Functional ice cream is becoming more popular than regular ice cream among health-conscious consumers as it contains high-quality ingredients and can fulfill consumers’ nutritional requirements. The increasing interest of ice cream manufacturers in fortification and the addition of functional ingredients may influence the consumer’s decision to select a healthy alternative. Beyond basic nutrition, functional food provides advantages that can help lower or prevent the risk of certain diseases such as nutrient deficiency. Moreover, sugar-free, low-fat functional ice creams are gaining huge popularity due to their health benefits. The COVID-19 pandemic further influenced the demand for functional ice creams, and manufacturers are taking advantage of this opportunity. Low-sugar and high-protein ice creams have become especially popular among athletes and consumers looking for non-staple food and beverage products with better nutritional content. In January 2023, Museum of Ice Cream, a Singapore-based manufacturer, launched an innovative probiotic ice cream to fulfill the demand for functional ice creams. The probiotic ingredients in the ice cream have immunity boosting properties and aid in the healthy digestive system.

The popularity of functional ice cream is majorly driven by product innovations, especially in terms of taste profile and nutritional value. In August 2022, California’s cult ice cream brand and celebrity favorite Coolhaus made its debut in Singapore with six flavors. Whey as is the base of all ice creams. The result is creamy ice cream with the taste and mouthfeel of conventional dairy. They are also more digestible than dairy as it’s lactose-free. These launches of functional products help consumers follow and maintain their health goals and enjoy a good meal simultaneously, as health became a priority for consumers during the COVID-19 crisis. Since people have started focusing on convenience food products while maintaining the nutritional balance in their diets, manufacturers are launching nutritionally enriched ice creams. Such product innovations help them extend their reach and gain a competitive edge in regional markets. Thus, the rising demand for functional ice creams is expected to create lucrative opportunities for the ice cream market in the coming years.

The Southeast Asia ice cream market is segmented on the basis of flavor, category, and distribution channel. Based on flavor, the Southeast Asia ice cream market is segmented into vanilla, chocolate, fruit, and others. The fruit segment held the largest share of the market in 2022, whereas the chocolate segment is expected to register the highest CAGR from 2022 to 2028. Chocolate flavors contain cocoa content. Dark chocolate, white chocolate, milk chocolate, brute chocolate, and bittersweet chocolate are a few types of chocolate flavor. The flavor provides many health benefits as its consumption protects cells from inflammation, improves body function, and boosts immunity and cardiovascular health because it is a rich source of flavanols. Therefore, its plenty of variations and health benefits encourage consumers to opt for chocolate flavor, which drives the demand for chocolate flavors. Chocolate flavor can be both light and rich. Also, antioxidant properties of chocolate make it a favorite flavor for all age groups. These factors increase the consumption of chocolate-flavored ice cream across the region.

Based on country, the Southeast Asia ice cream market is segmented into Indonesia, Malaysia, the Philippines, Thailand, Singapore, Vietnam, and the Rest of Southeast Asia. In 2022, Indonesia accounted for the largest share of the Southeast Asia ice cream market. Indonesia is one of the major countries dominating the ice cream market in Southeast Asia. The market growth in the country is attributed to increasing demand for different flavored ice creams and rising disposable income in the country. In July 2019, Yili Group announced the launch of its first Mocha Coffee ice cream in Indonesia. PT. Campina Ice Cream Tbk and Unilever PLC are the leading players operating in the ice cream market in this country. Various strategies such as expansion and acquisition by leading players are further propelling the growth of the ice cream market across the country. In January 2022, Yili Group announced the launch of the first phase of the Yili Indonesia Dairy Production Base in West Java, Indonesia. The project aimed to increase ice cream manufacturing with a production capacity of four million products on a daily basis.

Lotte Corp, Nestle SA, BR IP Holders LLC, Morinaga & Co Ltd, Mars Inc, General Mills Inc, Unilever PLC, Bigrade Co Ltd, Udders Pte Ltd, and American Food Co Ltd are a few of the major players operating in the Southeast Asia ice cream market.

The overall Southeast Asia ice cream market has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Southeast Asia ice cream market.

Table of Contents

Companies Mentioned

- Lotte Corp

- Nestle SA

- BR IP Holders LLC

- Morinaga & Co Ltd

- Mars Inc

- General Mills Inc

- Unilever PLC

- Binggrae Co Ltd

- Udders Pte Ltd

- American Food Co Ltd.

Table Information

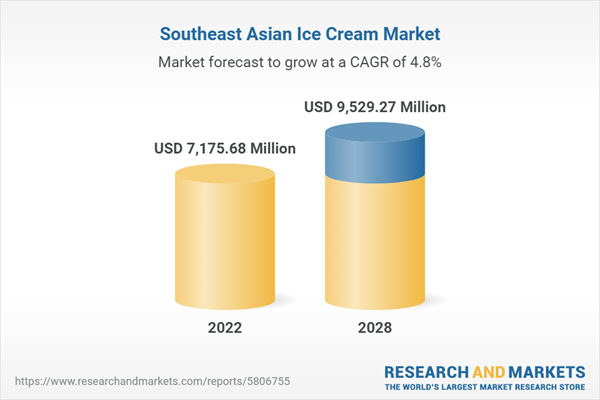

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | May 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 7175.68 Million |

| Forecasted Market Value ( USD | $ 9529.27 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |