ltd.

- Alcon, Inc.

- AJL Opthalmic SA

- LinkoCare Life Sciences AB

- CorneaGen

- DIOPTEX GmbH

- Mediphacos Industrias Medicas S.A.

- EyeYon Medical Ltd.

- KeraMed, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Presbia PLC

- CorNeat Vision Ltd.

- Alcon, Inc.

- AJL Opthalmic SA

- LinkoCare Life Sciences AB

- CorneaGen

- DIOPTEX GmbH

- Mediphacos Industrias Medicas S.A.

- EyeYon Medical Ltd.

- KeraMed, Inc.