A medical product category, medical biomimetics, was created by taking design cues from natural components. Problems relating to cardiac diseases, orthopedic diseases, ocular diseases, and dental diseases are resolved using medical biomimetics. Drug delivery and tissue regeneration are two medical applications of biomimicry.

In order to use natural systems and organisms as the basis for new scientific, technical, and technological solutions suitable for interventional use in dentistry and medicine, including tissue bio-engineering, biomimicry is a fusion of approaches needing the detection, perception, observation, identification, and close study of these entities.

A similar journey invites elucidating the underlying mechanisms and connections between the function and structure of the stimulating natural system(s) for applied and translational biomimetics, biomimicry, or biomimetics to humans, whether as single individuals or in groups and when healthy end-users/consumers or patients in need of therapies. Biomimetics is a multidisciplinary field that utilizes principles from chemistry, engineering, and biology to create materials, machines, or synthetic systems that mimic biological processes.

Biomimetics-based designs have potential applications in drug delivery, regenerative medicine, and tissue engineering. In addition, utilizing biomimetics in the field of pharmaceutics and medicine shows great potential for addressing life-threatening illnesses such as cancer. The rapid expansion of the medical biomimetics market is primarily fueled by heightened government investment in biomimetics research, as well as the integration and advancements of medical engineering and nanotechnology in the healthcare sector.

COVID-19 Impact Analysis

Companies have restarted their procedures to fulfill the demand for products, as a result of the easing of lockdowns, the advantages of vaccinations, and a drop in COVID-19 cases. Quarantine and the pandemic scenario are getting better and clearly on the mend in many nations. Several practitioners have launched their services by putting local and international guidance into practice. Additionally, the market share for medical biomimetics increased during the forecast period due to increased sales of medical biomimetics, technological advancements in biomimetic products, government initiatives to lessen the burden of disease, and regulatory approval. Therefore, it is anticipated that these trends will stabilize the market and cause it to grow over the course of the forecast period.Market Growth Factors

The constant aging of the population raises the demand for biomimetics

The growing older population is one of the most important concerns impacting emerging nations globally. It is also projected that the prevalence of chronic conditions in the elderly, such as heart disease, peripheral artery disease, and venous thromboembolism, will increase demand for and adoption of medical biomimetics. According to research by the Centers for Disease Control and Prevention, nearly 27% of men and more than 21% of women will have peripheral vascular disease in 2020, affecting more than 19.1% of people aged 55 to 65. As a result of expanding uses of biomimetics in patient care joined with the increasing number of diseases due to the aging population will aid in the market growth.Growing nanotechnology development to support the market growth

The advancements in drug delivery systems brought about by nanotechnology innovations will positively affect the growth of medical biomimetics during the forecast period. Nanomaterials are appealing for biomedical applications and show tremendous potential in biomimicry medicine based on their biocompatibility, physical and chemical properties. The development of biomimetic functionalized nanotechnology has allowed for the functionalization and modification of nanomaterials by components obtained from cell membranes, resulting in biomimetic nanomaterials with improved stability, biocompatibility, specificity, and targeting. Thus, using biomimetic nanomaterials for non-invasive disease diagnosis can aid the market growth during the projected period.Market Restraining Factors

High cost associated with medical biomimetics

The complicated manufacturing procedures needed to create biomimetic technology might make them expensive to develop and produce. This may reduce its accessibility to patients by lowering its pricing and availability. In addition, because it is much more difficult to work with the chemicals needed to make traditional pharmaceuticals and even biopharmaceuticals than working with cells or viral vectors, cell and gene therapies have become much more expensive. As a result, the number of patients who will receive the drug is multiplied by thousands or millions for typical biopharmaceuticals. Thus, the high cost associated with medical biomimetics is anticipated to hamper the market growth during the anticipated period.Disease Type Outlook

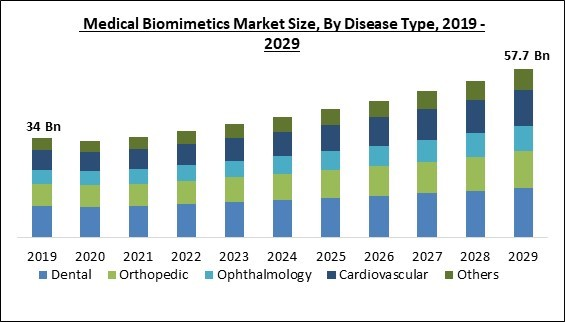

Based on disease type, the medical biomimetics market is characterized into ophthalmology, cardiovascular, orthopedic, dental, and others. The cardiovascular segment procured a considerable growth rate in the medical biomimetics market in 2022. This is because, with 17.9 million deaths annually, CVD is the leading cause of death globally. Every year, more than 2.1 million people have CVD implants to prolong their lives. Additionally, during the forecast period, the segment will benefit from lucrative opportunities brought on by the introduction of technologically advanced products and government funding, which will increase the utilization of medical biomimetics and thereby surge the segment's growth.Application Outlook

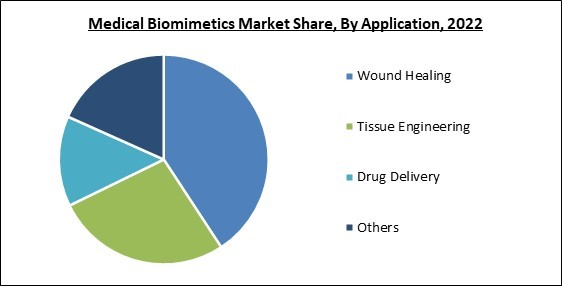

On the basis of application, the medical biomimetics market is classified into wound healing, tissue engineering, drug delivery, and others. The wound healing segment witnessed the largest revenue share in the medical biomimetics market in 2022. This is owing to a growing number of surgical cases and the rise in the incidence of chronic diseases, increasing the demand for products promoting wound healing and wound care. It is becoming increasingly advantageous to reroute fibrotic wound healing toward a regeneration process by advancing instructional materials and biomimetics.Regional Outlook

Region wise, the medical biomimetics market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generate the highest revenue share in the medical biomimetics market in 2022. This is due to increased dental disorders that necessitate dental biomimetics goods, increased government support for biomimetics product research, and a considerable increase in capital income in industrialized countries. In addition, the sophisticated reimbursement mechanism that already exists and strives to lower expenditure levels also contributes to the market's expansion. As a result, these elements fuel the medical biomimetics market growth in the North America region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Zimmer Biomet Holdings, Inc., BioHorizons, Inc. (Henry Schein, Inc.), SynTouch Inc., CorNeat Vision Ltd., Osteopore International Pte Ltd, Curasan, Inc., Otsuka Medical Devices Co., Ltd. (Otsuka Holdings Co. Ltd.), Swedish Biomimetics 3000 ApS, Keystone Dental Group and Blatchford Limited.

Strategies Deployed in Medical Biomimetics Market

- Oct-2022: CorNeat has launched EverMatrix tissue integrating material technology. Evermatrix features a 100% synthetic biomimetic extracellular matrix that merges with human tissue for a lifetime. It also features a flexible and tough body structure that maintains its form when drenched.

- Jul-2022: Curasan AG launched CERASORB CPC bone fillers. CERASORB CPC features phosphate and calcium salts dispersed in biocompatible oil made from plant extracts. The product is used mainly for minimally invasive applications. By introducing this product, curasan AG has strengthened its position in the market by countering the problems faced by medical personnel due to following a rigid protocol during the treatment of the wound.

- Apr-2022: Keystone Dental Group has teamed up with Milestone Scientific for a channel partnership regarding Milestone's STA Single Tooth Anesthesia System. The collaboration aims at providing better patient care for Keystone's customers.

- Sep-2021: Keystone Dental Inc. took over Osteon Medical. The acquisition strengthens Keystone's position in the dental market and provides sales opportunities for its synergistic and expanded implants. Furthermore, Keystone would be able to serve its customers in a better way owing to the combined portfolio of the company after the acquisition.

- Mar-2021: CorNeat has partnered with LiveU, a remote solution production and video streaming company, for developing Remote Surgeon Virtual Presence (RSVP) Solution. The new solution would allow CorNeat to spread its clinical trials to more sites. RSVP also serves as a compliment for launching Corneat Kpro to train surgeons virtually across the globe.

- Jan-2021: Osteopore International has teamed up with Maastricht University Medical Centre to develop a bone implant solution that averts leg amputation. This collaboration is directed at the adoption of 3D-printed bioresorbable implants across a wide clinical base.

- Aug-2020: Blatchford Limited has unveiled ElanIC, a firm, and lightweight microprocessor-enabled hydraulic ankle. ElanIC features a lightweight and compact waterproof design that provides greater comfort to the user. Furthermore, the prosthetic features a standing support mode to improve the resistance when the user is stationary. The benefits of the prosthetic include reduced risk of trips, increased walking speed, improved ground clearance, and enhanced control.

Scope of the Study

By Disease Type

- Dental

- Orthopedic

- Ophthalmology

- Cardiovascular

- Others

By Application

- Wound Healing

- Tissue Engineering

- Drug Delivery

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Zimmer Biomet Holdings, Inc.

- BioHorizons, Inc. (Henry Schein, Inc.)

- SynTouch Inc.

- CorNeat Vision Ltd.

- Osteopore International Pte Ltd

- Curasan, Inc.

- Otsuka Medical Devices Co., Ltd. (Otsuka Holdings Co. Ltd.)

- Swedish Biomimetics 3000 ApS

- Keystone Dental Group

- Blatchford Limited

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Zimmer Biomet Holdings, Inc.

- BioHorizons, Inc. (Henry Schein, Inc.)

- SynTouch Inc.

- CorNeat Vision Ltd.

- Osteopore International Pte Ltd

- Curasan, Inc.

- Otsuka Medical Devices Co., Ltd. (Otsuka Holdings Co. Ltd.)

- Swedish Biomimetics 3000 ApS

- Keystone Dental Group

- Blatchford Limited